PENGU Flashes Firm Bullish Signs as Analysts Set Sights on $1

- PENGU climbs on bullish breakouts with strong speculative interest driving market momentum.

- ETF delay strengthens scarcity narrative while keeping PENGU firmly in market spotlight.

- Pudgy Party surpasses 500K downloads, adding brand strength beyond token speculation.

PENGU token continues to capture market attention with strong gains, rising nearly 10% on the day and close to 30% over the week. At press time, the coin is trading above $0.037, the token’s market capitalization has reached $2.34 billion, reflecting a 9.67% increase, while 24-hour trading volume jumped 40.47% to $647.08 million.

The performance highlights sustained momentum for the Pudgy Penguins, while regulatory hurdles remain in the background. Much of the attention arises from the SEC’s decision to hold its ruling on Canary Capital’s proposed PENGU/NFT ETF until October 12.

The fund is distinctive in its allocation of up to 95% of its holdings to PENGU tokens while providing exposure to both meme tokens and NFTs. This unusual structure has produced a narrative of scarcity which continues to attract institutional and retail interest.

Although the delay initially caused an 11% drop in the markets in late August, traders now see October as a crucial period for possible approval. That anticipation has kept speculative demand alive and helped drive PENGU’s price recovery in recent days.

The rise in activity accompanies increasing community traction. Pudgy Penguins announced that its mobile game, Pudgy Party, has passed the 500,000 downloads mark across the Apple App Store and Google Play Store. This milestone shows the brand’s growing reach beyond just the tokens.

PENGU Price Action: Breakout Sparks Bullish Momentum

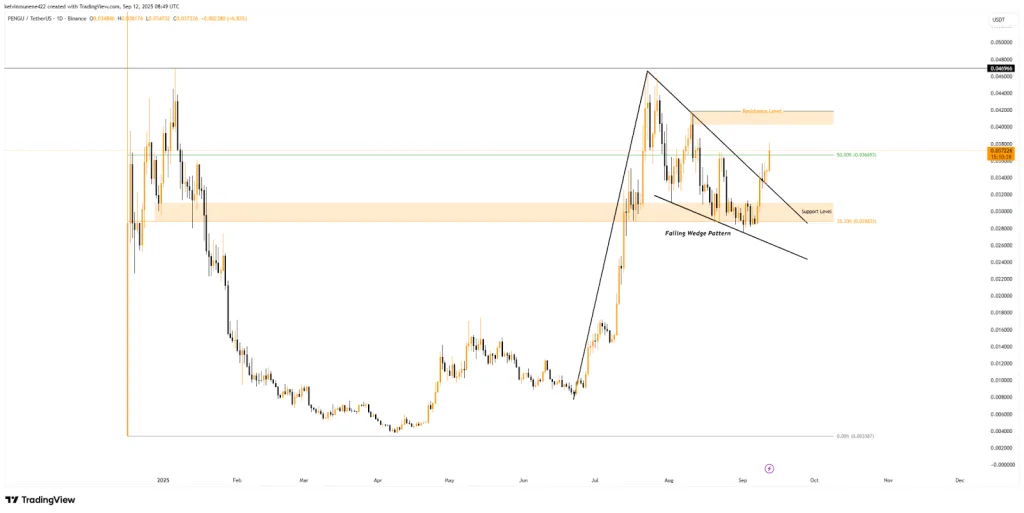

Pudgy Penguins native token, PENGU, is showing strong bullish signals on TradingView’s daily chart after breaking out of a falling wedge pattern. This setup is commonly linked to trend reversals, and the breakout gains more weight as the token crosses a key Fibonacci retracement level.

The 50% retracement at $0.0366 had played the role of a ceiling against upside attempts in the past, but now PENGU has surpassed it. With price momentum now in gear, analysts are looking forward to the $0.040-$0.041 resistance area, last tested in early August, as the next immediate target.

That move would reflect an 8% to 12% advance from current levels. If this zone is cleared, PENGU could accelerate toward this year’s peak of $0.0469, with a potential push to the $0.050 mark, translating to a 25%–34% surge.

On the downside, the newly claimed 50% Fib level at $0.0366 now acts as short-term support. Should prices dip further, traders will watch the wedge’s upper boundary near $0.031–$0.0289. This range doubles as a secondary support, offering possible re-entry opportunities for those seeking lower entries before the next leg higher.

