Grayscale Files Bittensor ETF Focusing On Decentralized AI

- Grayscale has filed to convert its Bittensor trust into a spot ETF.

- The filing points to institutional demand for blockchain networks that power AI work.

- Bittensor rewards open machine learning contributions using cryptoeconomic design.

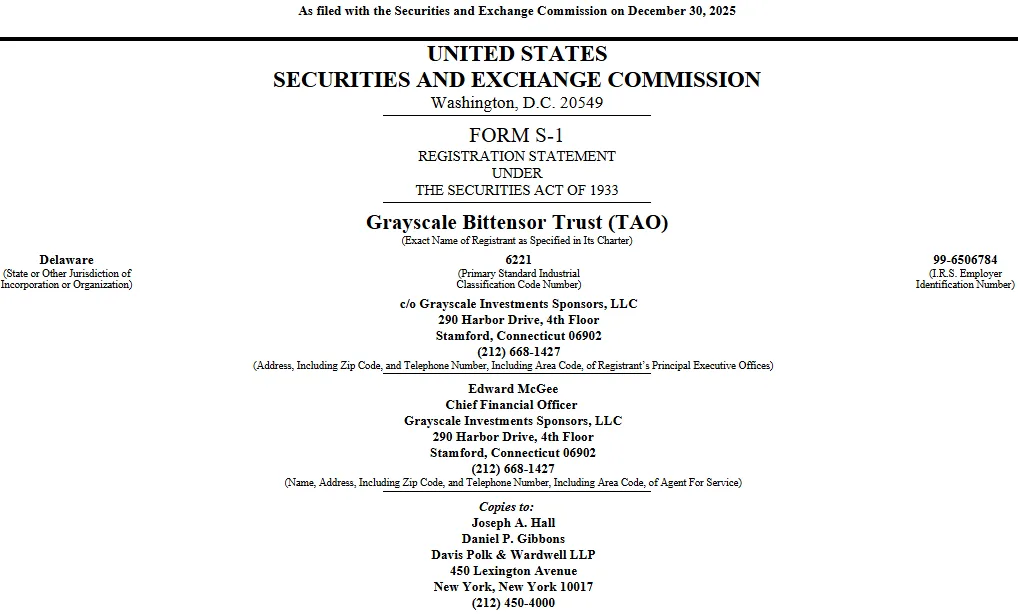

Grayscale Investments has filed a preliminary registration statement with the U.S. Securities and Exchange Commission to launch an exchange-traded product tied to Bittensor, a decentralized artificial intelligence network. The proposed trust would trade under the ticker GTAO and offer regulated exposure to Bittensor’s native token, TAO. The filing places decentralized AI infrastructure at the center of institutional crypto strategy as capital moves beyond Bitcoin and Ethereum products.

Grayscale operates as a subsidiary of Digital Currency Group and manages more than $30 billion across crypto investment products. Its earlier offering, the Grayscale Bitcoin Trust, was later converted into a spot ETF after U.S. approval in early 2024. That approval marked a turning point for regulated crypto access and expanded participation from traditional investors.

The GTAO filing comes at a time when institutional investors are evaluating blockchain networks that are capable of handling computation and artificial intelligence. Bittensor, in contrast with networks focused on payments, associates the value of its tokens with the progress of AI and the contributions made by the model. Hence, this transition alters the perception of crypto risk from being solely about the utility of the transaction to being about the productive infrastructure.

Grayscale Expands Its Crypto ETF Strategy

Grayscale’s initial S-1 declaration proposes the transformation of its current Bittensor trust into a spot ETF. The product would be traded on NYSE Arca and would pass TAO directly to investors. This formation is similar to the previous Bitcoin and Ethereum ETF frameworks, which are already known to the regulators and institutions.

Source: SEC

The trust eliminates the necessity for direct token custody by providing regulated access. This deal lowers the operational friction for wealth managers and institutional investors. It also coincides with Grayscale’s enduring strategy of expanding digital-asset access via traditional means.

Grayscale’s leadership role grew through products like the Grayscale Bitcoin Trust. That vehicle became one of the first spot Bitcoin ETFs approved in the United States. The GTAO filing extends that model into AI-focused blockchain assets.

Bittensor and the Economics of Decentralized AI

Founded in 2019, Bittensor operates as an open-source network for machine learning collaboration. Participants contribute computing resources, data, or models to a shared intelligence system. The network rewards those contributions using cryptographic scoring and token incentives.

The TAO token is the source of power for staking, governance, and payment contributions in the protocol. The token’s rewards are determined by the informational value that every user brings to the network. This system sets up a market where artificial intelligence can be regarded as a good quantifiable on-chain product.

The Bittensor framework is not similar to monopolized centralized AI platforms owned by a single company. Its decentralized approach encourages any developer with the right equipment to take part. Wikipedia portrays the network as a decentralized global marketplace for machine intelligence.

Related: Bittensor Halving Begins as TAO Supply Tightens Rapidly

Institutional Interest and Market Signals

Grayscale’s filing signals confidence in decentralized AI as an investable asset class. Other asset managers, including Bitwise, have submitted related ETF filings tied to TAO. These moves suggest coordinated interest across traditional finance in AI-linked blockchain exposure.

Earlier in 2025, TAO reached highs of approximately $520 amid strong AI market enthusiasm. The token later corrected sharply as broader crypto conditions shifted. Some analysts now project a possible move toward $300 if ETF approval advances.

The filing arrives as previous Bitcoin ETFs attracted more than $50 billion in assets within months. GTAO positions AI production, not payments or storage, within the evolving crypto investment landscape.