INJ Price Risks $10 Breakdown as Liquidations Mount

- INJ drops under $14 as $1.26M in liquidations spark heavy selling and raise market concerns.

- Open interest declines to $148.89M from $220.43M, showing traders cutting risk and exposure.

- Critical support zones near $10 and $8 loom as liquidation risks, pressure leveraged positions.

Injective’s rally may have reached a breaking point as sharp selling pressure unsettles traders. According to Coinglass data, the token slipped under $14 on August 25, wiping out over $1.26 million in leveraged long bets.

That liquidation wave, equal to about 1.2% of Injective’s daily turnover, triggered a cascade of forced selling that intensified the slide. The broader market added to the strain, with the total crypto capitalization falling 1.7% in the past 24 hours.

Altcoins carried the heavier losses, underperforming Bitcoin, which saw its dominance rise to 57.32%. The setback has fueled fresh anxiety that INJ could test the $10 mark, a level widely seen as psychological support. Consequently, analysts caution that should market sentiment continue to sour, INJ’s recent stumble could be a warning sign of deeper corrections.

INJ’s Price Action: Key Levels To Watch

On the broader trend, Injective is trading within a descending wedge formation that has persisted since March, a setup often linked to bullish reversals after prolonged consolidation.

Yet recent price action shows the token struggling to break higher. Recently, sellers forced a rejection near the $17 resistance zone, aligned with the 38.2% Fibonacci retracement level. That rejection has driven INJ back below $13, highlighting renewed downward pressure.

The weekly chart underscores this weakness, as the token now hovers beneath the 23.6% Fib at $13.17, which has flipped from support into short-term resistance. Failure to reclaim this level could accelerate losses toward the $10 psychological support, a zone reinforced by prior demand.

For bulls, however, to regain momentum, Injective must secure a decisive close above $17.40. Such a move could open the path toward the 50% Fib at $20.81 and potentially extend to the 78.6% retracement at $29.09.

If downside pressure persists, the chart points to a critical support base around $7-$5.40, representing the 0% Fib level. A breach there would confirm a deeper bearish cycle, erasing much of the token’s prior gains and signaling broader market capitulation.

Market analyst Ali_Charts hints at a similar outlook, noting that Injective has confirmed a breakdown from its ascending triangle structure. According to his projection, the token could slide toward the $8.00 region, with intermediate support levels forming at $11.66, $10.53, and $9.51.

Related: Shiba Inu Traders Eye Autumn 2025 as Token Struggles Under Bearish Pressure

Bullish Conviction Tested as INJ Liquidation Risk Escalates

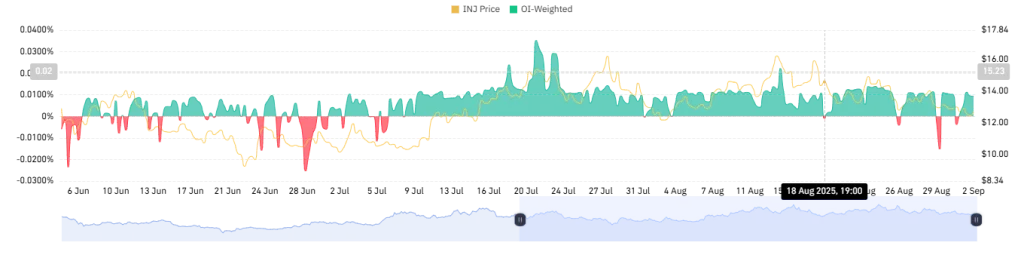

Injective’s derivatives market is flashing mixed signals as traders weigh short-term risks against long-term conviction. The OI-weighted funding rate sits at +0.0094%, showing that long positions are paying shorts to keep trades open—a sign of bullish sentiment as investors bet on further upside rather than closing positions.

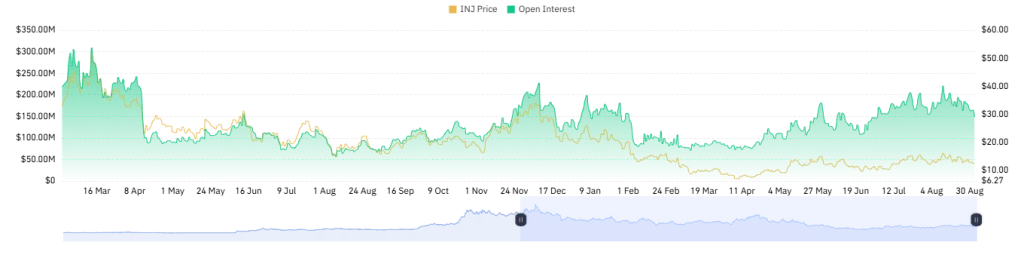

At the same time, open interest has cooled to $148.89 million, retreating from a mid-August peak of $220.43 million. The decline suggests that some traders are reducing exposure, a move that could translate into added selling pressure.

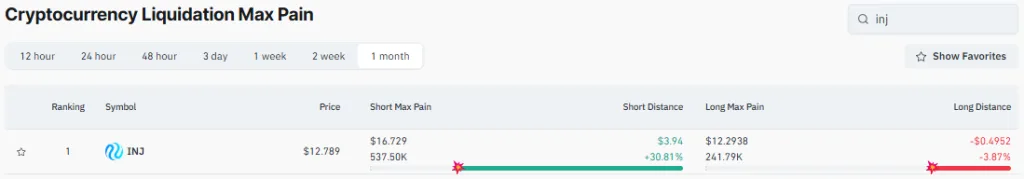

Still, open interest remains relatively elevated, suggesting underlying confidence in the token’s prospects. From a liquidation standpoint, Coinglass’s max pain data underscores the immediate risk.

Short liquidations would only come into play if INJ rallied 31% to $16.72, while longs face pain much sooner, with their threshold at $12.29, just 3% below current levels. With INJ trading near $12.78, the setup places overleveraged longs in a vulnerable position, raising the likelihood of forced selling if downside pressure persists.

Conclusion

Injective’s outlook remains uncertain as technical signals and derivatives data point to rising volatility. While bullish conviction persists through positive funding rates, weakening open interest and liquidation risks highlight fragile market conditions. Key support levels around $10 and $8 remain critical in determining the token’s next direction.