Gold Pulls Back from $4K as Silver Hits ATH and Bitcoin Holds Above $121K

- Gold pulls back below $3,950 after touching $4,000, signaling a short-term cooling phase.

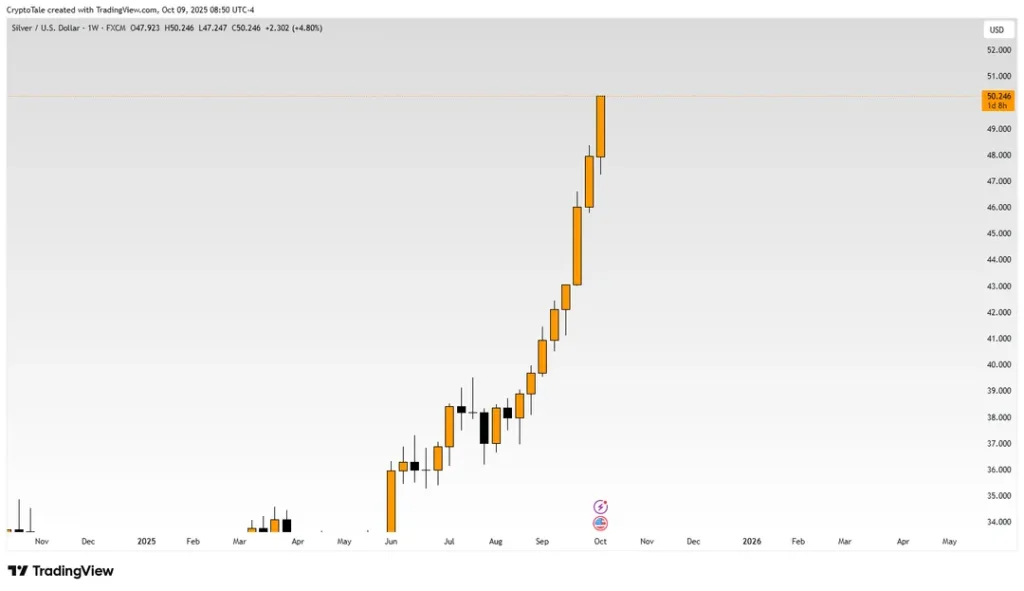

- Silver surges past $50, outpacing gold with a 75% yearly gain driven by industrial demand.

- Bitcoin holds steady above $121K, reinforcing its role alongside metals in the hard asset rally.

Markets are entering a new phase where traditional and digital assets are moving together. Investors are increasingly turning to tangible stores of value such as gold, silver, and Bitcoin to shield themselves from rising inflation and currency risks.

The historic gold rally came to a halt this week after surpassing the $4,000 milestone. The metal experienced resistance near the milestone level and dropped to around $3,950. Meanwhile, silver rose to a new all-time high of $50 before easing slightly. Bitcoin remained solid over the $121,000 level, holding its position following a new record of over $126,000 it hit earlier in the week.

Gold Faces Resistance as Momentum Cools

Gold (XAU/USD) briefly crossed the $4,000 level, making an all-time high at $4,057 before sellers took control. The psychological barrier triggered heavy profit-taking, pushing prices below $3,950. Analysts say the move was technical, not a reversal, as the metal remains in a strong uptrend.

The Relative Strength Index (RSI) on gold’s daily chart stands near 74, signaling overbought conditions. Smaller candles and spinning tops were observed as traders saw no indication of panic in the market, but market hesitation. Gold is still trading within a defined uptrend channel, with buyers protecting support at around $3,910.

Several factors contributed to the short-term pullback. The U.S dollar showed mild strength, while Treasury yields rose slightly, reducing the demand for non-yielding commodities such as gold. In addition, funds rotated into silver after its breakout, diverting short-term liquidity.

Still, the broader narrative remains bullish. This year has seen gold increase by over 50% driven by inflation fears, increasing government debt, and geopolitical tension. Analysts believe gold may consolidate further before advancing to higher ground as long as it remains above its major support levels.

Silver’s Breakout Signals a Broader Shift

Silver (XAG/USD) has emerged as the standout performer among hard assets. It climbed to a new ATH above the $50 mark this week. The rally represents a 75% gain this year, outpacing gold’s performance.

Silver’s rise has been fueled by two main forces: safe-haven demand and strong industrial consumption. The metal finds wide application in renewable energy, electric vehicles, and electronics, sectors seeing rapid growth worldwide.

Its RSI at 84 shows an extreme momentum, which may translate to short-term profit-taking. However, the size of the rally highlights a revival of interest in physical properties. The surge above the 2011 high sparked fund rotations in commodities, showing investor confidence in the long-term outlook of silver.

Platinum has also benefited from the move, gaining nearly 80% in 2025. The concurrent increase in various precious metals indicates that investors are getting prepared for economic uncertainty.

Related: Deutsche Bank: Central Banks May Hold Bitcoin and Gold by 2030

Bitcoin Holds Steady Amid Hard Asset Rotation

Bitcoin (BTC) remained resilient despite the volatility in conventional markets. At the time of writing, Bitcoin was trading above $121,500. Its RSI around 62 indicates a balance in momentum compared to gold and silver.

Unlike the metals, Bitcoin’s trend remains more stable. It has avoided overextension, consolidating below its new resistance zone near $125,000. Traders say the coin’s steady performance highlights its growing acceptance as part of the “hard asset” class.

Institutional inflows into Bitcoin have remained strong throughout the year. Many investors now view it as digital gold, a decentralized store of value uncorrelated with central bank policy. As inflation persists and fiat currencies weaken, Bitcoin’s role in diversified portfolios continues to expand.

The Hard Asset Supercycle Takes Shape

The coordinated moves in gold, silver, and Bitcoin are an indication of the emergence of a new hard asset supercycle. Investors are hedging against inflation, debt growth, and geopolitical changes by investing in assets that have a small supply.

With gold experiencing some near-term resistance and silver cooling off to record highs, the overall trend remains aligned. Bitcoin’s inclusion in the same narrative marks a major evolution in global investment behavior. Together, the three assets are redefining how markets perceive safety and value in a world of monetary tightening and economic uncertainty.