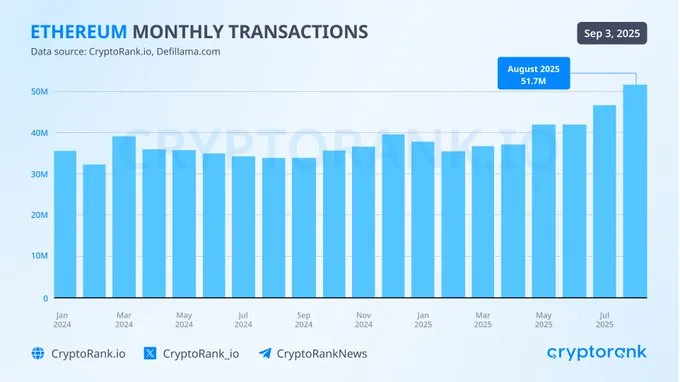

Ethereum Records All-Time High of 51.7M Transactions in August

- Ethereum recorded 51.7M transactions in August, showing the highest monthly record yet.

- Institutional investors hold millions of ETH, showing long-term market confidence.

- Liquidation Heatmap shows upside pressure at $4500 and major support at $4,093 and $3,838.

Ethereum recorded its highest-ever monthly transaction volume in August 2025, crossing 51.7 million. The surge came after months of gradual increases, with activity climbing from 33 million in February 2024 to over 48 million in July 2025. This increase is an indication of rising network adoption and supports the perception that Ethereum has become the central node of decentralized finance (DeFi), stablecoins, and scaling solutions regardless of the market cycle.

Sustained Growth in Transaction Activity

In the year 2024, the transaction levels were maintained between 33 million and 40 million per month. As an example, March 2024 had almost 39 million transactions, and November 2024 had approximately 38 million. The shift appeared to pick up in mid-2025 when it surged to more than 42 million in May and 47M in July. August 51.7 million leap finished the trend and set another historical high.

The growth aligns with the growth of decentralized exchange (DEX) trading volumes, the total value locked (TVL), and the number of active Ethereum addresses. The similarity in growth across several categories validates the widespread momentum of Ethereum.

Institutional Accumulation Adds Weight

As the retail traders argue over price fluctuations, institutional investors are still accumulating ETF positions. Bitmine, one of the largest crypto treasury companies, now has 1.87 million ETH, which is worth billions of dollars at current prices. This build-up is strategic positioning and not speculative interest.

Another major investor, SharpLink, has a total of 832,000 ETH. These massive inflows indicate that institutions are making long-term bets on the value of Ethereum as a financial product and as a technological infrastructure. This kind of uniform purchasing is also liquid and helps stabilize the overall market perspective.

A combination of record transaction activity and aggressive institutional accumulation forms a strong background. It indicates that utility and capital allocation are converging in favor of the next stage of growth of Ethereum.

Related: Ethereum Foundation Plans 10,000 ETH Sale to Fund Grants

Ethereum Liquidity Builds at $4,500, Setting Stage for Breakout

According to the Binance ETH/USDT liquidation heatmap, the market is starting to heat up with liquidity accumulating at the 4,500 level. The chart displays thick bands of short liquidity stacked around this resistance area, which forms an environment that can support massive price action.

The one-week chart shows that Ethereum is trading between $4,200 and $4,500, and the liquidity concentration is evidently at the upper level. There are large support levels observed under this range at $4,093 and $3,838, although the heatmap indicates that the pressure is on the upside. If Ethereum clears $4,500 decisively, momentum could send the asset closer to new all-time highs, squeezing shorts along the way and turning resistance into an aggressive launchpad.