Hedera Surges Ahead of Canary HBAR ETF Nasdaq Debut

- Hedera jumps above $0.20 after breaking out of a descending pattern, indicating greater momentum.

- HBAR ETF set to launch on Nasdaq, reinforcing investor optimism and Hedera’s market recovery.

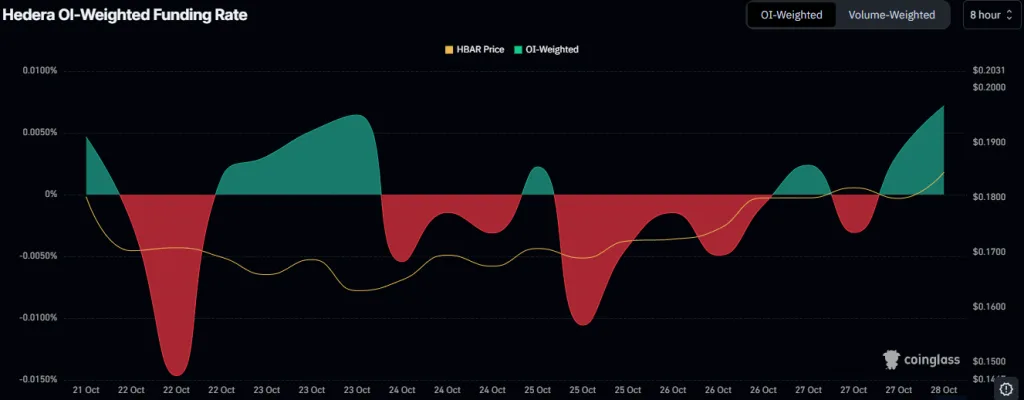

- Funding rates turn positive for the first time in a week, confirming higher trader confidence and long exposure.

Hedera (HBAR) is regaining traction across multiple fronts as the network’s price, derivatives data, and the token’s listing on the Nasdaq ETF converge in a synchronized uptrend. The token has rallied by 13.52% to $0.20978 after bouncing from a strong support zone near $0.17865. Market experts have linked the hike to a combination of technical strength, improving investor sentiment, and sustained network activity. HBAR’s rebound also follows the launch announcement of the Canary HBAR ETF being released today, which has fueled renewed investor enthusiasm. HBAR’s rebound is also following yesterday’s announcement that the Canary HBAR ETF will launch today on Nasdaq, reigniting investor optimism across the market.

Market Structure Shifts as Hedera Breaks the Downtrend

The daily chart of Hedera shows a significant breakout from the descending channel, attracting investors and boosting market activity. The asset price rose to $0.21975 at one point, but the momentum cooled slightly as some traders took profits. The essential resistance areas have now been established at $0.22692 and $0.24183, where the upper Fibonacci retracement zones are situated.

The first jump from the $0.17865 support level was seen as confirmation of the strong demand for buyers. If the price remains above the $0.20569 level, it is likely to rise toward $0.22692. A breakthrough at that point would mean moving targets closer to $0.27518 and $0.30500; thus, the reversal pattern would be completed.

Technical momentum supports this outlook. The Relative Strength Index (RSI) stands at 60.37, suggesting growing strength without nearing overbought conditions. If the RSI approaches 70, minor corrections may occur, but the underlying structure suggests continued upward pressure. The critical question that investors are left with is, will this trend continue, or is it just another short acceleration for its bearish proceedings?

Derivatives Data Confirms Bullish Trader Behavior

Data from Coinglass shows Hedera’s open interest (OI)-weighted funding rate has turned positive for the first time in a week. Between October 21 and October 28, funding rates fluctuated between -0.015% and +0.010%, indicating an alternating control between long and short traders.

On October 22, the funding rates declined to -0.014%, aligning with the HBAR’s price pullback to near $0.165. By October 28, funding rates had recovered to above 0.005% as HBAR traded above $0.19, indicating that traders were once again paying premiums to maintain their long positions. Such activity is a sign of a shift in the derivatives market’s optimistic mood.

Related: HBAR Price Tests $0.20 Support as Market Pressure Mounts, Will it Hold?

Hedera Gains Momentum as Nasdaq Lists Canary HBAR ETF

The Canary $HBAR ETF (Ticker: $HBR) is set to debut on Nasdaq, marking a pivotal milestone for the Hedera ecosystem. Trading begins under Canary Capital Group’s management, offering investors direct spot exposure to HBAR, the native token of the Hedera Network. The fund will hold actual HBAR, secured by BitGo and Coinbase Custody, with price data supplied by CoinDesk Indices.

This launch represents a major step toward institutional participation in the crypto market, giving traditional investors a regulated pathway to access Hedera through Nasdaq’s framework. The move is expected to boost market liquidity, attract new buyers, and enhance recognition of HBAR across the financial landscape.

The ETF’s approval has already sparked optimism, coinciding with HBAR’s 13.5% price jump to above $0.20. Analysts suggest the fund could drive further upside, as institutional investors gain confidence from the ETF’s secure custody and transparent structure.