Ethereum Whales Stack Tokens: What This Means for Price

- Ethereum’s price surges as large holders proceed with stacking ETH over time.

- Whale accumulation is a major factor in Ethereum’s price movement and trends.

- Growing whale dominance may impact decentralization and disrupt ETH’s supply balance.

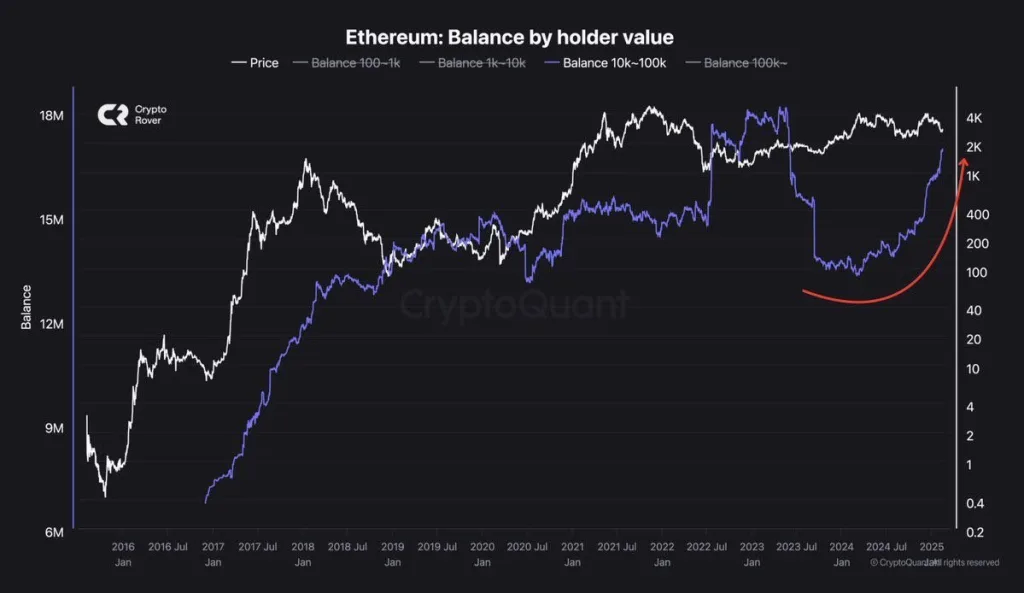

In a recent chart shared by Crypto Rand on February 18, 2025, Ethereum’s price movement is compared with the variation of ownership across various account sizes, shedding light on how large Ethereum holders—whales—are influencing the market. This data, sourced from CryptoQuant, provides a detailed analysis of the token’s market dynamics over the past decade, highlighting how the balance of ETH held by different wallet tiers affects its price.

Whale Accumulation: Large Holders Continue to Stack ETH

The graph reveals an increase in the balance of Ethereum held by those with 10K to 100K ETH (the blue line), indicating that whales have consistently stacked more coins since Ethereum’s inception in 2015. By 2024, these accounts held over 15 million ETH. This trend became evident in 2023 and early 2024, when the coin’s value broke above $1,000 and approached the $2,000 mark. As large owners continue to accumulate, their influence on the ecosystem grows, likely exerting pressure on ETH while simultaneously driving the price upward.

Related: Ethereum Faces Bearish Pressure: Will It Break Resistance?

Price and Whale Correlation: A Self-Fulfilling Cycle

The price, represented by the white line, follows cycles, with periods of growth, corrections, and rallies. However, the presentation highlights a correlation between price increases and large accumulation. Whales appear to buy ETH in anticipation of price increases, which creates upward pressure on the asset. As the cost rises, more of those who are accumulating them are motivated to continue doing it, reinforcing the bullish trend. This behavior indicates that ETH could experience further price growth if whales continue their accumulation strategies.

The distribution of the token is becoming more concentrated among large accumulators. While this trend presents a potential risk to market decentralization, it also signals bullish sentiment. If whale accumulation continues at this pace, the market could face a supply-demand imbalance, potentially driving ETH’s value even higher, especially if the largest holders (those with 100,000+ ETH) gain more influence over the market.