Massive Liquidations Hit Bitcoin as Price Sinks Below $99K

- Bitcoin sees $452M in liquidations amid rising market tension across major platforms.

- Long-term holders are taking profits amid significant BTC outflows over the past few weeks.

- High leverage clusters on exchanges trigger selling waves as traders defend BTC levels.

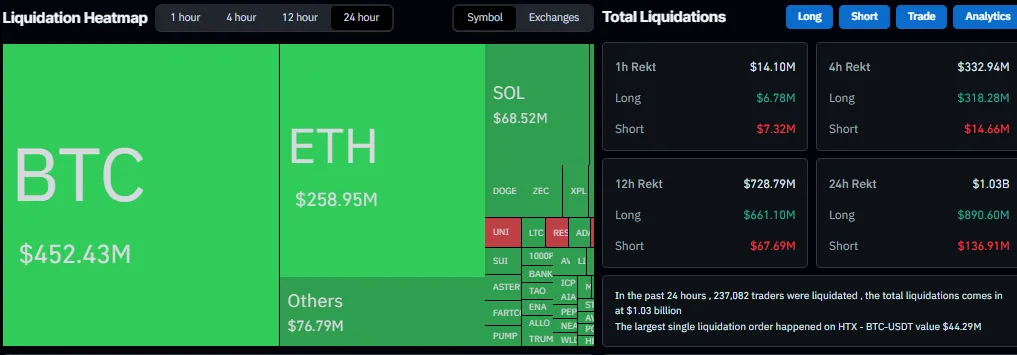

Bitcoin fell sharply below $99,000 as more than $1.03 billion in leveraged positions liquidated across the crypto market, according to CoinGlass. Traders faced rapid losses as 237,082 accounts were liquidated within 24 hours, marking one of the most aggressive deleveraging events since early November.

The figures indicate that Bitcoin had $452.43 million in liquidations, Ethereum was next with $258.95 million, and Solana experienced $68.52 million, whereas the rest of the altcoins together garnered $76.79 million in losses.

Market-Wide Liquidations Accelerate

CoinGlass recorded $14.10 million liquidated in the last hour alone. Longs lost $6.78 million, while shorts dropped $7.32 million. The four-hour window showed a sharper intensity with $332.94 million liquidated. Long traders absorbed $318.28 million of these losses, while short traders lost $14.66 million.

Source: Coinglass Liquidation Heatmap

The twelve-hour period delivered the most brutal hit, with total liquidations reaching $728.79 million. Long positions accounted for $661.10 million, while shorts lost $67.69 million. The most significant single liquidation occurred on HTX, where a BTC-USDT order worth $44.29 million was closed.

Nevertheless, Bitcoin continued to slide. CoinMarketCap data shows BTC trading at $97,503.82 after a 5.12% daily decline. Market cap dropped 5.11% to $1.94 trillion, while trading volume surged 52.96% to $109.68 billion, signaling intensified selling pressure. Bitcoin last traded near $101.98K before entering a consistent decline that touched $87.28K overnight.

Leverage Clusters Drive Additional Selling

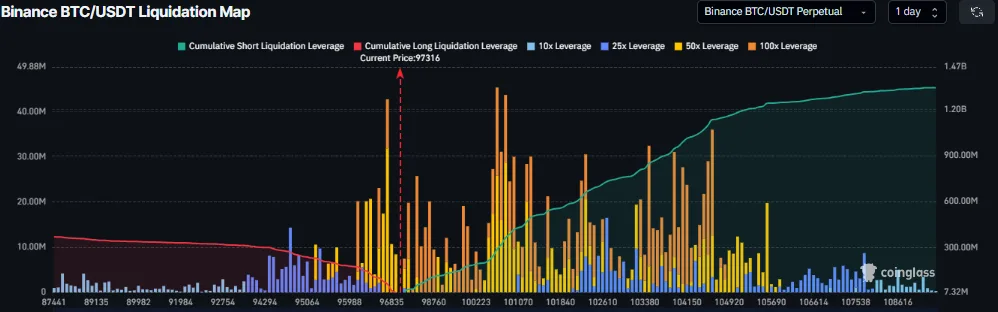

The Binance BTC/USDT Perpetual Liquidation Map showed concentrated high-leverage activity around $96,835–$101,000. Liquidations included 10x, 25x, 50x, and 100x positions. Several high-leverage long bars surpassed $30–40 million in size. Bitcoin traded at $97,316 at the time of the reading.

Source: Coinglass

The map also displayed the cumulative long-liquidation curve declining into the $96–97K area. Meanwhile, the cumulative short-liquidation curve increased steadily above $1.47 billion on the right side of the chart. The lower range, between $87,441 and $95,000, contained smaller liquidation pockets, dominated by 10x and 25x traders.

Since November 11, Bitcoin has lost momentum. The price dropped from $107,000 to $102,000. On November 12, Bitcoin recovered to $105,000 before falling again to $101,000, although it remained above the psychological $100,000 threshold.

Related: Bitcoin Stays Range-Bound as Bulls and Bears Battle for Momentum

Pressure Builds as Traders React

This decline arrived even after the U.S. government shutdown ended, a development that many expected to support market recovery. Analysts at Glassnode reported increased profit-taking by long-term holders.

They stated that bulls defended the $100,000 level, but selling pressure increased. According to CryptoQuant, long-term holders realized 815,000 BTC over the past 30 days, the highest figure since January 2024.

Additionally, blockchain researchers at Arkham noted that early Bitcoin whale Owen Gunden sold $290 million worth of BTC on the day. His wallets still hold assets worth $250 million. The correction followed a cascade of liquidations across Binance, OKX, and Bybit, with cumulative short leverage exceeding $3.6 billion near $99,000.

Following the November surge, Bitcoin has dropped to its minimum level, which has led the traders to experience uncertainties once again. The question that arises with the increase in volatility is whether the ongoing deleveraging will alter the short-term market direction.