ONDO Price Eyes $1 Mark as Bulls Defend Key Support

- ONDO consolidates near $0.92 support as Fibonacci levels align with growing bullish momentum.

- The launch of Ondo Global Markets adds utility by offering tokenized access to U.S. equities.

- Futures CVD charts show steady buy-side strength, confirming trader confidence in higher targets.

ONDO’s price is losing momentum, with its market value dipping by 6% from its recent peak around $0.986. This move hints at a modest profit-taking by traders following the token’s recent 12% rally from a low of $0.876, last achieved on Tuesday. Despite the slight retreat, the cryptocurrency’s overall market sentiment reveals a bullish sentiment.

Why is ONDO’s Price Up?

According to the TradingView chart, ONDO exhibited a double bottom within a structured support zone in the $0.87-$0.84 price range. This technical pattern hints at a reversal trend as buyers step in to defend the lower price levels, potentially leading to a bullish move in the near future.

True to its purpose, ONDO experienced a 12% rally to the $0.986 peak. Notably, the bullish momentum coincided with a major development: Ondo Finance’s launch of its Global Markets platform. This initiative aims to bring tokenized equities and ETFs directly onto Ethereum, unlocking access to U.S. securities for non-U.S. investors.

At launch, over 100 stocks and ETFs were tokenized, with the company targeting as many as 1,000 listings by year-end, pending regulatory clearance. Unlike synthetic products, Ondo’s model is fully backed.

In other words, each token issued represents the actual underlying asset held by registered U.S. broker-dealers and custodians, certifying parity with the real-time value. The move builds on Ondo’s acquisition of Oasis Pro, strengthening its infrastructure for regulated digital securities.

Analysts note that the expansion signals Ondo’s ambition to become a crucial bridge between traditional markets and blockchain networks, particularly as global finance experiments with tokenization.

Despite excitement, ONDO has since lost heat from its rally. The token is consolidating near $0.92, a level aligned with the 23.60% Fibonacci retracement, which now acts as short-term support.

ONDO’s Price Action: Key Levels to Watch

Given that the 23.60% Fib retracement level holds firm, the price of ONDO is expected to surge toward the $1.00 mark, which coincides with the 50% Fib level. This marks the first key resistance, 8% up from the current price, which ONDO is set to overcome in order to push toward higher levels.

A break above this level might establish the $1.10 level (78.60% Fib level) in play, triggering a revisit to the $1.16-$1.13 resistance zone, last seen in late July. As the token remains in what analysts call the discount zone, investors may see this as a buying opportunity in anticipation of potential price gains.

This will add more fuel to bullish sentiment. If, however, $0.92 does not hold, ONDO may fall deeper and probably revisit the $0.87-$0.84 support zone next before attempting another bullish reversal. Yet, a breach below this range could invalidate the bullish sentiment and open the door for a more significant downtrend in the near term.

ONDO Price Stalls as Indicators Signal Sideways Action

From a technical perspective, the Relative Strength Index (RSI) currently sits at 47.67, indicating a mildly bearish trend but remains close to the neutral zone. This suggests the market lacks strong momentum in either direction.

The Moving Average Ribbon indicator paints the same picture. ONDO is floating between the 50-day MA at $0.97, serving as short-term resistance, and the 200-day MA at $0.91, acting as temporary support. This implies that in this price range, the token is consolidating, lacking a strong trend in either direction.

Related: TRUMP Token Faces Fragile Balance With $8 Support at Risk

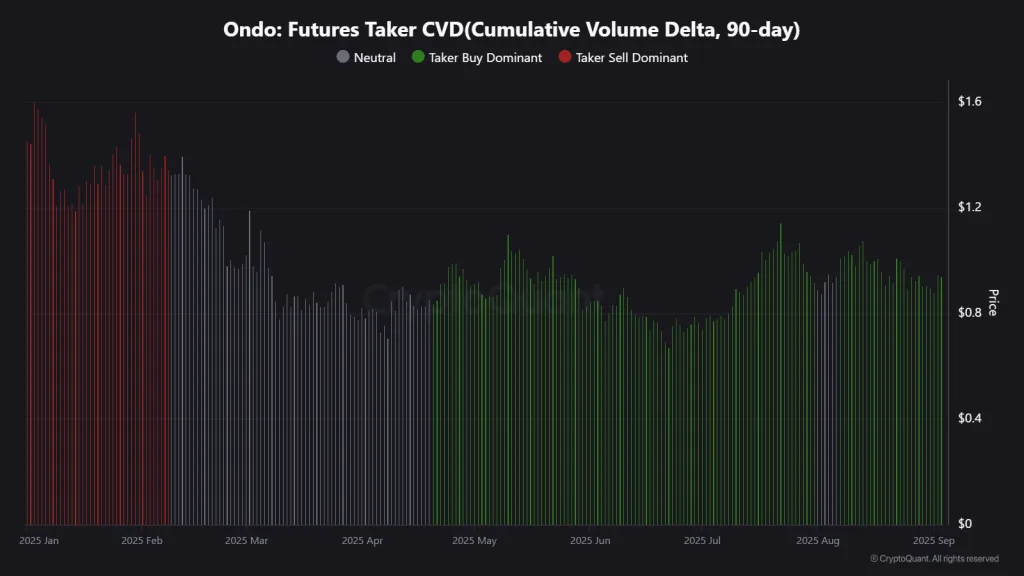

Meanwhile, on-chain metrics provide further evidence supporting ONDO’s recent strength. Data from the Futures Taker CVD (Cumulative Volume Delta) for the past 90 days show a transition from strong sell-side dominance earlier this year to clear buy-side dominance since late April.

This shift represents a powerful buildup by taker buyers, which reflects the growing conviction of derivatives traders who are preparing for the upside. Historically, such patterns coincide with bullish turnovers and the onset of big price expansions.

Conclusion

ONDO’s recent move shows a token pullback after a strong rally, but the macro situation is bullish. The technical support at $0.92 remains intact, while on-chain data maintains an unconditional support for accumulation from both whales and futures traders.

With the launch of Ondo’s Global Markets platform, which brings real-world utility, momentum is building below the surface. If support is maintained, ONDO looks ready for another attempt at the $1.00-$1.10 range in the short term.