Mantle Cools Off as Profit-Taking Follows a Strong 7% Surge

- Mantle slips as profit-taking grows, and sector weakness pulls major tokens lower today.

- Exchange inflows rise to $4M and point to stronger sell pressure building across markets.

- Mantle faces firm resistance at $1.43–$1.32 as funding rates turn negative for traders.

Mantle lost some of its heat today after a sharp 7% jump the day before, with the token slipping back toward the $1.15 region as traders rushed to lock in gains. The move came during a wider market pullback that swept across major altcoins, particularly those tied to the Layer-2 and DeFi sectors, both of which endured another difficult trading session.

Macro Tension Rekindles Risk-Off Behavior

According to CoinMarketCap’s data, roughly $110 billion evaporated from the digital-asset market in the past 24 hours. The drop, about 2.18%, was concentrated in segments that typically move faster when sentiment weakens.

Layer-2 tokens fell 2.15%, while DeFi names slid 2.35%. Mantle, which has tracked Ethereum closely for weeks—its 30-day correlation sits at 0.89—was dragged lower as ETH slipped toward the $3,200 line. The immediate catalyst for the shift was a set of remarks at the Federal Reserve’s Dec. 10 Payments Innovation Conference, where officials suggested that rate cuts may take longer to arrive.

That single message was enough to push traders back into defensive mode. Consequently, Mantle’s trading volume thinned to $168.68 million, down nearly 13%, and its market cap fell to $3.71 billion, a loss mirroring the day’s price decline.

Technical Levels Keep Mantle Pinned Down

From a technical perspective, the rally that began earlier in the week stalled right under $1.884, a level that has turned back several attempts at a breakout. Besides, Mantle is still sitting beneath the 23.6% Fibonacci retracement at $1.63, and the broader $1.43–$1.32 band continues to act as a lid on upward movement.

One of the more stubborn obstacles remains the 200-day simple moving average, hovering near $1.1497. Mantle has struggled to clear that line, which has functioned as a ceiling for more than a week. On the opposite end lies the familiar support region between $0.94 and $0.86, which held during November’s low.

Momentum indicators paint a mixed picture. The RSI has climbed to 51.18, showing that buyers are more active than they were earlier in the month, yet the signal is still too soft to call a trend reversal. Moreover, short-term moving averages are finally bunching together beneath the price, but the formation remains fragile.

Exchange Behavior Points Toward Selling Pressure

Exchange flow data reinforces the idea that traders have moved into a profit-taking phase. On Dec. 10, Mantle posted $4.02 million in net inflows at roughly $1.1656. Although inflows might appear constructive at first glance, they typically mean something else entirely: tokens are being moved onto exchanges, usually because traders expect to sell or reduce exposure.

This marks a notable shift from earlier in the year. Between February and August, Mantle regularly saw net outflows exceeding $5 million, and several days dipped below –$30 million, suggesting accumulation. That pattern has now reversed.

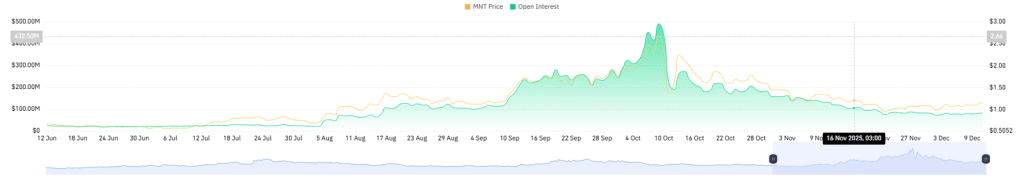

In derivatives markets, open interest climbed from $71 million at the start of December to more than $80 million, a sign that traders are preparing for larger swings. The funding rate, sitting at –0.0099%, shows that short-leaning sentiment has taken hold, with sellers willing to pay a discount to maintain their downside positions.

Related: Why XRP Is Down Today and What Analysts Are Watching

Outlook Hinges on Two Major Levels

Analysts say the next clue lies in Mantle’s ability to reclaim the 200-day MA and push the RSI past the 60 mark. Clearing both would strengthen the case for another move toward the $1.43–$1.32 resistance band. However, failure to do so could send Mantle back toward its $0.94–$0.86 base, particularly if short-term MAs begin to tilt downward again.

For the moment, the token’s pause reflects a blend of profit-taking, renewed inflows to exchanges, heavier macro pressure, and stubborn technical ceilings. Traders appear to be watching closely, uncertain whether Mantle’s latest rally was a brief spark or the early stage of a broader recovery.