HBAR Drops 7% as Institutions Sell, Bulls Face Key Test

- HBAR sinks 7% to $0.23014 as heavy institutional selling shakes key support zones.

- Breakout from falling wedge keeps bulls aiming for $0.26 to $0.30 resistance targets.

- Positive funding rates and steady open interest highlight firm bullish conviction.

Hedera (HBAR) token faced heavy turbulence between September 14 and 15, sliding 7.14% from $0.24857 to $0.23014 in one of its sharpest moves this week. The $0.01843 swing highlighted how quickly institutional flows can rattle support levels when large-scale selling takes hold.

The steepest drop struck in the pre-dawn hours of September 15, when a wave of liquidations between 06:00 and 08:00 UTC cut through the $0.24 support barrier. More than 126 million tokens exchanged hands in that session alone, triple the average for corporate flows.

Still, a recovery attempt briefly surfaced at $0.23734 later that day, but demand died out before gathering steam. This left the token weighed down at $0.2349 by press time. That price reflects a 1.1% dip on the day, though it remains supported by a broader 2% gain on the weekly charts.

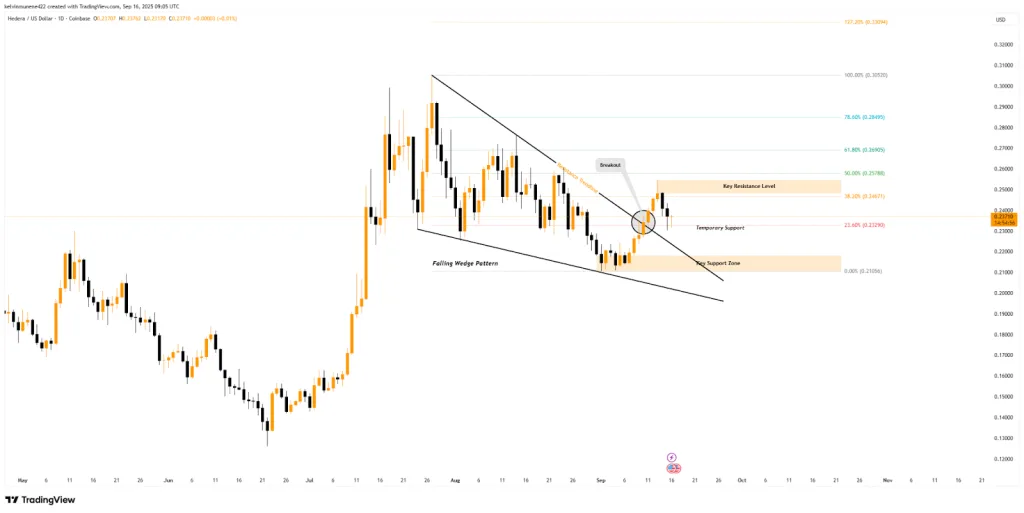

HBAR Price Action: Wedge’s Breakout Sparks Bullish Hopes

On higher timeframes, Hedera’s HBAR token is gaining traction after breaking out of a falling wedge, a classic pattern often tied to bullish reversals. The charts indicate the altcoin is now moving toward a crucial retest of the wedge’s resistance trendline, a barrier that has hampered its upward momentum since late July.

For traders, a successful retest here would signal a confirmation of long entries with more upside potential in the near term. Presently, HBAR rests at a temporary support at 23.60% Fibonacci retracement of $0.23290. For now, the support has kept the token away from further declines.

If buyers continue to defend this level, attention is likely to shift toward the $0.24671–$0.25788 range, located between the 38.20% and 50% Fib levels. This level stands out as the next key resistance for bullish momentum. A decisive break above this zone could lead to a higher target.

Next in line would be the 61.80% Fib at $0.269 and the 78.20% Fib at $0.284, with room for a potential push toward the $0.30 level. Achieving this move would constitute an impressive 30% rally from current prices. On the other hand, failure to hold $0.23290 could shift sentiment.

In that case, HBAR may revisit its former wedge resistance, overlapping with the $0.21836–$0.21056 support zone. While this area could attract bargain hunters, a sustained breakdown below it would risk invalidating the broader bullish thesis and returning control to sellers.

Related: Monero Price Soars 6% Amid Reorg Shock That Sparked Network Concerns

Bullish Conviction Grows as Traders Keep Positions Open

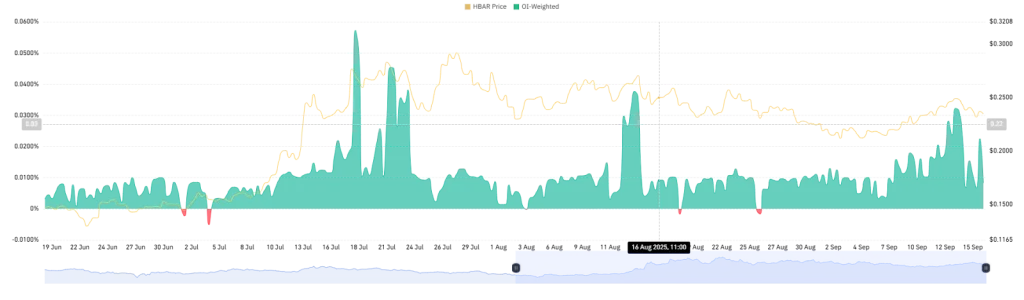

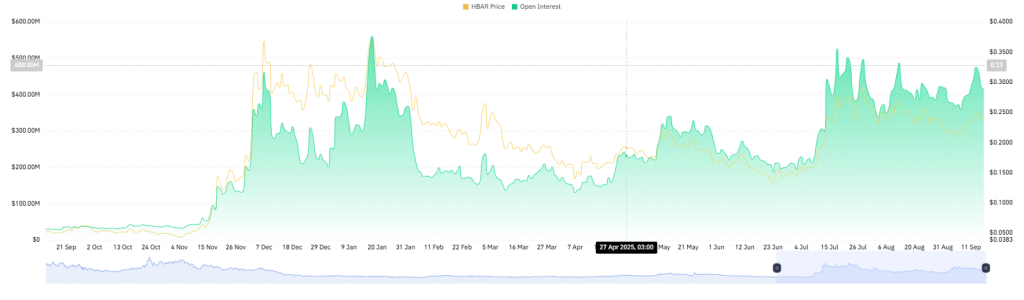

HBAR’s derivatives market is flashing clear bullish signals. The OI-weighted funding rate is firmly positive at +0.0224%, showing that long traders are paying shorts a premium to hold positions open.

This shows increasing confidence in upward momentum as traders willingly hold up exposure in expectation of further gains. Open interest corroborates the same story. Although it’s down from $474.84 million to $413.88 million, the level is still elevated, suggesting that the participants prefer to keep open positions over cashing out. Such behavior demonstrates unwavering trust in HBAR’s price behavior and resilience in market activity.

Conclusion

Despite the short-term volatility, technical developments show increasing resilience for HBAR. Support levels remain intact, whereas funding rates and open interest show firm bullish conviction. Should buyers hold the line, the token will test higher resistance zones shortly and could break away toward $0.30.