JPMorgan Predicts Bitcoin Rise With Fair Value Seen at $165K

- Bitcoin is now valued near $119K and JPMorgan foresees fair value climbing to $165K

- Retail traders drive ETF inflows, while institutions rely on CME futures for exposure.

- Volatility declines make Bitcoin more appealing as a defensive hedge, similar to gold.

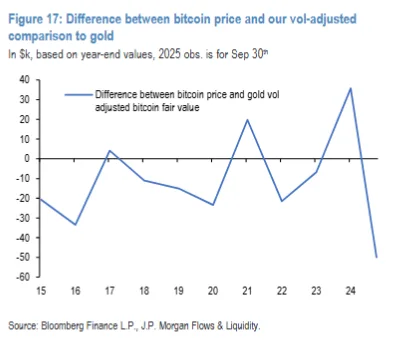

Banking giant JPMorgan projects Bitcoin could reach $165,000 on a volatility-adjusted basis compared with gold, suggesting strong upside potential. The Wall Street lender’s models indicate that Bitcoin is trading approximately $50,000 below its fair value and would need to rise by 40% from current levels to align with gold’s scale once risk is accounted for. The forecast comes as investors increasingly adopt Bitcoin alongside gold within the so-called “debasement trade,” a strategy to hedge against inflation, deficits, and erosion of fiat currencies.

At press time, Bitcoin trades at $119,859.15, marking a 1.11% gain over the past 24 hours, with a market capitalization of $2.38 trillion. Its fully diluted valuation stands at $2.51 trillion. Despite a 12.18% decline in daily volume to $66.74 billion, Bitcoin maintains a volume-to-market-cap ratio of 2.75%, reflecting consistent activity.

Volatility Dynamics and Risk-Adjusted Value

JPMorgan’s analysis highlights a key factor: Bitcoin’s volatility relative to gold. The Bitcoin-to-gold volatility ratio has recently fallen below 2.0, indicating that Bitcoin requires only modestly more risk capital than gold. According to a valuation model shared by Matthew Sigel, head of digital assets research at VanEck, Bitcoin currently consumes 1.85 times more risk capital than gold.

On this basis, JPMorgan estimates Bitcoin’s market capitalization of $2.3 trillion must expand by nearly $1 trillion to match gold holdings on a risk-adjusted scale. That would bring its valuation closer to $3.3 trillion and push the nominal price toward $165,000.

The bank notes that Bitcoin remains undervalued by approximately 34.5%, trading at $119,000 compared to its implied fair value target near $160,000. This calculation is presented as a mechanical estimation rather than a fundamental forecast, but it is positioned as evidence of Bitcoin’s upward potential under favorable conditions.

Related: US Clears Path for Companies to Hold Bitcoin Tax-Free: Report

ETF Inflows, Institutional Futures, and the Debasement Trade

JPMorgan places the forecast within the broader debasement trade narrative, where investors pour funds into bullion and, increasingly, Bitcoin as hedges against fiat currency erosion. Retail investors continue to be the chief drivers of Bitcoin ETF inflows, with momentum having held since the second half of 2024.

The new money has flowed into Spot Bitcoin ETFs at a rate that often exceeds that of gold ETFs, giving rise to a narrowing of the gap between the two markets. Institutional players, on the other hand, have preferred the CME Bitcoin futures market to ETF allocations. Still, these higher levels of institutional participation have not reflected the surge led by retail.

The bank also posits that decreased realized volatility of Bitcoin is opening further pathways for institutional allocations, especially within a context of inflation pressures, uncertain interest rates, and alterations in capital flows. Going low on volatility puts a stronger claim on Bitcoin as a portfolio hedge compared to gold.

JPMorgan states that whether the forecast is reached or realized depends on capital flows as well as global economic conditions and investor sentiment in play. But its analysis clearly puts Bitcoin in the same risk-hedging framework as gold, which will hold out for a price of $165,000 as long as it maintains momentum.