How Liquidity Aggregators Are Becoming DeFi’s New Power Brokers

Trading once required using many different platforms and screens to find a fair price. Today, liquidity aggregators operate in the middle and quietly guide order flow. From foreign exchange to crypto and DeFi, these systems pull prices from multiple sources, compare depth and fees, and then route or split orders in real time.

Even as trading volumes grow, liquidity remains fragmented across venues. Aggregators sit at the intersection of these markets, providing unified access to dispersed liquidity and optimizing execution across sources.

Fragmented Liquidity Still Disrupts Prices and Trading Costs

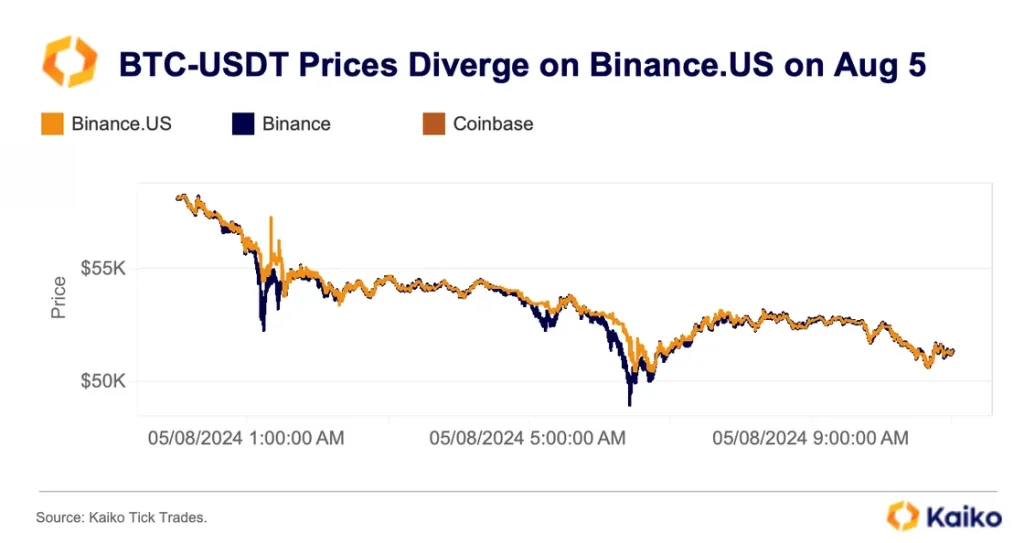

Liquidity fragmentation affects both foreign exchange and crypto markets, and it raises real costs for traders. In crypto, the impact is even clearer because liquidity is divided across numerous exchanges and trading venues, each with its own order books and pricing. Research from Kaiko finds that “liquidity fragmentation persists in crypto markets, and with it, price discrepancies across exchanges,” especially during stress events. For example, in an August 2024 sell-off, Bitcoin and other coins were priced differently on small exchanges and major platforms.

Moreover, other market-making firms highlight that fragmented order books make crypto markets fragile. Liquidity spreads across dozens of exchanges, so a large sale on one small venue can move prices sharply, even when deeper books exist elsewhere. As a result, slippage increases, and traders often get worse trade prices than the quoted price.

Fragmentation in crypto extends beyond exchanges. Capital is spread across multiple blockchains and layer-2 networks, and each chain hosts its own decentralized exchanges and lending pools.

In practice, a trader may find a better price on one chain but hold funds on another chain, which adds bridge costs and risk. This mix of venues, chains, and products creates a clear need. Markets require tools that can read across all these sources and direct orders to the optimal or most favourable combination in real-time.

How Liquidity Aggregators Work

Liquidity aggregators address this problem by collecting price and depth data from many sources and by routing orders across them.

In FX, multi-bank platforms aggregate quotes from several dealers and non-bank providers to offer clients a combined order book instead of separate streams. Markets describe such platforms as electronic systems that both aggregate and distribute quotes from multiple FX dealers.

Technology vendors now offer similar tools to brokers. Liquidity aggregation enables brokers to pull prices from banks, non-bank market makers, and ECNs, then present a consolidated order book to clients. This approach improves pricing, market depth, and execution speed because the system can fill one order from several providers. The aggregator monitors multiple venues in real-time, and it can also redirect flow away from any provider that slows down or widens spreads.

Smart order routing is positioned at the core of this structure. Aggregators scan for price, but they also check depth, latency, and fees. A DEX aggregator acts as a routing layer that scans multiple decentralized exchanges and request-for-quote (RFQ) market makers to find optimal swap paths while reducing slippage and gas costs. The same logic now appears in traditional brokerage platforms and multi-venue crypto tools.

Market experts see this as a structural shift. Traders now rely on technology to move across electronic venues while handling the complexity of a fragmented landscape.

Related: How AI is Revolutionizing Decentralized Finance and Market Making

DeFi and DEX Aggregators Address Fragmented On-Chain Liquidity

In decentralized finance, liquidity aggregators operate at the protocol level. For instance, 1inch describes itself as a DeFi aggregator that connects to many decentralized exchanges and finds optimal routes for token swaps. Instead of trading on a single DEX, a user sends an order to 1inch, and the protocol then splits that order across several pools if needed.

The split-trade approach often provides better effective rates than a single swap on one venue. Furthermore, DEX aggregators can optimize “slippage, swap fees, and token prices,” and they now play a central role in DeFi execution.

Other DEX aggregators follow the same pattern; these tools act as routing layers across multiple DEXs and RFQ sources. They make a scattered on-chain landscape into a single interface where users simply request an asset exchange and receive a best-effort result.

Market data support their rising influence. According to an analysis of cross-chain DEX aggregators, 1inch ranks as a leading routing engine, and several other platforms now integrate more than 100 DEXs and bridges. As more applications rely on these engines, the aggregators effectively decide which pools receive volume and which ones remain quiet.

