Recently, Bitcoin’s price soared by over 13%, sparking intense market speculation. Traders now eye the $50K mark as the new battleground. However, the spotlight on Bitcoin has led to an unexpected twist in the altcoin sector. As Bitcoin dominated discussions, altcoins gained momentum, flipping the script in the market dynamics as highlighted By Santiment via an X post.

Significantly, this pattern isn’t new. Historically, a Bitcoin price surge leads to an altcoin rally, followed by a market correction. This cycle has repeated since the bull run commenced in October. Initially, Bitcoin’s isolated gains captured the market’s focus. Subsequently, profits trickle down to altcoins, fueling a greed-driven surge. Finally, a mild Bitcoin retracement triggers a more dramatic end to the altcoin season.

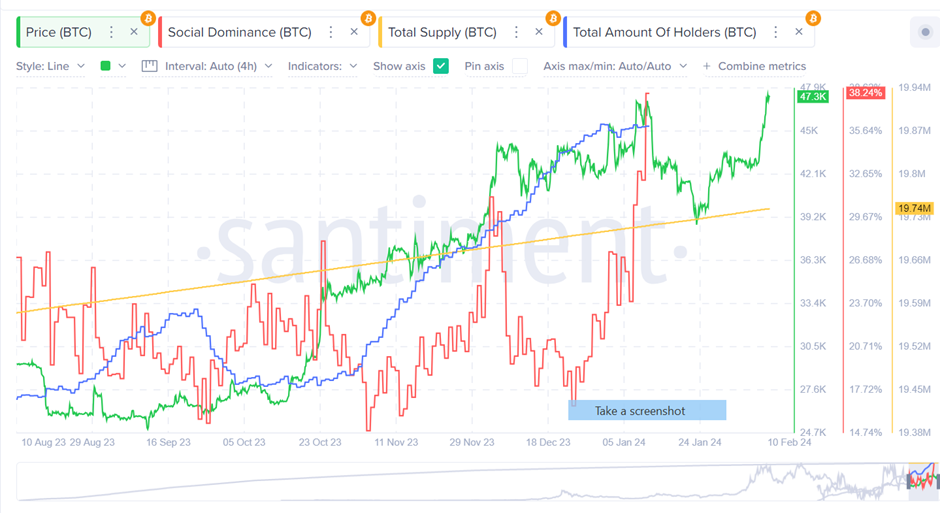

Moreover, the Santiment chart provides valuable insights into Bitcoin’s market behavior. The green line, denoting Bitcoin’s price, exhibits notable volatility, with a sharp increase observed recently. Besides, the red line indicates Bitcoin’s social dominance, showcasing how discussions around it fluctuate independently of its price. Per the chart, BTC’s last price record shows it is over the $47K mark at $47.3K.

Additionally, the total supply of Bitcoin, represented by a stable blue line, continues to grow steadily. This reflects the ongoing mining activities, inching closer to the 21 million cap. The orange line chart, highlighting the increasing number of Bitcoin holders, suggests a growing adoption rate among investors.

Furthermore, the volume bars reveal trading activity spikes, correlating with significant price movements. These insights, combined with the time frame from August to February, paint a comprehensive picture of Bitcoin’s market trends.

Hence, as the weekend approaches, market watchers are keenly observing the crowd’s response to altcoins. The anticipation is that a rise in speculative interest in altcoins may signal the impending third phase of the cycle. Consequently, investors are advised to monitor open interest levels closely.

The steady growth in Bitcoin’s supply and holder count reflects increasing interest and adoption. Despite the volatile price and social sentiment, Bitcoin continues to attract attention. Hence, traders and investors alike should monitor these trends closely.