Gold’s 60% Yearly Surge Ignites Market Frenzy Amid Overbought Fears

- PAXG’s surge sparks heavy trading and record liquidations across global markets.

- A weakening dollar and crypto outflows power gold’s climb to new record highs.

- Overbought indicators suggest gold’s rally may cool after months of relentless momentum.

In an uneasy world haunted by inflation, conflict, and fragile markets, gold has become a beacon of calm amidst the storm. Over the past year, it has climbed an astonishing 60%, breaking every known record and settling above $4,300 an ounce.

At one point, it even brushed $4,456, a price that once seemed little more than market folklore. The surge has startled traders and economists alike. After years of fading relevance and competition from digital assets, gold has staged a striking return.

Yet the glow carries a hint of danger. Charts now flash warning signs that the rally might be overheating. Technical indicators suggest momentum has stretched too far, leaving little room for error.

Behind the excitement, cautious voices are beginning to ask whether gold’s brilliance can last, or whether this moment of glory is already burning at its peak.

PAXG Price Action: Short Squeeze Sparks Firestorm

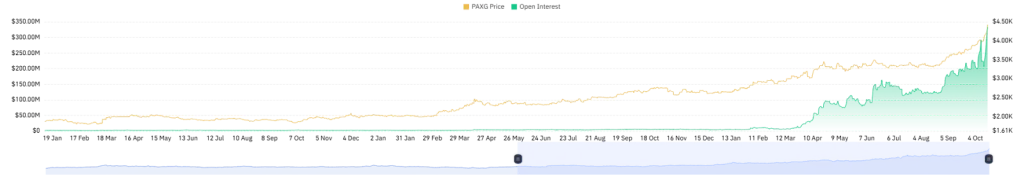

Over the past 24 hours, the token has dipped nearly 4%, now hovering around the $4,243 level, as of press time. Its weekly performance shows a 6% climb, while the monthly gain has swelled to roughly 15%. The asset’s market capitalization currently stands near $1.35 billion.

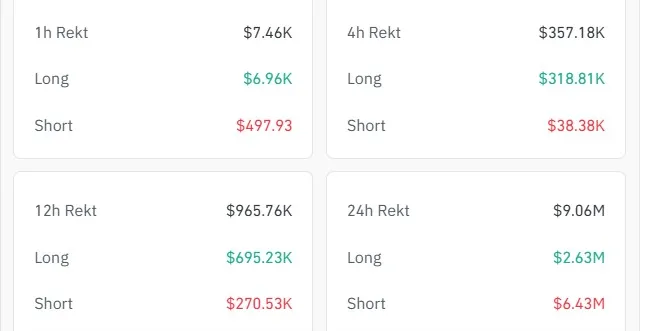

Behind the curtain of gold’s meteoric rise lies a high-stakes bloodbath for short sellers. On Friday alone over $6 million in gold short positions were forced to liquidate from its previous day. In simpler terms, these were leveraged bets that gold would fall, but when it didn’t, exchanges automatically closed out losing trades, triggering a cascade of urgent buying.

Source: CoinGlass

This domino effect, commonly referred to as a short squeeze, intensifies upward price movement, not because bulls are piling in, but because bears are panicking. Consequently, the chain reaction sent trading activity soaring. Its futures derivatives volume reached a record $1.47 billion, a 257% jump, while open interest rose to nearly $333 million.

Source: CoinGlass

These numbers tell a clear story: volatility is back. Traders are holding onto their positions longer, hinting at confidence in further upside. The pattern shows a market brimming with conviction, one that’s betting the gold rally has not yet run its course.

Why Is PAXG Rising?

Dollar Dimming, Gold Glistening

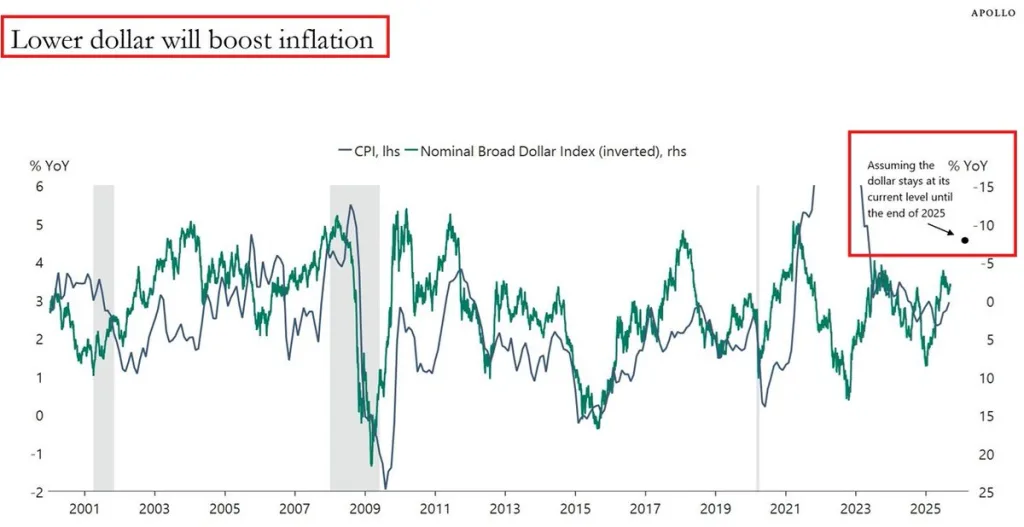

The U.S. dollar, once the world’s unrivaled haven, is showing signs of fatigue. Analysts at The Kobeissi Letter note that the greenback’s slide has been so sharp that Apollo Global Management warns it could stoke another wave of inflation.

Source: X

According to the Federal Reserve’s own model, every 10% decline in the dollar adds roughly 30 basis points to inflation. This year alone, the U.S. Dollar Index has already fallen more than 10%, marking its steepest annual drop since 1973. That weakness has made gold more affordable for overseas buyers, driving a surge in global demand.

The New Safe Haven Switch

Not long ago, Bitcoin was dubbed “digital gold.” But in today’s flight to safety, investors are making a very different choice. Amid rising volatility and regulatory pressures in the crypto markets, capital is pouring out of Bitcoin and back into traditional gold.

In the last month, Bitcoin dropped around 10%, while gold soared 18%. Fund managers are rotating into bullion for one reason: stability. Compared to crypto’s wild price swings, gold’s upward march feels almost serene.

As Sean Farrell of Fundstrat put it, “Capital is clearly favoring gold due to its momentum and reduced volatility profile.” The narrative has shifted. Once mocked as outdated, gold is now outperforming every major crypto asset, reasserting its position as the ultimate hedge against chaos.

Even institutional investors that once championed blockchain are quietly rebalancing toward gold. In uncertain times, glitter beats code.

Related: EVAA Hits $1.4B in Transactions and 300,000 Wallets: Report

The Warning Signs Flashing Beneath the Glitter

For all its brilliance, gold’s surge is not without risk. Analysts are growing wary of how far, how fast, and how blindly gold has rallied. The Relative Strength Index (RSI), a key technical indicator, recently broke above 86, deep into overbought territory. Historically, such levels are unsustainable and often precede sharp corrections.

The billions of inflows into gold ETFs, and the violent short squeezes, pictures a market that might be too euphoric for its own good. Market analysts warn that short-term consolidation is possible given the overbought conditions.

A cooldown, or even a pullback, is not just likely; it could be necessary. Yet, the bullish thesis remains intact. As long as global instability persists, the dollar weakens, and confidence in financial institutions wavers, gold will stay in the spotlight.