HYPE’s Price Rockets 20% in Just a Week, New ATH in Sight?

- HYPE gains 20% in a week to reclaim $50, signaling strong recovery momentum in the market.

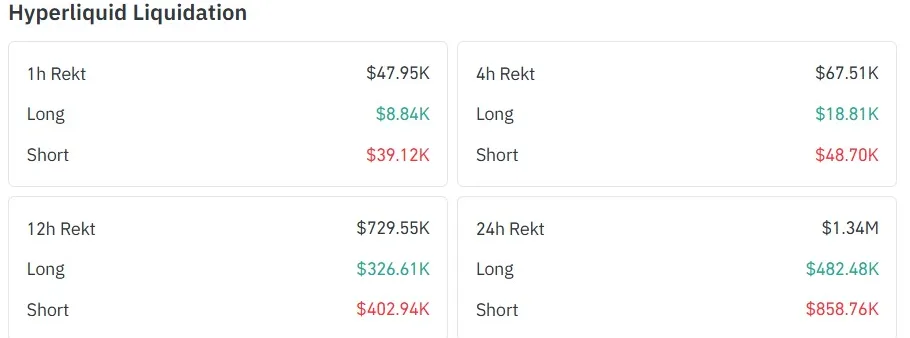

- Liquidations hit $1.34M in 24 hours as shorts face $858K losses, boosting bullish pressure.

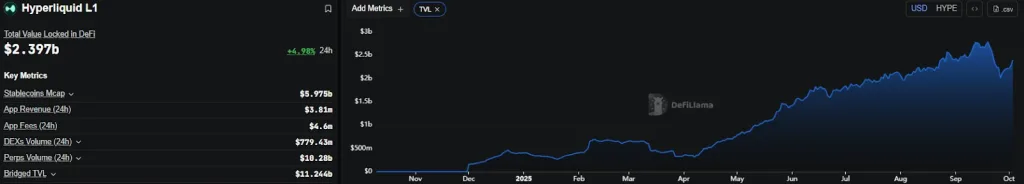

- TVL climbed to $2.39B, reflecting steady capital inflows and growing trust in Hyperliquid.

HYPE, the native token of Hyperliquid, posted a sharp rebound this week, climbing 20% to reclaim the $50 zone. The rally signals renewed strength across one of the fastest-growing decentralized exchanges. The move comes after a steep 33% correction from its all-time high near $59 to around $39. That level quickly attracted buyers, sparking a strong recovery that forced out leveraged short positions.

In the past 24 hours alone, liquidation data shows $1.34 million cleared, with $482K from longs and a larger $858K from shorts. The tilt toward short losses underscores a squeeze that fueled upward momentum.

Meanwhile, HYPE’s ecosystem strength remains evident in its broader market metrics. Its market capitalization has risen to $16 billion, while the fully diluted value now stands at around $50 billion. Trading activity also surged, with $480 million in volume, an approximate 10% increase that highlights deeper liquidity and growing market engagement.

Metrics Point to Strong Growth

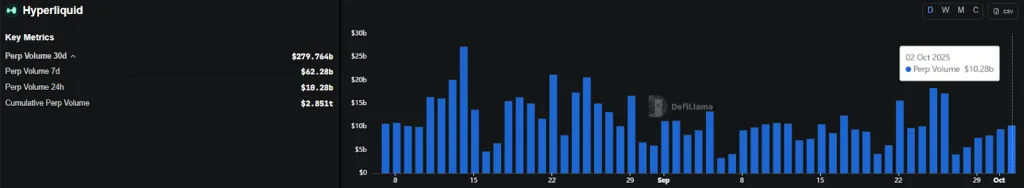

Beyond price action, Hyperliquid’s perpetual DEX is witnessing a resurgence in trading activity. According to DefiLlama data, volumes are averaging around $10 billion.

This increased activity underscores a surge in market engagement, driven by traders covering fees in HYPE as demand for the token strengthens. Confidence in the platform is also evident in its Total Value Locked (TVL).

Assets held in smart contracts have increased to $2.39 billion, indicating a rise of 4.79% in the last 24-hours. Such a scenario reflects steady inflows of capital into the ecosystem, underscoring user trust in Hyperliquid’s infrastructure and long-term prospects.

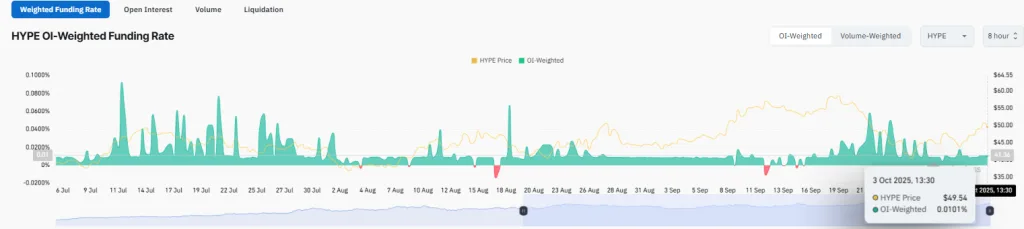

Funding data reinforces this outlook. The OI-weighted funding rate sits in positive territory at 0.0101%, showing traders’ willingness to pay extra to keep long positions open. This behavior reflects conviction in HYPE’s potential for further gains.

At the same time, open interest hovers around $2.45 billion, pointing to traders’ preference to maintain active positions rather than cash out. Elevated open interest signals robust market activity and adds to the potential for sharper price swings, illustrating the strong momentum surrounding HYPE.

Related: Altcoins Market Cap Retests 2021 Levels, Is a Breakout Imminent?

HYPE Price Action: Key Levels to Watch

HYPE is currently trading within an ascending broadening wedge pattern, a structure that signals heightened volatility and wider price swings. As of press time, the altcoin is hovering just above the 50% Fibonacci retracement level at $49.

This zone has acted as temporary support and remains critical to the token’s short-term direction. Should it hold, the next technical target lies at the 78.60% Fibonacci level near $55, followed by the established resistance zone around $59, which aligns with its previous all-time high. This price region reflects an approximate 20% climb from current levels.

On the downside, the 50% Fibonacci zone remains a decisive pivot. A daily close below this level would see the zone shift into resistance. The next support region is mapped between $45 and $42, coinciding with the 23.60% Fib level at $44.39. This range has been identified as an area where buyers have historically reentered the market.

Should that zone weaken, HYPE could retest the wedge’s broader support trendline, which has previously served as a foundation for recovery. Yet, a breach of this structural line would invalidate the entire bullish thesis in the token’s current trajectory.

The Relative Strength Index (RSI) provides additional context. Standing at 53.43, the indicator is positioned in the neutral zone but has risen from oversold levels, suggesting strengthening momentum. Should the RSI cross above 60, it could signal further confirmation of ongoing buying pressure.

In summary, HYPE’s rebound highlights growing strength across both price action and ecosystem metrics. If current trends persist, the token’s outlook leans bullish, reflecting sustained investor conviction and growing ecosystem strength.