Gold-Backed XAUT Soars to New Record as $4,000 Target Nears

- XAUt climbs to $3,950 as bulls target the crucial $4,000 resistance amid rising momentum.

- Analysts link XAUt’s rally to a weaker USD and Fed rate cuts, fueling bullish sentiment.

- On-chain inflows of $2.29M highlight strong investor demand and sustained market confidence.

Tether Gold (XAUT), the gold-backed cryptocurrency issued by Tether, reached a new all-time high of $3,950, supported by growing investor interest in tokenized commodities. However, the asset declined slightly by 0.21% over the past 24 hours to $3,945, in line with minor adjustments in the gold market.

Despite these nominal differences, the token still reveals a decisive bullish conviction. Over the last 12 months, XAUT’s value has climbed by nearly 50%, outperforming several top digital assets and strengthening its position as a stable, asset-backed alternative.

The token has also advanced 10% in the past month, signaling continued bullish momentum amid heightened global interest in digital representations of precious metals. Following this optimistic price action, Tether Gold’s market capitalization stands at $971 million, reflecting a 2% rise from the previous day.

Besides, its 24-hour trading volume surged to $85 million, representing a 43% increase, driven by increased activity from both retail and institutional investors. These metrics place XAUT among the top 100 cryptocurrencies globally by market cap.

Looking ahead, analysts view $4,000 as the next technical threshold. Persistent demand from traders seeking hedged exposure to gold through blockchain rails suggests Tether Gold’s ascent may extend if macro conditions remain supportive and spot bullion sustains its upward bias.

Experts Forecast XAUt’s Next Move Toward $4,000

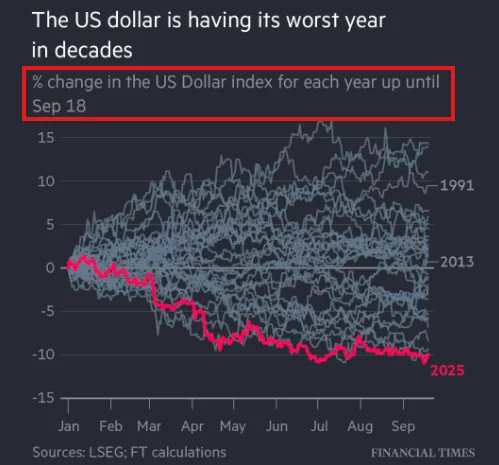

Market strategists believe the recent weakness in the U.S. dollar is providing a strong tailwind for XAUt. One such example is the Kobeissi Letter reports, which indicate that the U.S. Dollar Index has dropped more than 10% year-to-date, marking its worst annual performance since 1973.

As the dollar’s purchasing power erodes, down nearly 40% since 2000, investors are reallocating capital toward real-value assets such as gold and Bitcoin. Typically, a weaker dollar increases demand for dollar-denominated commodities, as they become more affordable for foreign buyers.

This dynamic, combined with the Federal Reserve’s shift toward rate cuts amid weakening labor data and rebounding inflation, has renewed appetite for inflation-resistant instruments. In this environment, XAUt’s tokenized structure provides it with a unique edge, offering investors blockchain-based exposure to gold without the direct storage or settlement challenges associated with physical gold.

As a result, experts now view the $4,000 level and beyond as a realistic near-term target if macroeconomic trends persist. Meanwhile, from a technical perspective, XAUt’s bullish trajectory appears intact.

In early September, the token broke above an ascending-triangle formation, a classic bullish continuation pattern that often precedes accelerated gains. Since then, XAUt has sustained upward pressure.

The token may break the $3,950 resistance and advance toward the 127.20% Fibonacci level near $4,100. Even so, analysts warn that the RSI sits around 87.56, placing XAUt in the overbought region.

This suggests a short-term correction could emerge before another leg higher. In that case, the 78.60% Fibonacci level near $3,700 may act as initial support. Additional levels at $3,639 (61.80%) and $3,543 (50%) could also limit further downside if selling pressure increases.

Related: BTC Surges to Record $125K Mark, Fueling $500K Price Ambitions

On-Chain Metrics Indicate Expanding Bullish Conviction

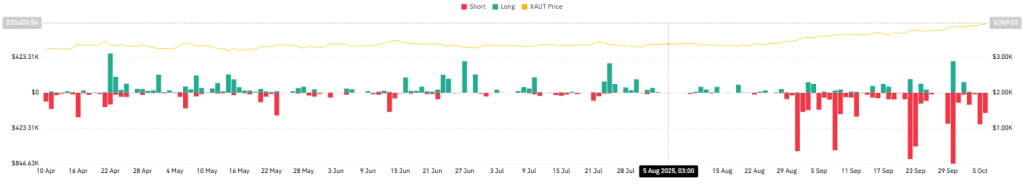

On-chain data further confirms XAUt’s bullish strength. According to CoinGlass, the token recorded $2.29 million in net inflows as of press time, showing that investors continue to accumulate despite overbought conditions. This steady buying interest signals strong market confidence and a potential for further price gains.

Liquidation charts also show a short squeeze developing. In the past four days, over $678K in short positions were liquidated, compared to only $15K in long positions. This imbalance suggests that short sellers are being forced to close positions, driving additional upward pressure.

Overall, Tether Gold’s sustained inflows and bullish structure reflect strong investor confidence. Supported by favorable macro trends and rising demand for tokenized assets, XAUt’s momentum remains firm. Despite possible short-term pullbacks, sentiment stays optimistic, with the $4,000 mark emerging as a realistic milestone in its ongoing upward trajectory.