Hyperliquid Hits $2M in Daily Fees as DeFi Activity Booms

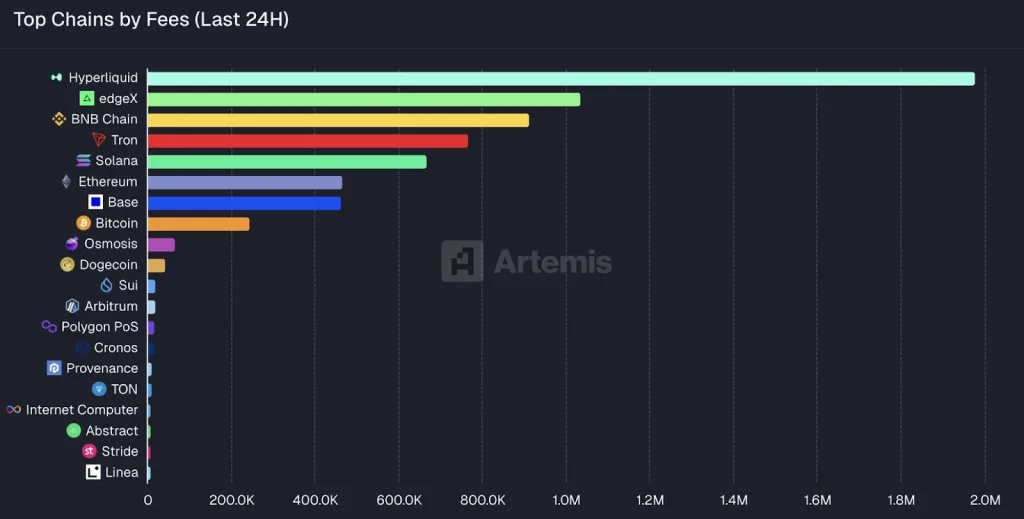

- Hyperliquid leads all blockchains with $2M in daily fees as trading volume surges rapidly.

- EdgeX and BNB Chain experience strong fee growth, driven by increased DeFi user engagement.

- On-chain fees rise across networks, showing strong multi-chain adoption and liquidity.

Crypto investors are eyeing a fresh surge in on-chain fee revenue that points to booming user activity across several blockchains. At the front of the pack sits Hyperliquid, a fast Layer-1 network built for perpetual futures.

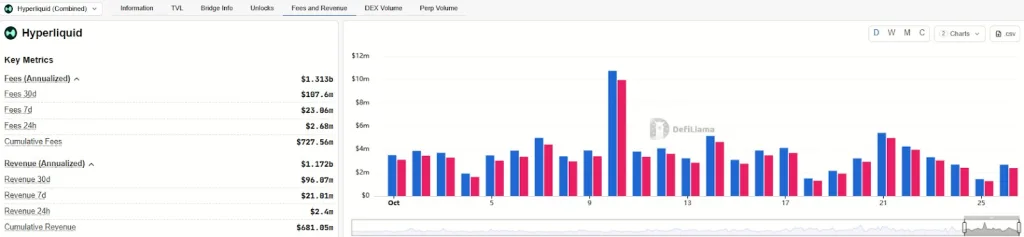

The platform generated approximately $2 million in fees within a single day, the highest total recorded across any blockchain during that period. This milestone is no one-time fluke. In fact, Hyperliquid’s fee growth has been climbing steadily for months, up more than 1,600% in October alone.

Source: DefiLlama

That surge pushed its monthly revenue to nearly $97 million. With perpetual trading volumes that often exceed $5 billion a day and peak fees above $10 million, the network is carving out a strong position as a preferred DeFi institutional-grade trading venue.

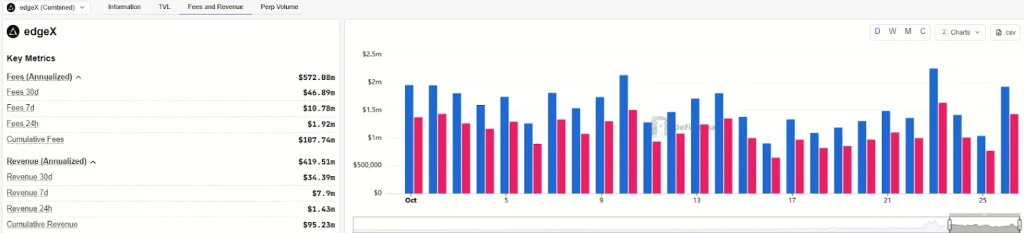

Close behind is EdgeX, a zero-knowledge Layer-2 created by Amber Group. Even without a native token, it has generated remarkable activity, collecting approximately $46.89 million in monthly fees, equivalent to a yearly pace of roughly $572 million.

Source: DefiLama

Over the last 24 hours, EdgeX has earned more than $1 million as traders sought liquidity and low-cost execution. Many are also participating in points campaigns tied to a future airdrop, demonstrating that EdgeX can build real demand long before formal incentives are introduced.

Notably, BNB Chain, a regular favorite among retail users, continues to command attention in the fee race. It placed third in the latest 24-hour count with more than $800k in fees. Much of this activity is driven by memecoin trading, DeFi transactions, gaming, and NFTs, powered by BNB Chain’s low transaction fees.

Importantly, its real-time BNB burn mechanism means that fee growth directly translates into token scarcity, a model that has recently sent BNB price levels to new highs.

Related: Humanity Protocol Surges to New All-Time High After Eco Digital ID Launch

Tron, Solana, Ethereum, and Base: Usage at Scale

Other heavyweights also made strong showings. Tron, often used for stablecoin transfers, logged more than $700k in daily fees. Given its ultra-low per-transaction cost, that figure implies an enormous number of transactions, likely in the hundreds of millions, confirming its lead in raw network activity.

Source: X

Similarly, Solana, rebounding from its 2022 lows, consistently posts top-tier fee revenue, aided by its dominance in NFT mints and high-frequency DeFi. Its ability to aggregate small fees across tens of millions of interactions continues to pay off.

Meanwhile, Ethereum maintains a stronghold in value-dense DeFi activity and high-value token launches, clocking just above $400K in fees daily, though its dominance has diminished in the face of cheaper and faster networks.

Base, the Layer-2 chain backed by Coinbase, also ranked in the top 10. Once fueled by the Friend.tech boom, Base continues to attract social and DeFi usage with its ultra-low fees. Meanwhile, Bitcoin maintained above $200k in network fees, confirming steady activity driven mainly by ordinal inscriptions and exchange settlements.

To sum up, the increase in blockchain fee revenue reflects the revival of on-chain activity across the entire cryptocurrency market. While networks like Hyperliquid, EdgeX, and BNB Chain are experiencing strong daily earnings, it is evident that user engagement is growing in various ecosystems. This additional momentum signals a more developed DeFi landscape, one that operates on the principles of real demand, efficiency, and continuous multi-chain engagement.