Institutional Solana Staking Yields Boost Market Confidence

- Solana hits $675M in institutional holdings, signaling strong treasury interest.

- Staking yields drive SOL demand with returns 20–40% above exchange offerings.

- Upexi, DFDV, and others adopt Solana treasuries for secure blockchain exposure.

Solana’s recent price performance, while notable, aligns with a broader macro trend centered on institutional adoption of blockchain assets. Public companies and treasury firms have significantly increased their SOL holdings, indicating strategic confidence in the platform’s long-term viability. One such firm, DeFi Development Corp (DFDV), now holds 1.3 million SOL tokens valued at over $260 million. Their daily earnings from this stockpile reach approximately $63,000, illustrating the yield potential that staking strategies offer institutional participants.

Institutional investors are drawn to Solana’s combination of low transaction fees and high throughput, which provides a viable environment for blockchain-based treasury operations. A complete figure of the SOL in the hands of the public firms has reached the $675 million mark, which reinforces the case of strategic positioning of Solana in treasury portfolios. These holdings are not speculative investments; they are structured investments that aim to capitalize on the strengths of staking yields.

Treasury Models and Yield Strategies

The DFDV Treasury Accelerator has introduced a global franchise model that decentralizes treasury operations by partnering with regional entities. These local treasuries slip through the market-specific regulations but work along with the strategic interests of DFDV. An equity holding in regional vehicles will mean that governance is not subject to fluctuations, and performance incentives also exist between jurisdictions.

One major aspect of the Solana treasury is staking. Institutions can generate substantial returns through validator infrastructure, yielding far more than centralized exchanges. These returns—20% to 40% greater in some cases—are especially attractive amid rising interest in decentralized finance strategies. This model is particularly compelling for corporates seeking blockchain exposure without the volatility of trading-based gains.

Technical Infrastructure Supporting Growth

The validator economy is the major force securing the network and rewarding them. Alpenglow consensus rewrite has also lowered the amount of capital necessary in order to be a validator. This shift will give more institutions the freedom to pursue network security and earn yield, therefore, increasing decentralization and scaling.

With over 1 million SOL tokens staked on this infrastructure, the network benefits from enhanced security and a reduced likelihood of large-scale stakeholder manipulation. This is an architectural benefit that allows Solana to compete with other Layer 1 blockchains, as well as showing its long-term sustainability as an institutional quality asset. The validation model will enable the simultaneous achievement of network integrity and yield production.

Strategic Corporate Partnerships and Expansion

Recent trends indicate a strong institutional adoption of Solana. On August 12, Upexi, which holds 1.9 million SOL tokens, announced that Arthur Hayes, co-founder of BitMEX, would join its advisory committee. The participation of Hayes is an indicator of a high strategic move to help Upexi gain influence in the Solana ecosystem.

It is done as an extension of the overall plan to expand treasury activities focused on Solana through specific collaborations and deployments. The strategy of Upexi rests on the development of its operational presence and the development of a leadership position in treasury innovation. The advisory committee will be aimed at boosting performance and encouraging uptake of the same by other corporates, as well as looking at adopting a similar approach using blockchain.

Related: Solana ETF Approval Could Come by September: Here’s Why

Market Response and Forward Indicators

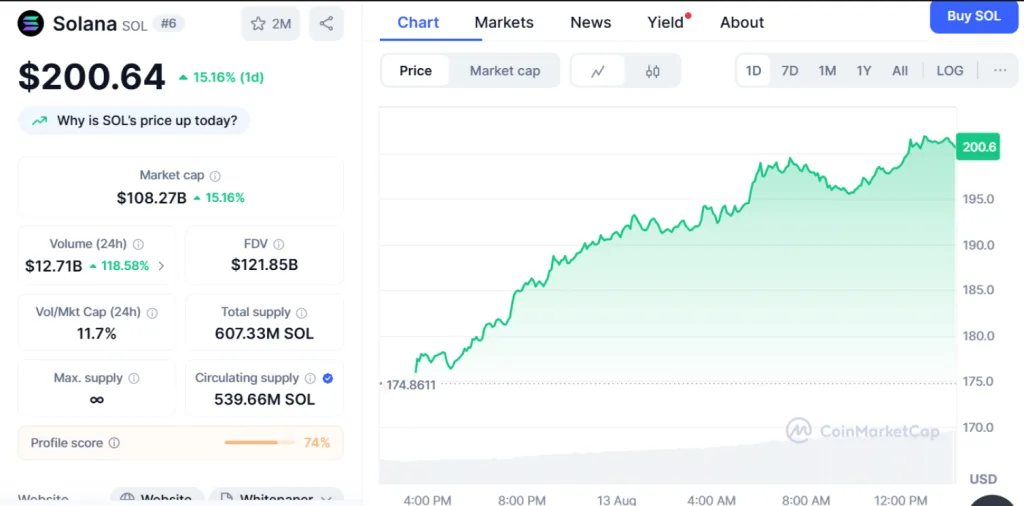

The market has responded strongly to these institutional signals. Solana’s price increased by more than 15.16% in 24 hours and expanded above $200. The trading volume grew 118.58% to $12.71 billion, and has a market cap of $108.27B.

Solana has institutional backing, which will ensure a differentiated growth avenue. The consistent accumulation of SOL by corporate treasuries and institutional managers is emerging as a key driver of market resilience.