Ethereum Fees Fall to 2017 Lows as Network Activity Surges

- Average Ethereum fees fall below $0.01 even as network activity remains near multi-year highs.

- Daily transaction counts reach nearly 2.9M without causing the sharp fee spikes seen before.

- Layer-2 scaling reduces congestion and keeps transaction costs close to historic lows.

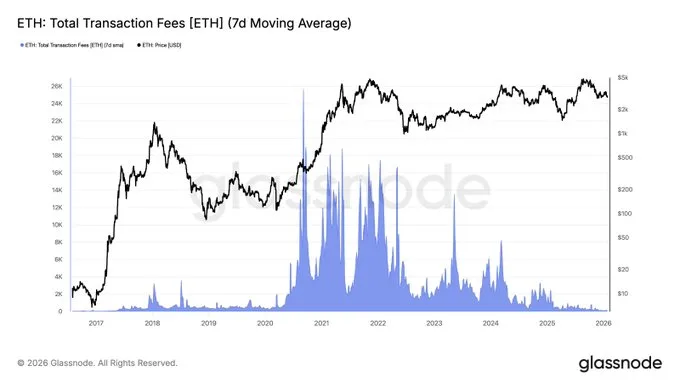

Ethereum is showing an unusual network pattern marked by strong activity and extremely low transaction costs. On-chain data from Glassnode shows average transaction fees have fallen below $0.01. This is the lowest level since May 2017. The decline is notable because network usage remains elevated, reversing the historical link between congestion and rising gas costs.

Source: X

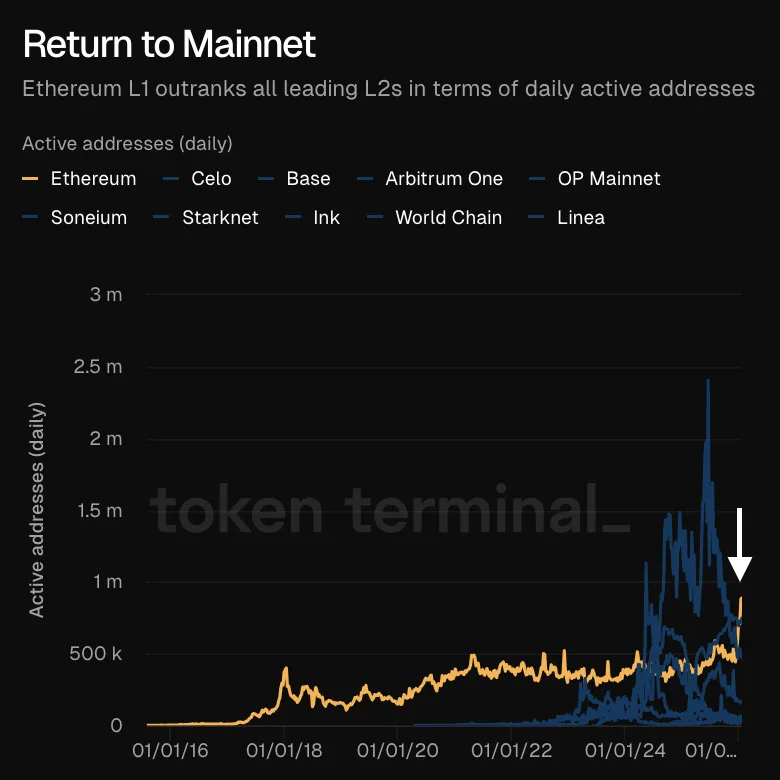

The data indicates increased direct use of Ethereum’s base layer. The drop in fees followed the Fusaka upgrade, which reduced execution and data costs. Token Terminal reported daily active addresses on the Ethereum mainnet at about 945,000 in early January. This figure represents a clear increase compared with activity levels seen in recent months.

Source: X

Ethereum Handles Rising Transactions Without Fee Pressure

Transaction volume has also reached high levels. On January 16, Ethereum processed close to 2.9 million transactions in a single day. In earlier cycles, similar usage resulted in sharp fee spikes. This time, costs remained compressed, signaling improved efficiency across the network.

Glassnode’s seven-day average confirms that transaction fees are now at levels last observed during Ethereum’s early years. Simple transfers frequently cost less than one cent. In many cases, fees fall well below that threshold. This allows users to move funds and interact with applications without facing material cost barriers.

Lower fees reduce friction for a wide range of network activity. Traders could rebalance positions without fee pressure. Users could send stablecoins without losing value to gas. Developers benefit from predictable costs, which simplifies application design and usage planning.

Several technical changes explain this shift in fee dynamics. Earlier upgrades, including EIP-4844, reduced the cost of posting transaction data. Additional improvements increased effective block capacity.

Layer-2 networks also play a central role. Platforms such as Arbitrum, Optimism, and Base now handle a large share of transactions. These networks process activity off-chain and settle results on Ethereum.

Because of this architecture, Ethereum no longer faces constant demand pressure. The base layer could now accommodate settlement activity without competing with routine transactions. As a result, fees remain low even when overall usage rises.

Lower Fees Expand Ethereum Use While Shifting Supply Dynamics

Lower transaction costs expand Ethereum’s practical use cases. Small-value payments are now feasible. Decentralized finance applications face fewer entry barriers. NFT minting and trading also become more accessible due to reduced costs.

Related: Vitalik Shifts Ethereum Endgame Toward Resilient Sovereignty

Lower fees also support broader user participation. High gas costs once discouraged smaller users from interacting with the network. That constraint has eased. New users could now explore applications without facing immediate financial friction.

Developers benefit from this environment as well. Applications for payments, gaming, and social interaction become easier to deploy. User acquisition becomes less dependent on fee subsidies. This supports more sustainable application growth.

Stablecoin activity also gains from lower fees. Transfers that previously cost several dollars now cost almost nothing. This improves Ethereum’s suitability for routine financial transactions. It also supports cross-border value movement with minimal overhead.

However, reduced fees affect Ethereum’s supply mechanics. Lower transaction costs result in less ETH being burned. During some periods, this could lead to net supply growth rather than contraction.

Despite this, network metrics show expanding usage. Higher activity levels increase the utility of the base layer. More transactions strengthen Ethereum’s role as settlement infrastructure.

The data indicates that Ethereum is running with record efficiency. High transaction numbers are now combined with low costs. This was not seen in earlier market cycles.

As of press time, Ethereum is trading at around $2,908. The price has risen by 0.36% over the last 24 hours. It has risen by around 6% over the last week.