MYX Finance Soars 1,400% in a Week but Risk Signals Flash Red

- MYX Finance posts a massive 1,400% weekly surge to a new all-time high of $18.52.

- MYX V2 upgrade promises zero-slippage, cross-chain support, and portfolio margining features.

- Overheated RSI and negative funding rates hint at rising risks of a sharp correction.

MYX Finance is grabbing headlines again after a remarkable surge of more than 1,400% in just seven days. The rally has not been a one-day feat and has steadily risen to give the token a robust push. At its peak, MYX touched an all-time high of $18.52, fueling optimism among holders, though some voices in the market warn of possible price manipulation. The timing adds to the buzz. As the crypto market continues to rise on the eve of key events, such as the upcoming FOMC meeting, MYX has been the standout performer.

Over the last 24 hours, the token gained over 30%, solidifying its position as one of the day’s best performers. However, MYX has experienced a slight backlash after hitting its all-time high and is currently around 17.76. Nonetheless, its market capitalization is at $3.5 billion, with the trading volume increasing to 547.66 million, a true indicator of high demand in the market.

Key Triggers Behind MYX Finance’s Price Rally

The strategic exposure, coupled with timely upgrades, has assisted MYX Finance in having an explosive rally. On September 8, the project reassured that its V2 upgrade was on track, leading to a burst in investor confidence and a 300% price increase the same day.

The upgrade boasts features that are attractive to traders who desire efficiency: zero-slip trading, cross-chain interoperability, and portfolio margining. These additions not only satisfy the user experience but also reinforce the role of MYX Finance as a serious player in the DeFi perpetuals market.

Extended cross-chain support, specifically, might increase Total Value Locked by providing access to liquidity across numerous networks. To further fuel the hype, MYX Finance attracted odd attention by listing the Trump-linked WLFI token.

The move broadened visibility for the platform, indirectly amplifying interest and demand for its native token. Instead of the typical exchange listing driving growth, this association with a high-profile asset provided MYX Finance with a unique surge in attention.

MYX’s Price Rally: A Red Flag?

The sharp surge in MYX Finance has pushed momentum indicators into extreme territory. The Relative Strength Index (RSI), for instance, is now hovering near 96.95, a rare level that highlights just how overheated the rally has become.

While no clear bearish divergence has emerged, analysts caution that the upside appears increasingly limited, leaving the market vulnerable to a pullback. The Murrey Math Line indicator reinforces these warnings.

Source: TradingView

Having broken through the 8/8 Ultimate Resistance at $12.5 and cleared the +1/8 Overshoot at $14.06, the MYX is about to retest the +2/8 Extreme Overshoot at $15.63. These high areas are commonly regarded as fatigue areas, where rallies frequently stagnate or turn back.

Should the buying pressure be reduced, Murrey’s theory indicates that the prices would revert to the 8/8 point at $12.5 or even the 6/8 pivot at $9.37. However, beyond the technical jeopardy, analysts are also raising concerns about suspicious trading.

Some market observers, such as MrsBeastDeFi, believe the boom is being pumped, and some refer to it as textbook manipulation. Although the price action is dramatic, the buzz on social media and the community is quiet, aiding the suspicions that the rally might not have been totally organic.

MrsBeastDeFi noted, “$MYX is probably the wildest crime I have ever seen on @binance.” Meanwhile, whale wallets have started locking in profits, with some traders warning of a possible crash toward $1 if sentiment shifts abruptly.

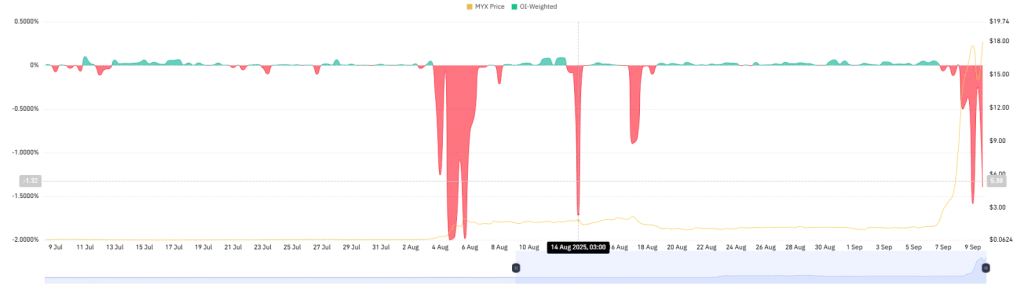

Source: CoinGlass

On the other hand, MYX’s OI-weighted funding rate has plunged deep into negative territory, now at -1.3925%. This is an indicator of diminished trust in the derivatives market, where short sellers are offering longs a discount to retain positions. These dynamics tend to indicate a reduction in purchasing power, increasing the threat of a price adjustment in the short term.

Conclusion

MYX Finance has seen one of the most visible rallies in the market, supported by new upgrades and increasing visibility. However, under zeal, it is difficult to overlook warning signals, such as overheated signals and unusual trade trends. While the optimists view progress, the pessimists see risk, and they each have a point. While the token has steadily increased its price, concerns loom over a potential drop, and if it happens, it could bring in unprecedented changes. Hence, market observers closely watch its every move to avoid being at risk.