ETH Slides as Selling Pressure Rises and Whales Exit Positions

- Ethereum extends its decline as selling pressure increases across major market sectors.

- Whale 0x0c19 sells 2,404 ETH, adding strain to an already weakened market trend.

- Exchange reserves drop as holders withdraw ETH while traders track key support levels.

Ethereum is trading near $3,185 after a sharp daily decline, signaling a clear shift in market direction amid pressure across spot and derivatives markets. The asset dropped 9.11% in the past 24 hours and extended its monthly slide while market participation increased during the fall. Trading volume rose as activity intensified, but price movement stayed weak across key levels.

Lookonchain reported that Whale 0x0c19 sold 2,404 ETH valued at about $7.7 million. The address originally bought the position in August 2021 at $3,190. The sale brought the holder back to break-even after years of inactivity. The move gained attention because large outflows often affect short-term sentiment when the broader trend is already down.

Derivatives Activity Shows Mixed Market Pressure

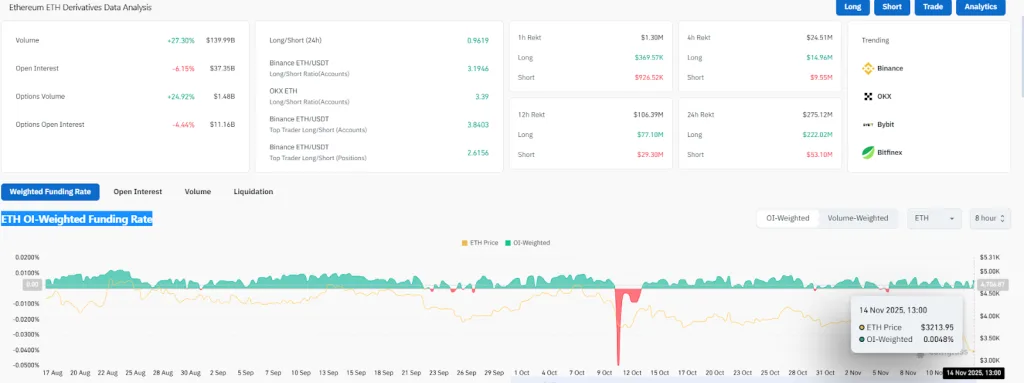

CoinGlass recorded a substantial rise in derivatives participation. Derivatives volume climbed to $139.99 billion, up from the previous day. Open interest dropped to roughly $37.35 billion, showing reduced commitment among highly leveraged traders.

The funding rate stood near neutral at 0.0048%. Total liquidations reached about $275.12 million, with long positions losing $222.02 million and short positions losing $53.10 million.

Source: Coinglass

A CryptoQuant analyst stated that Ethereum’s net taker volume on a 30-day moving average remains in negative territory. The metric remained weak after its lowest September reading.

Selling pressure stayed stronger than buying activity in the futures market despite signs of contraction. The indicator has historically moved positively near market bottoms. The current pattern suggested that both price adjustment and time consolidation may still be required.

ETH Withdrawals Surge as Holders Move Off Exchanges

Exchange reserves continued to fall. On-chain data showed that centralized platforms now hold around 13.3 million ETH. Supply reached a high of roughly 35.5 million ETH in August 2020. Only 10% of the circulating supply is available for trading on exchanges.

More than 700,000 ETH left these platforms recently as holders shifted toward self-custody. The movement reflected a broader withdrawal trend among long-term participants.

Bitmine Immersion Tech expanded its position by more than 110,000 ETH. The company increased its total holdings to almost 3.5 million ETH after the purchase. Large institutional accumulation added to the decline in available exchange supply.

Related: Bitcoin and Ethereum Lead $1.17 Billion Crypto Fund Outflows

This behavior pointed to long-term storage strategies rather than short-term market rotation. Reduced exchange supply reinforced the ongoing pattern of withdrawals.

Ethereum Holds a Bearish Technical Structure

Price action stayed bearish as Ethereum remained under major exponential moving averages. The 20-day level stood at $3,562, and the 50-day level held at $3,817. Longer-term averages near $3,841 and $3,584 also remained above the current price.

Source: TradingView

All averages moved lower, showing sustained pressure. Repeated rejections near the 20-day average at $3,560 indicated strong seller resistance. No consistent upward attempts emerged from the current range.

Ethereum continued to trade near $3,185 with intraday lows reaching $3,104. A breakdown below this zone could pull the price toward the $3,000 support area. That level carries psychological importance and may attract short-term buyers.

Resistance held near $3,560 and $3,840, areas where prior selling concentrated. Price behavior at these zones indicated persistent overhead supply.

Ethereum continues to face sustained downward pressure as selling dominates both spot and futures activity. Exchange supply continues to decline, adding to overall market weakness. Traders are watching key support levels as they wait for signs of stabilization or a shift in momentum.