However, caution remains. If the $0.0289 support floor gives way, the bullish thesis risks unraveling. Such a breach could shift sentiment sharply, leading to extended losses and undermining the breakout’s credibility.

Analysts See PENGU’s Surge Rhythm Unlocking Higher Targets

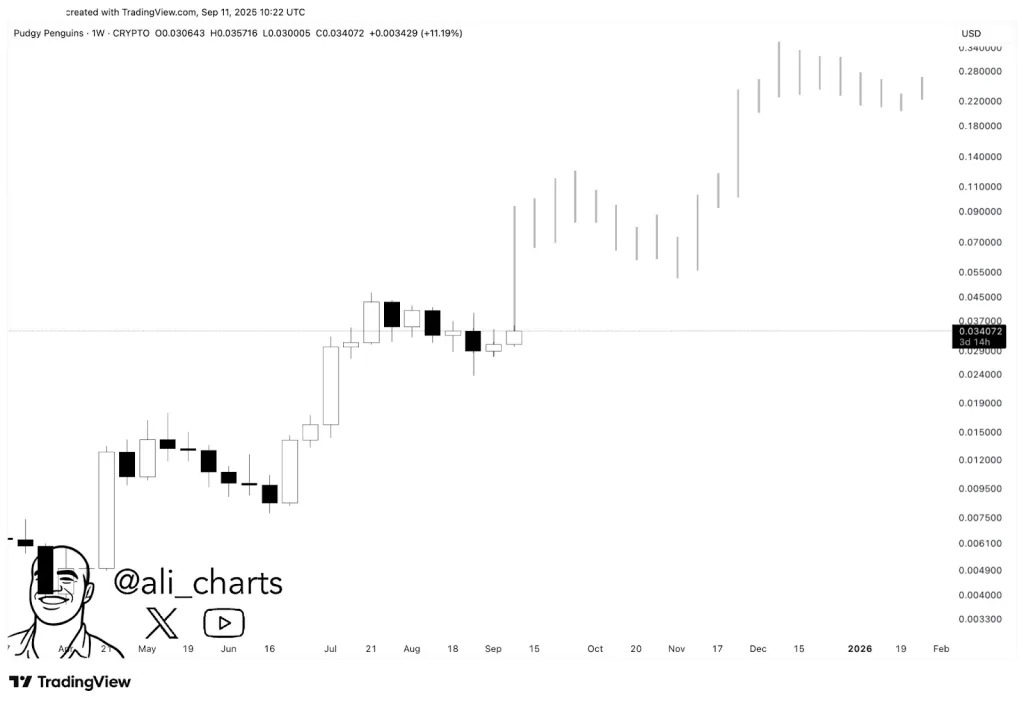

According to market analyst Ali_Charts, PENGU has a tendency to follow a recognizable rhythm: explosion, pullback, explosion, pullback. He noted that the latest retracement has already reset conditions for another sharp move upward.

In his outlook, PENGU is poised to first test the $0.11 level before consolidating again and eventually extending its climb toward $0.34, a zone that would mark a significant milestone for the token’s long-term trajectory.

Related: Conflux CFX Targets 30%–50% Upside as Bullish Pennant Forms

On a broader technical setup, analyst KALEO reinforces this narrative. According to the analysis, PENGU has repeatedly met resistance along a trendline, breaking through each time with sharp rallies. This pattern has resurfaced with the token just breaking its resistance line and currently aiming for the $0.045 range as its next short-term target.

Beyond this immediate barrier, the analyst points to the possibility of a blowout toward $0.17, which would value the project’s market cap at approximately $10 billion. More ambitiously, the chart establishes the mark of $1.00 as a long-term target, which, if bullish momentum holds, is seen as the ultimate destination for this cycle.

On-chain metrics further show a clear sway in momentum, with bearish positions visibly taking the heavier hit. Data reveals that short traders have so far absorbed $931.43K in liquidations, hugely outpacing the $244.73K in longs.

This imbalance indicates a classic short squeeze, where bearish bets are being forced out of the market as prices rise. The pressure associated with covering the shorts is providing further fuel for the PENGU rally while bullish traders consolidate their holdings, gaining more control of the market and exacerbating upward movement.

Conclusion

PENGU’s recent explosion indicates a combination of technical power, the growth of community interest, and increased speculative interest. With renewed confidence in its price rhythm and growing adoption, the market narrative is gaining ground. While risks persist, current signals indicate Pudgy Penguins is poised to continue its path upward, keeping investor interest alive and forming expectations for future growth.