PancakeSwap Surges 24% in a Day, Can Bulls Hold Momentum?

- CAKE surges 24% in one day as daily volume rockets 912% higher to reach $672 million.

- The token approaches $3.85 resistance, with bulls aiming for the $4.50 to $4.80 price zone.

- Open interest reaches $100 million, while funding rates confirm a strong bullish conviction.

PancakeSwap’s CAKE token stunned markets with a decisive 24% rally in just one day, climbing to $3.30 at press time and reigniting bullish chatter across crypto circles. Following this surge, the token’s trading activity skyrocketed, with daily volume spiking over 912% to $672 million, underscoring the intensity of the move.

Yet the bigger story lies ahead: CAKE now sits inside a rising channel, hovering just below a crucial resistance near the $3.57-$3.40 price range. Technical metrics indicate the next battleground lies at the 78.6% Fibonacci level of $3.85, while the 50% Fib level at $2.86 serves as vital short-term support.

With bulls eyeing a push toward the long-unseen $4 levels, the question becomes unavoidable: will CAKE extend its breakout, or is this upswing only setting the stage for a pullback?

CAKE’s Price Action: Key Levels to Watch

As shown in the weekly chart, the altcoin is forming a bullish narrative, with its structure of higher highs and higher lows signaling steady upward momentum. The Relative Strength Index suggests a bullish case, with a reading of 61.41 and trending upward. This level reflects increased buying pressure while leaving room for further growth before the indicator enters the overbought zone at 70.

Based on this momentum, CAKE is positioned to challenge the 78.6% Fibonacci retracement at $3.85, a resistance level that now stands as the immediate test for traders. A breakout above that barrier would confirm stronger conviction, opening the path toward the $4.50 to $4.80 region last visited in December 2024.

Yet, caution remains necessary. Failure to break the channel’s ceiling could drive the token back toward the 50% Fibonacci level at $2.86, a key area of short-term support. A deeper slide might extend losses toward the $2.50 to $2.20 zone, where renewed demand could stabilize the price.

Adding to this outlook, analyst Javon Marks has mapped out an even bolder scenario. His long-term outlook highlights a breakout structure that could propel CAKE toward $40.794, translating into an upside of more than 1,170% from current levels.

The analysis builds on the token’s recent formation of higher highs and higher lows, strengthening the view that CAKE may have entered an extended recovery phase after years of consolidation.

Related: HYPE’s Price Rockets 20% in Just a Week, New ATH in Sight?

Confidence Builds as Trading Metrics Climb

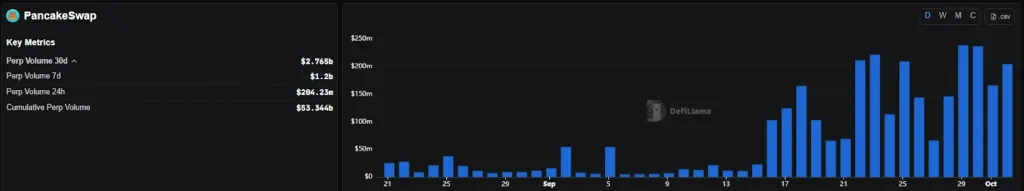

Data from DeFiLlama shows that perpetual trading volume over the past 30 days has reached $2.76 billion, with the last seven days alone accounting for $1.2 billion. Daily activity now stands at $204.23 million, bringing PancakeSwap’s cumulative perpetual market volume to more than $53.34 billion.

The chart illustrates a clear upswing from mid-September, with daily volumes often exceeding $150 million and occasionally reaching $250 million. This consistent growth signals renewed confidence in PancakeSwap’s derivatives ecosystem and an influx of traders positioning for further moves.

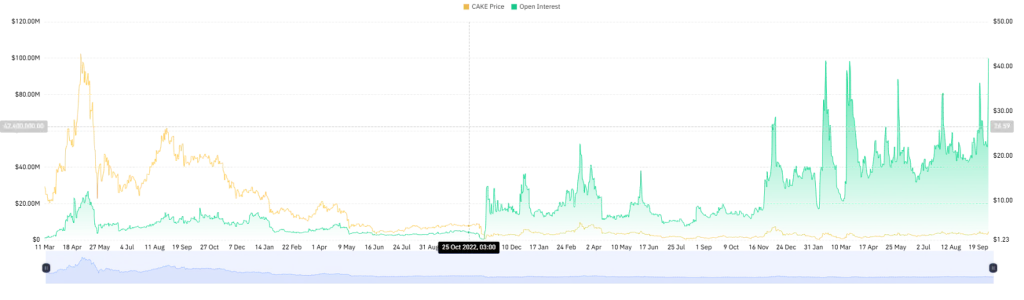

Market sentiment is further reinforced by funding rate and open interest data. The OI-weighted funding rate has climbed to a two-month high of 0.020%, entering the green zone. This indicates that long positions are paying a premium to shorts, a sign of bullish expectations.

Besides, Open interest has reached an all-time high of $100 million. This milestone suggests that traders are increasingly opting to keep positions active rather than cashing them out, underscoring their confidence in the potential for continued upside. The surge also indicates heightened market volatility, reflecting increased activity and growing trader engagement with the asset.

In summary, while resistance levels remain a test for bulls, sustained conviction from traders highlights confidence in the token’s longer-term outlook, keeping CAKE positioned as a focal point in the ongoing market recovery narrative.