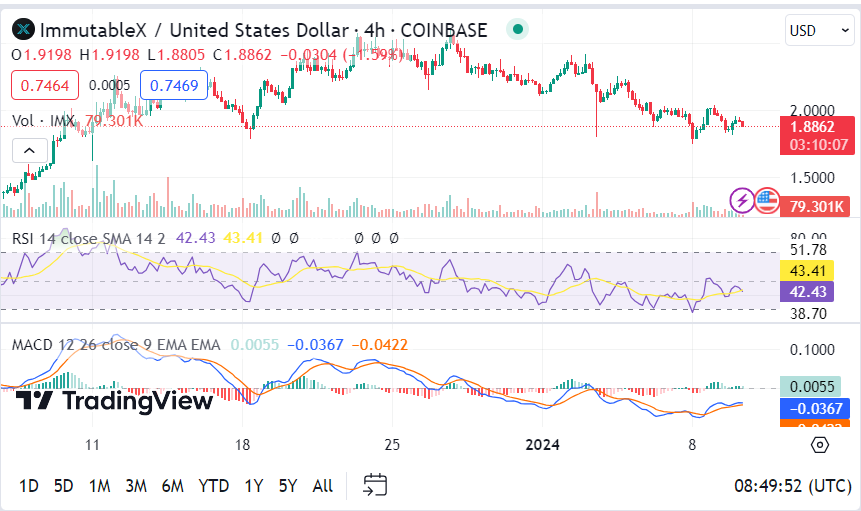

Investors and analysts have recently turned their focus to ImmutableX (IMX), which, after experiencing a short-term downtrend since late 2023, shows signs of a potential bullish reversal. As observed on the 4-hour chart, this shift is marked by a classic falling wedge pattern. Trading at $1.88, IMX is poised near a critical breakout point.

Typically indicative of a bullish reversal, the falling wedge pattern emerges prominently during downtrends. This pattern is characterized by its two distinct trendlines. One is descending, connecting a series of lower highs, and the other is ascending, linking the lower lows.

This pattern suggests decreased selling pressure and a possible gain in buying momentum. It signals that the downtrend is losing steam, potentially leading to a reversal or significant upward movement. Notably, a breach above the breakout point could propel the asset to rally, mirroring the height of the pattern’s initial point.

Hence, it translates to a target price of $2.26 for IMX, an almost 16% increase from the breakout point. The support zone, crucial in this scenario, stands at $1.85. It allows IMX another breakout opportunity, even if the current attempt falters.

However, the market’s response to this pattern is more fluid. Price indicators offer mixed signals. The Relative Strength Index (RSI), currently below the neutral 42.42 mark, suggests a bearish outcome. Conversely, the Moving Average Convergence Divergence (MACD) indicates bullish tendencies, demonstrated by rising green bars on the histogram.

Moreover, the broader market conditions, particularly the anticipation of a spot Bitcoin ETF approval, play a significant role in determining IMX’s trajectory. These external factors could bolster or dampen the bullish potential the falling wedge pattern suggests.

Hence, while the technical analysis points towards a bullish reversal for ImmutableX, investors must navigate this cautiously. Investors should consider the complex interplay of market sentiment, external economic factors, and technical indicators in the cryptocurrency market. This domain is often unpredictable due to its inherent volatility and uncertainty, making it crucial to weigh these multiple aspects before making investment decisions.