ICP Rally Sparks Hope After Record Low: Can Bulls Hold $3?

- ICP rebounds after hitting $1.16 amid easing market pressure and weak sentiment.

- Oversold metrics suggest sellers may be losing strength as support levels hold.

- Declining open interest signals fading leverage and potential market stability.

The Internet Computer (ICP) token has spent most of the year under steady downward pressure as a wave of sell-offs and fading investor confidence continue to weigh on its price. The slump reached its worst point on October 10, when ICP tumbled to an all-time low of around $1.16 after a record $20 billion market liquidation swept through the crypto sector in a single day.

Following that massive sell-off, the token staged a modest rebound, climbing back above $3.00 and offering a brief sign of stability. Still, its broader trend remains weak. ICP has lost roughly 63% over the past year, shed 31% in the last month, and slipped another 11% during the past week.

The numbers indicate that sellers continue to dominate the market, while buyers remain cautious about any potential long-term recovery. From a technical viewpoint, however, ICP now trades near a central support area between $2.92 and $1.16.

Moreover, momentum indicators are deeply oversold, suggesting that the token may be trading below its fair value. Such readings often signal exhaustion among sellers and can attract opportunistic investors seeking discounted entries.

For now, the market stands at a crossroads. The question dividing traders is crucial yet straightforward: has ICP finally reached its bottom, or is another leg down still ahead?

Key Technicals Show Signs of Seller Exhaustion

The Murrey Math Lines, for instance, indicate that the token has breached the –2/8 Extreme Oversold region, a technical zone that often marks the final stretch of selling pressure before a potential rebound. This area suggests that bearish momentum may be fading as traders begin to eye possible accumulation levels.

Yet, volume remains low, suggesting weak buying conviction. Nevertheless, if sentiment shifts, the Murrey Math setup points to $4.68 as the first test for a rebound. A break above that line could invite more momentum toward the $6.25 region, which has repeatedly capped rallies since March. Surpassing it would mark a substantial change in tone and could set the stage for a move beyond $11. But the risk remains. If bulls fail to hold ground, ICP could drift into new territory on the downside.

Related: Cardano Defends $0.60 Line, Can ADA Bulls Ignite the Next Rally?

On-Chain Metrics Signal Market Cooling Phase

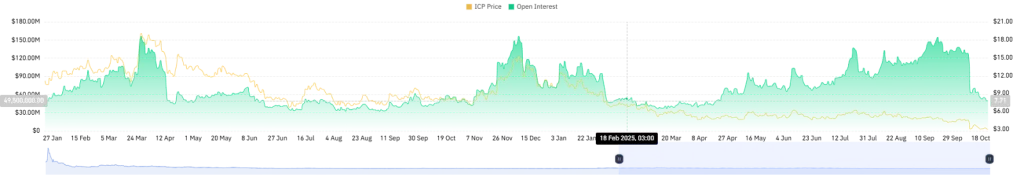

From an on-chain lens, ICP’s derivatives market has entered a cooling phase. Open interest has dropped sharply, sliding under $50 million from highs above $154 million seen in mid-September. That kind of contraction typically indicates that traders are backing away from high-risk, leveraged positions.

With fewer speculative bets in play, the wild price swings that marked earlier weeks have started to ease. The pullback also suggests that the market is catching its breath. When leverage unwinds, activity tends to flatten, and prices often drift sideways for a while.

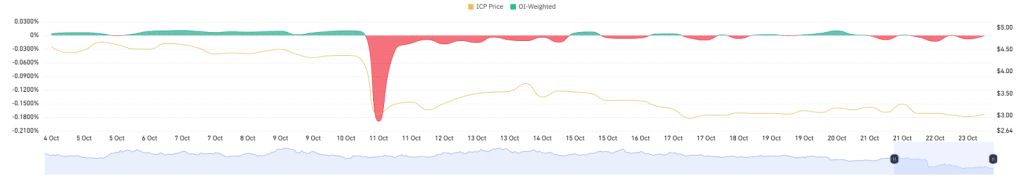

Weighted open interest tells a similar story. It’s holding near -0.0004%, a sign that short sellers are still paying a discount to keep their trades open. That’s usually a reflection of doubt, not conviction.

It shows that confidence among long traders remains thin, but it also leaves room for surprise. If those short positions start to close, the same pressure that weighed ICP down could drive a quick rebound.

In summary, ICP’s market is showing early signs of stabilization after months of decline. Oversold technicals and easing open interest suggest selling pressure may be slowing. However, confidence remains fragile, and the subsequent few sessions will reveal whether this recovery can gain strength or fade into further weakness.