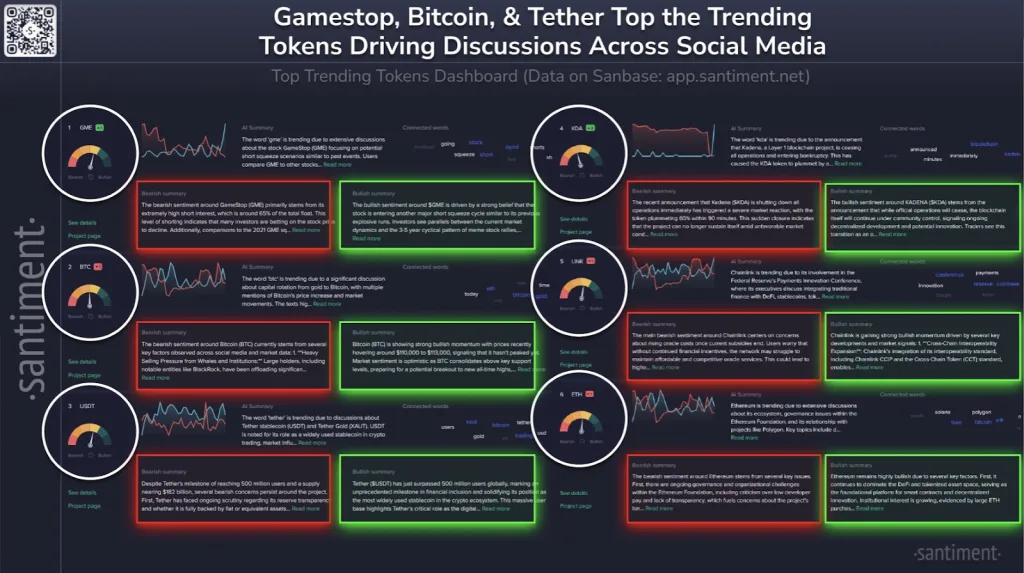

GameStop, Bitcoin, and Tether Ignite Massive Market Buzz

- Gamestop leads discussions with speculation about short squeeze and retail interest.

- Bitcoin sees capital rotation from gold, signaling confidence in its long-term value.

- Tether surpasses 500 million users as debates over transparency and reserve intensify.

GameStop (GME), Bitcoin (BTC), and Tether (USDT) have emerged as the most discussed assets across social media, according to on-chain data from Santiment. The platform’s Top Trending Tokens Dashboard, published on X (formerly Twitter), indicates that retail traders and institutions are driving a renewed wave of interest in these assets.

The conversations revolve around GME’s short squeeze, shifting capital from gold to Bitcoin, and debating Tether’s transparency and stability issues.

Source: X

GameStop’s Short Squeeze

GameStop leads social discussions as investors revisit the 2021 short squeeze phenomenon. Santiment reports that about 65% of its total float is shorted, sparking comparisons with earlier meme-stock rallies. Traders debate whether the company could experience another explosive squeeze.

Many retail participants link the GME to AMC and Beyond Meat (BYND), comparing short interest and trading behavior across these stocks. Data shows that strong short interest has again become a key driver of retail speculation. The bullish faction believes GME is entering a new multi-year short squeeze cycle, suggesting another wave of volatile price movements.

Bitcoin Driving Retail Buzz

Bitcoin follows closely as the second-most-discussed token. Discussions center on a visible shift in capital from gold to Bitcoin. Analysts and traders on social media mention Bitcoin is consolidating between $100,000 and $103,000, showing strong price resilience. According to Santiment, this shift represents growing confidence in Bitcoin’s long-term appeal as digital gold.

Nevertheless, a few analysts discuss the short-term volatility caused by the sale of large portions of shares by institutional holders, including BlackRock. Nonetheless, the expectation of a new all-time high as soon as the selling pressure stabilizes is the reason why the overall sentiment is positive.

Tether and Kadena Attract Market Interest

Tether is the third most talked-about digital asset. Santiment’s data indicates that Tether now has a user base of more than 500 million worldwide. Its overall supply has recently reached over $182 billion, which is a significant milestone in its growth. Speculation continues about the composition of its reserves and the extent of its diversification, particularly after Tether was said to have made investments linked to Bitcoin and gold.

The conversation shifts toward Tether Gold (XAUT), a digital asset backed by physical gold. Spreading the risk is a good option when market conditions are unclear. The debate about how USDT affects the liquidity of DeFi and its role in stabilizing the broader cryptocurrency market has intensified over the last month.

On the other hand, Kadena (KDA) stirred up the market by posting a total ban on its operations. The news led to a nearly 60% decline in the price of KDA, resulting in substantial losses for the investors. Although the community will control the project’s blockchain, official operations and financial support are no longer available.

Related: GameStop Raises $1.5B, Adds Bitcoin to Treasury Strategy

Chainlink’s Participation in The Conference

Chainlink (LINK) garnered significant attention due to its participation in the Federal Reserve’s Payments Innovation Conference. The executives discussed the concept of integrating DeFi systems with traditional finance, which involves collaboration with Google Cloud, BlackRock, Coinbase, and Circle. Chainlink’s Cross-Chain Interoperability Protocol (CCIP) continues to attract users, solidifying its position as a key player in the tokenized asset ecosystem.

Ethereum’s Network Momentum

Ethereum (ETH) remains the primary topic of conversation, with discussions encompassing governance, technical updates, and its connection to Polygon’s Layer 2 scaling. The upcoming Fusaka Hard Fork and the recent transfer of large amounts of ETH by the Ethereum Foundation have sparked discussions about reorganization. The institutional investors remain interested despite ETF redemptions and short-term volatility.