Digital asset regulations and enabling infrastructure go hand-in-hand in broader adoption of cryptocurrencies. Quantity of Bitcoin (BTC) ATMs, blockchain entities, and public excitement for cryptocurrencies make Florida rank top among 50 U.S. states ready for crypto adoption.

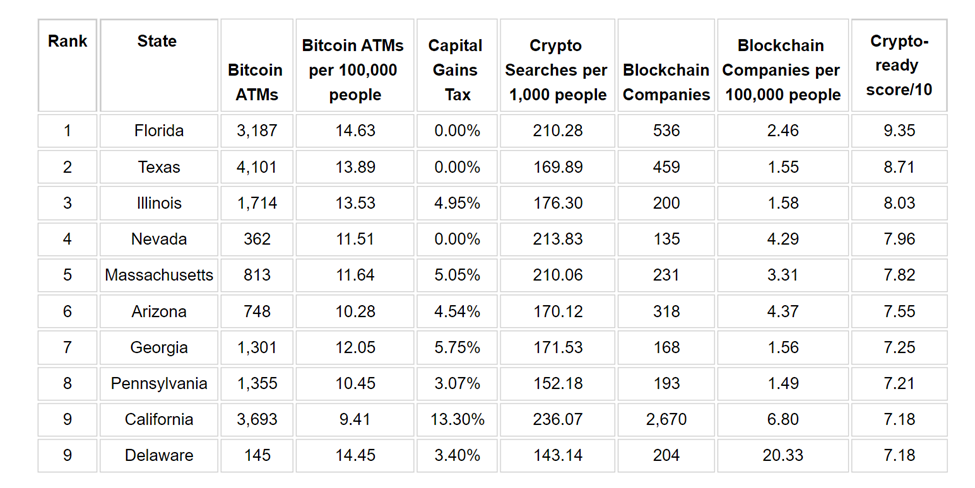

An Invezz research reveals Florida is the national leader in broader crypto adoption readiness in the U.S., with the highest 9.35 crypto-ready score. Texas and Illinois follow Florida with 8.71 and 8.03 as crypto-ready scores, respectively.

Given the dynamic engagement of the thriving crypto economy, Miami accounts for having the most number of Bitcoin ATMs (14.63 per 100,000 people) per person.

The state of Florida also exhibits a reinvigorated public interest in cryptocurrencies. This hypothesis is based upon 210.28 Google searches for crypto per 1,000 people in Florida.

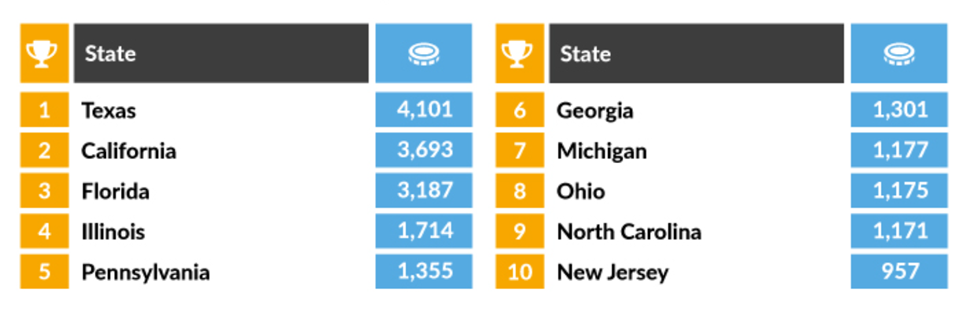

Residents of Texas, California, and Florida also account for the highest crypto engagement scope in the research.

In totality, the U.S. accounts for a thriving network of 33,865 Bitcoin ATMs—or 87.1% of global crypto ATM installations. The contribution of the U.S. to the global Bitcoin hash rate is 37.8%.

But a state-wise analysis unravels the reality that all 50 U.S. states aren’t uniformly prepared to adopt crypto as yet.

Vermont, the research reveals, has no BTC ATMs, at all, whereas Texas hosts 4,101 BTC ATMs. The least crypto-ready states include Vermont, West Virginia, and Montana, scoring 0.99, 1.19, and 1.91, respectively.

The states least prepared for crypto adoption in the United States.

The existence of Bitcoin ATMs represents the crypto access and usage readiness of the public. The most number of Bitcoin ATMs per 100,000 people and per 1,000 square miles in the United States is tabulated below:

State-wise Bitcoin ATMs in the United States.

But from an investor perspective, state taxes play a prominent role in crypto adoption. The U.S. states that offer 0% capital tax gains to investors are Washington, Wyoming, South Dakota, New Hampshire, Alaska, Nevada, Texas, Tennessee and Florida.