Gold Declines While Bitcoin Holds $113K and Signals Strength

- Bitcoin trades at $113K, holding within key Fibonacci zones, awaiting a clear breakout.

- Volatility between BTC and gold narrows to 0.2%, marking a rare milestone of stability.

- Analysts signal a possible rotation from gold to BTC as historical cycles align again.

Bitcoin (BTC) maintained stability at $113,047 on Tuesday, as market signals suggested a potential shift from gold to digital assets. Analyst Merlijn The Trader said on X, “THE SIGNAL IS CLEAR: GOLD OUT, BITCOIN IN.” His most recent graph provided a comparison between the cycles of gold and Bitcoin in 2020 and 2025 that exhibited very similar patterns before the giant Bitcoin movement. Meanwhile, volatility data from CryptoQuant confirmed that the token’s price movement now closely mirrors that of gold, with a 0.2% difference in their three-month volatility levels.

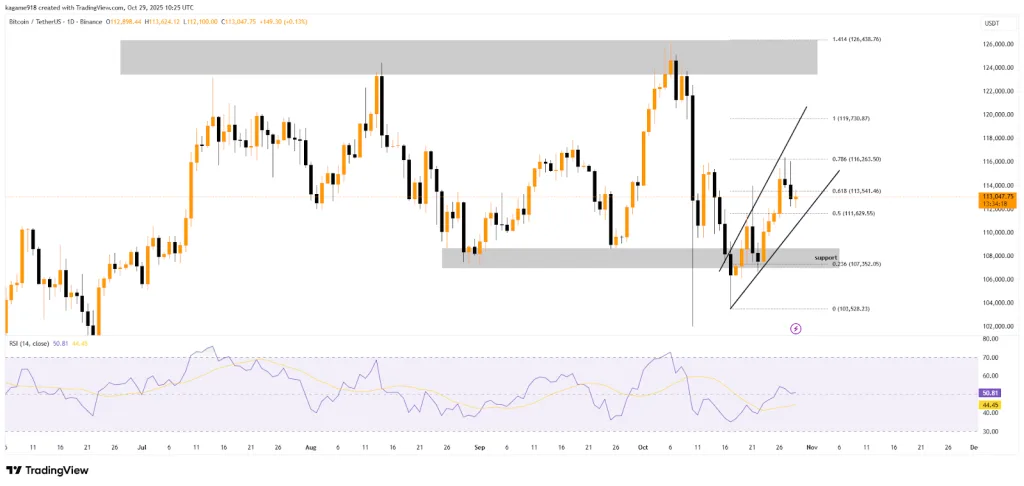

Bitcoin Consolidates Between Critical Fibonacci Zones

The current technical structure of BTC is showing strength after the price bounced back from $103,528, which was the exhaustion point of its decline in October. It is now trading at 113K, within a specified range of $107,352 to $116,263, which aligns with the Fibonacci retracement levels of 0.236 to 0.786.

TradingView’s chart data indicates a short-term ascending channel, which is confirmed by the ongoing buying activity supporting the price below $108,000. The sellers are still attempting to keep the price below the resistance zone of $116,000 to $119,730, where the expected profit-taking is close to the 1.414 extension target of $126,438. If the buyers manage to close above $116,263, then a move towards $120,000 is likely to occur.

The RSI (14) is at 50.81, while its moving average stands at 44.45, indicating a state of equilibrium between the bull and bear forces. The market is exhibiting calm behavior, with traders eagerly awaiting a breakout in the subsequent sessions, regardless of the direction.

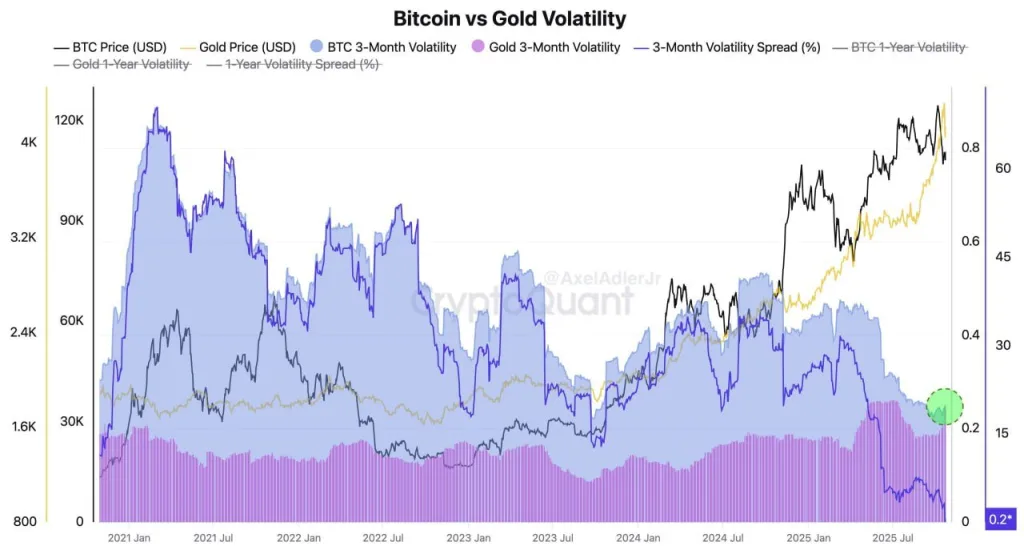

BTC’s Volatility Matches Gold for the First Time

According to analyst Axel Adler Jr., Bitcoin’s volatility now equals gold’s at 0.2%, marking the first convergence in more than a decade. The data, shared on CryptoQuant, shows a maturing asset class that is stabilizing amid global uncertainty.

Between 2021 and 2025, the BTC price increased from under $30,000 to over $120,000, while the price of gold rose from approximately $1,600 to more than $4,000. The price movements of the coin have not been the primary focus, falling from 0.8 to 0.2, thereby establishing a stable profile with gold’s usual volatility range of 0.15-0.25.

The 3-month volatility gap, which had previously surpassed 50%, has now contracted to nearly zero. This convergence suggests that its market behavior is becoming increasingly similar to gold, characterized by mild fluctuations and consistent investor sentiment. Adler opined that the situation reinforces the claim that BTC is the “digital gold,” and this trend indicates deep institutional involvement and the availability of liquidity throughout the market.

Related: Bitcoin Nears $116K as Futures Open Interest Soars to $100B

Historical Pattern Signals Potential Bitcoin Upswing

In another post, Merlijn, the trader, mentioned that the recent peak of gold corresponds to its 2020 high of nearly $2,100, after which there was a considerable drop. Gold reached a high of almost $3,955 per ounce again in October 2025 and then trended lower. On the other hand, Bitcoin is sitting at $112,834, reflecting its 2020 consolidation before its 600% rally.

The comparison chart indicates the reverse pattern of gold with a red arrow, while the setup of Bitcoin’s 2025 is shown with a green circled base, the same kind of structure seen before its historic 2020 surge. Merlijn said, “Smart money knows where this ends,” hinting that institutional capital may already be rotating from gold into BTC.

The market now watches closely as history appears to repeat itself. If the pattern holds, could Bitcoin be preparing for another breakout phase that once again redefines its status as “digital gold”?