MemeCore Rebounds at Support and Jumps 10% in Fresh Rally: Will It Hold?

- MemeCore lifts 10% at support as shorts unwind, though broader sentiment remains fragile.

- RSI climbs from oversold, yet key resistance zones still stand in the way.

- Liquidity incentives boost activity, though broader market caution limits momentum.

MemeCore found its footing again after sliding for most of the past month, bouncing off the familiar support pocket between $1.26 and $1.19. The token climbed to roughly $1.35, recovering close to 10% within a single day, enough to nudge its market value toward $1.7 billion. The move arrives at a moment when many traders had already stepped aside, allowing even a small shift in positioning to show up quickly in price.

Support Reaction Drives a Short-Term Price Turnaround

The recovery began shortly after the token tapped the lower end of its multi-week range, the same area that arrested an earlier decline on November 27. Following this rebound, derivatives figures captured a modest flush of short positions, only a few thousand dollars’ worth, but lopsided enough to give buyers a brief advantage.

According to CoinGlass, short liquidations outpaced long liquidations by a wide margin, hinting that the rebound wasn’t simply organic buying but also the product of traders closing losing bets. Even so, the larger picture has not changed much.

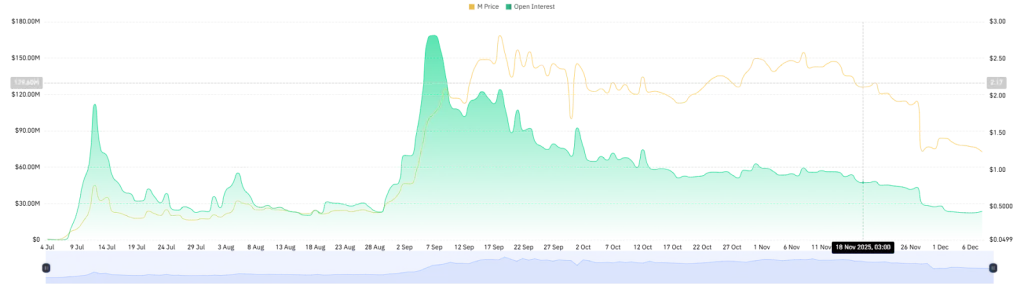

MemeCore continues to trade below its 50-day moving average, lodged around the $2 level. Over the past week, the token slipped by almost 5%, and the monthly loss remains steep with a massive 44% ebb.

Similarly, participation has thinned dramatically: open interest, once above $160 million, has fallen to just a fraction of that, now at $24 million. This shift means price movements begin to lean on small bursts of activity rather than broad conviction, leading to decreased volatility in the market.

Catalysts Behind Today’s Price Move

Some of the renewed activity traces back to MemeCore’s own ecosystem. On December 6, its Perp DEX, MemeMax, extended the MaxPack airdrop campaign into January 2026. That decision kept incentives in play longer than expected and coincided with a sharp rise in network transactions, several times the usual volume.

Earlier in November, the DEX also received a sizable allocation of M tokens meant to steady liquidity and attract sustained usage. Campaign-driven activity can help in the short term, though it often comes with trade-offs. More tokens entering circulation can pull against the price later, especially when rewards eventually reach users who may choose to sell.

Still, the burst of engagement appeared enough to remind traders that activity inside the ecosystem has not dried up entirely. Beyond internal developments, broader market sentiment set an unusual backdrop. Bitcoin spent the day drifting lower, a move mirrored by a slide in the Fear & Greed Index, which fell deep into “extreme fear.”

Yet several battered altcoins, Zcash and Canton among them, caught meaningful bids. MemeCore’s move fits into that pattern: assets that had been hit hardest were the first to bounce when traders went looking for bargains.

RSI and Price Structure: Can Momentum Sustain?

From a technical perspective, the RSI has begun to climb out of oversold conditions, sitting near 34, which is still subdued but no longer in freefall. However, for the momentum shift to grow strong, the price will need to challenge the cluster of resistance forming above.

The first test lies around $1.52, a level it failed to clear late last month. A stronger barrier waits near $1.60, aligning with a familiar Fibonacci marker watched by technical traders. And, only when the RSI pushes decisively toward the mid-range, and ideally past it, would the market gain evidence of stronger buyer commitment.

Without such a move, rebounds at this depth often fade as quickly as they appear, sending price back toward the same support that just held. Multiple retests can weaken that floor over time.

Related: HYPE Extends Its Slide with a 9% Drop as Whales Load Up: Time to Buy the Dip?

Outlook: Momentum With Caveats

In summary, M’s recovery shows that buyers still defend key levels and that short positioning remains vulnerable when the market leans too far in one direction. The bounce also shows that the ecosystem is not entirely quiet, with campaign incentives still drawing users back into activity spikes.

But the broader landscape is unchanged. Declining open interest, a downtrend still intact on higher timeframes, and a risk-averse market leave little room for confident upside calls. Unless MemeCore clears nearby hurdles and rebuilds momentum, this latest rally may serve more as a relief move than the start of a new cycle.

For the moment, the token holds its support. Whether it can build anything more durable from here will depend on fresh inflows rather than short-term positioning alone.