Iran Central Bank Uses USDT to Offset Sanctions Pressure

- The Central Bank of Iran accumulated USDT to access dollar value without bank channels.

- Blockchain analysis revealed a structured approach to bypass financial sanctions.

- Stablecoins now function as alternative dollar reserves for sanctioned economies.

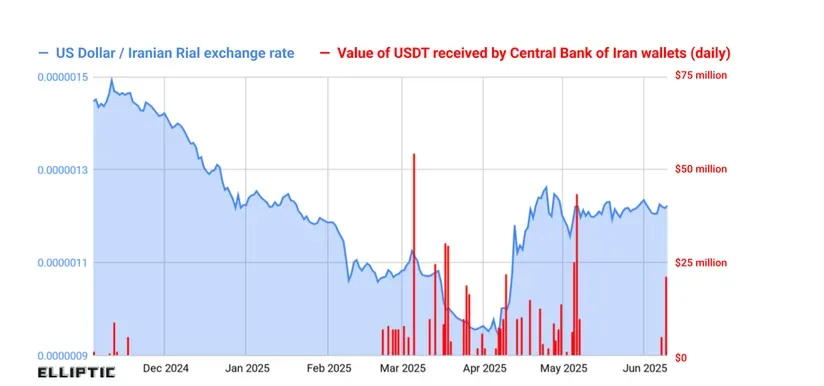

Iran’s central bank accumulated at least $507 million in USDT to influence currency markets and support the rial, according to blockchain analytics firm Elliptic. The purchases came as the rial traded near 1.4 million per dollar amid severe inflation and unrest. Researchers traced the activity through leaked documents that mapped wallets linked to the Central Bank of Iran.

Central Bank Strategy Moves On-Chain

Elliptic said the documents revealed a systematic USDT buildup worth at least half a billion dollars. Chief scientist Tom Robinson said the pattern pointed to a coordinated approach rather than isolated trades. “It indicates a sophisticated strategy to bypass the global banking system,” Robinson said in the report.

The United Nations reinstated sanctions on Iran in 2025 tied to its nuclear programme after prior relief ended. Those measures blocked access to correspondent banking and cross-border dollar settlement. As a result, Iranian authorities sought alternative dollar liquidity channels outside traditional finance.

By acquiring dollar-pegged stablecoins, officials created what Elliptic called digital off-book eurodollar accounts. These holdings allowed dollar value storage without routing payments through banks or SWIFT rails. Elliptic said this structure weakened the reach of U.S. financial enforcement tools.

Stablecoins Replace Blocked Dollar Channels

The rial’s collapse accelerated during 2025 as inflation surged and confidence eroded. The currency lost half its value in eight months and reached about 1.47 million per dollar by January 2026. In contrast, the rial traded near 32,000 per dollar when Iran signed the 2015 nuclear deal.

Elliptic said the central bank likely used USDT for currency intervention in local markets. Robinson said most of the tokens moved to Nobitex, Iran’s largest crypto exchange. He added that analysts lack visibility after that point, though sales for rials appear likely.

Elliptic cannot confirm whether the central bank still holds USDT today. Robinson said the flow pattern suggested deployment rather than long-term custody. Nobitex later suffered a 2025 hack linked by investigators to actors suspected of Israeli ties.

Civilian Use Grows as Controls Tighten

Iran is not alone in using crypto to manage sanctions pressure. Blockchain analytics firm Chainalysis reported that sanctioned states received nearly $16 billion in digital assets in 2024. Robinson said Iran, Russia, and North Korea rely heavily on U.S. dollar stablecoins.

Street protests erupted across Iranian cities after Dec. 28 amid inflation and currency collapse.

During this period, local bitcoin purchases increased as residents sought value protection.

Chainalysis observed rising withdrawals from Iranian exchanges to personal wallets until an internet blackout on January 8.

Related: Iran Accepts Crypto Payments For Arms Export Evading Sanctions

Tether retains the authority to freeze wallets under sanctions guidance. A spokesperson for Tether stated that the firm works with law enforcement to freeze illicit assets. The company has frozen more than $2.8 billion in USDT across over 4,500 wallets since launch.

Iran’s expanding use of USDT reflects a deeper shift in how sanctioned states respond to financial isolation. Blockchain data indicates that stablecoins now serve as parallel dollar channels at both the state and citizen levels. As enforcement tightens, transparent ledgers increasingly expose these strategies while also revealing how digital assets fill gaps left by collapsing national currencies.