HYPE Price Surges 5% as Market Rally and Policy Tailwinds Converge

- HYPE price rebounds 5% as markets rise and new Washington policy efforts draw attention

- Support near $27 to $29 holds, as RSI and Fib levels indicate steady demand now

- Hyperliquid funds a policy center with HYPE tokens as traders monitor evolving price signals

HYPE price advanced nearly 5% in the past 24 hours to trade at $29.58, trimming last week’s losses, which remain slightly negative at 2.72% at press time. The rebound unfolded alongside a broader market recovery, as Bitcoin rose 2.07% over the same period, and the total crypto market capitalization increased 1.51% to $2.33 trillion. The synchronized movement suggests the token’s short-term performance closely followed overall market sentiment.

Trading activity also reflected a measured response rather than an isolated spike. Per CoinMarketCap’s data, volume rose 6.75% to $197 million, aligning with wider market participation instead of a singular surge. Analysts observed that the rally appeared largely beta-driven, mirroring Bitcoin’s direction rather than stemming exclusively from internal catalysts.

Washington Policy Push Adds Context

The upward move coincided with Hyperliquid’s announcement of a Washington, D.C.-based DeFi advocacy initiative. According to reports, the Hyper Foundation disclosed it would contribute 1 million HYPE tokens, valued at approximately $29 million, to establish the Hyperliquid Policy Center.

The tokens were later scheduled to be unstaked to fund the effort. Moreover, crypto attorney Jake Chervinsky was named to lead the policy group. In an official statement on X, the organization said the initiative aims to secure clearer decentralized finance regulations and provide formal representation in Washington.

The foundation added that it expects the Policy Center to influence regulatory dialogue constructively. While the announcement contributed to renewed interest, price data shows the broader market’s positive momentum played a parallel role in lifting the HYPE price.

Technical Structure Signals Stabilization

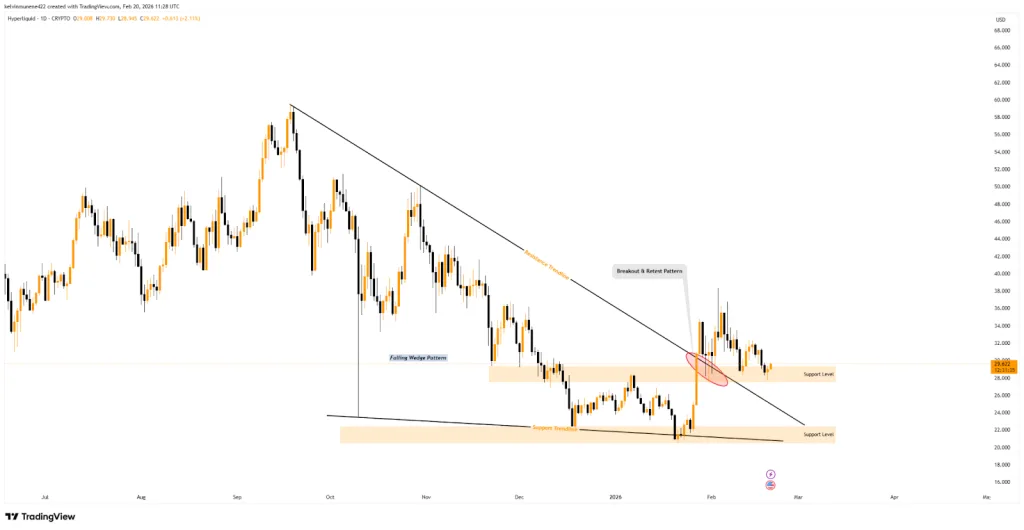

On the daily chart, the HYPE price found support between $27 and $29, an area that coincides with the 50-day moving average. This support zone also aligns with the 38.2% Fibonacci retracement level, reinforcing its technical significance.

Before this recovery took shape, the token had previously encountered resistance between $36 and $38 earlier this month, near the 200-day moving average. At press time, the asset hovered slightly above the 50% Fibonacci retracement at $29.425.

Source: TradingView

Besides, the Relative Strength Index stood at 49.49 and pointed upward, indicating strengthening buying pressure. However, the indicator remains below the neutral 50–60 expansion zone, meaning confirmation of sustained bullish strength is still pending.

If upside momentum continues and RSI breaches the 60 mark, HYPE could first test $31. A clean break above that level would expose $34 as the next technical barrier. Beyond that, price may attempt to retest the $36–$38 supply zone where sellers previously gained control.

Related: WLFI Price Breaks $0.11 After 30% Rally: Can Bulls Sustain Momentum?

Falling Wedge Breakout Holds

A broader technical perspective further confirms HYPE’s potential for a bullish sentiment in the near future. On the same daily chart, HYPE’s price action is seen breaking out of a multi-month falling wedge pattern, often associated with bullish reversals after extended declines.

The breakout was followed by a retest phase, which traders frequently monitor to confirm structural shifts. Following that confirmation, the token rallied roughly 25% and peaked near $38.36. Currently, price action approaches the wedge’s upper trendline, which may now serve as support.

Source: TradingView

Technical analysts emphasize that maintaining levels above this trendline preserves the broader reversal structure. Still, a decisive move below it would alter the prevailing momentum outlook.

Overall, the combination of policy developments and synchronized market recovery has positioned the HYPE price within a technically significant zone. Price levels, volume growth, and broader crypto market expansion collectively frame the token’s current trajectory within measurable and observable market data.