Kaiko’s research on crypto pricing concerns shows why this routing layer is needed. During sharp market moves, spreads and price gaps between exchanges widen, and some venues show large disconnections. DEX aggregators can reduce the execution risk by routing trades to deeper liquidity and avoiding small venues during market stress.

Cross-Chain and Stablecoin Aggregators Build Unified Liquidity Layers

Fragmentation also occurs between chains, and cross-chain aggregators aim to address that layer. For instance, Rango describes itself as a “universal cross-chain DEX and bridge aggregator” that offers smart routing over DEXs, DEX aggregators, bridges, and cross-chain protocols. It routes swaps as a sequence: a DEX trade on the source chain, a bridge transfer, and a final DEX trade on the destination chain.

Reportedly, Rango integrates over 100 DEXs and bridges and supports many wallets, while 1inch acts as a core router that now plays a role in cross-chain swaps and single-chain swaps. This combination offers aggregators a broad view of on-chain liquidity.

LI.FI takes the idea even further. The protocol describes itself as a bridge and DEX aggregation layer that connects to major DEX aggregators, bridges, and intent systems through a single API. A recent report notes that LI.FI has processed over $30 billion in transfers and now aggregates liquidity across more than 30 blockchains.

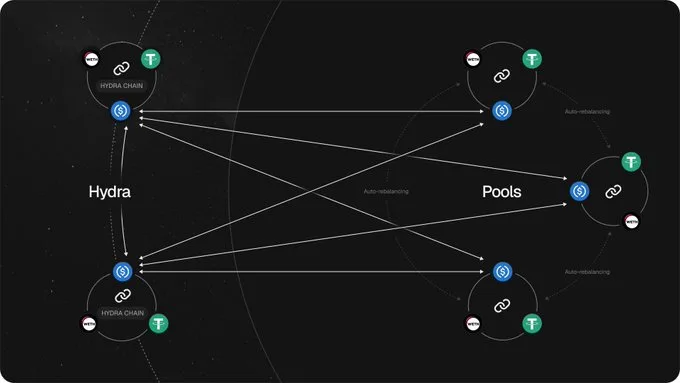

Stargate Finance offers another part of this solution. Nansen describes Stargate as a liquidity protocol with unified pools that support 1:1 native asset swaps across many blockchains. A report from the project states that Stargate “abstracts liquidity into a unified layer with over $1.3 billion in capitalized pools,” which addresses one of DeFi’s main fragmentation challenges.

Furthermore, stablecoin infrastructure now embeds aggregation logic as well. Circle’s Cross-Chain Transfer Protocol (CCTP) lets USDC move natively between chains by burning tokens on one network and minting them on another. Circle says CCTP “enables USDC to flow natively 1:1 between blockchains, unifying liquidity and simplifying user experience.”

These systems do more than move assets. They create shared liquidity layers above individual chains. Traders access deeper pools and lower slippage, while developers gain one interface instead of multiple bridge integrations. However, control over that routing now rests with a small group of cross-chain aggregators.

Institutional Aggregators and Prime Brokers Gain Influence

Institutional crypto trading shows a similar rise in aggregation. According to Frank van Zegveld, head of EMEA sales at Talos, who says, “Talos alone connects to over 70 sources of liquidity. Unlike traditional markets, where trading is concentrated on a few dominant venues, the digital asset ecosystem is highly fragmented.”

Talos positions its platform as “connective tissue” between exchanges, OTC desks, lenders, and custodians. It aggregates order flow and market data, allowing institutional clients to trade through one system instead of building several separate connections. This model turns Talos and similar firms into key access points for large investors.

Prime brokers extend that role by adding balance-sheet support and custody. Kraken Prime, launched in June 2025, offers access to liquidity that represents over 90% of the digital-asset market across over 20 venues. The service uses smart order routing to move orders between on-platform and external venues, while also providing credit lines and qualified custody.

Kraken’s broader strategy shows how power can flow to aggregators. The crypto exchange has moved into commission-free stock trading, acquired the CFTC-licensed Small Exchange, and reached a $20 billion valuation after its latest funding round while preparing to go public in 2026. These steps extend its reach from crypto spot markets into derivatives and traditional securities.

Partnerships between native crypto firms and traditional banks reinforce a similar pattern. This includes FalconX, a crypto prime broker, which partnered with Standard Chartered to combine the bank’s FX and cash-management network with FalconX’s digital-asset trading services. In this structure, FalconX acts as the main liquidity access point for many institutional clients, while the bank handles fiat settlement and regulation.

As more institutions rely on these platforms, aggregators accumulate information on flows and prices. They also gain leverage in fee negotiations with venues. Over time, this role can resemble that of major data vendors and order-routing firms in equities and FX.

Related: The Evolution of Crypto Exchanges: From Forums to Super Apps

Market Power, Risks, and the Push Toward Unified Liquidity

Liquidity aggregators clearly improve efficiency. They reduce search costs, cut slippage, and bring more depth to each trade. However, they also concentrate power at the routing layer of markets.

In DeFi, 1inch now ranks as a leading DEX aggregator across several chains, and wallets and dApps often plug directly into its routing engine. LI.FI, Rango, and Stargate control major parts of cross-chain routing and unified pools. When traders and applications rely on these tools, they effectively hand execution choices to the aggregator.

In traditional and institutional markets, Talos, Kraken Prime, and similar platforms now stand between clients and dozens of venues. They determine routing paths across different exchanges, which can significantly influence price discovery and market competition.

Regulators already study this dynamic process. Central banks highlight the need to monitor how liquidity aggregators affect transparency, access, and fairness in FX and other over-the-counter markets. Similar questions will likely arise in crypto as aggregators gain more data and more influence over routing.