PENGU Smashes $0.012 Barrier After 26% Rally: Can Bulls Keep Momentum Alive?

- PENGU reached its highest value since November 20 after climbing 26% in one strong rally.

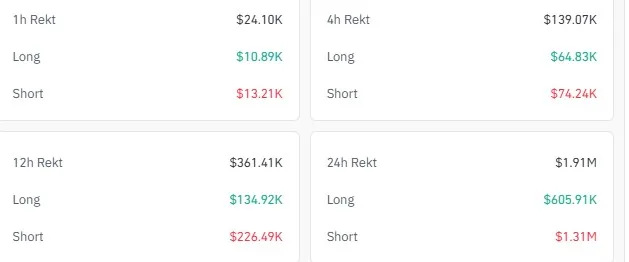

- A sharp short squeeze wiped out more than $1M in short positions within a day.

- Fresh support levels now cluster between 0.0120 and 0.0106 as the structure strengthens.

Pudgy Penguins’ native token, PENGU, staged one of the day’s strongest rebounds on Wednesday, reaching the key $0.012 resistance level after a sharp 26% surge in 24 hours. The move pushed the token to its highest price since November 20 and positioned it firmly among the top-performing assets in the NFT-linked sector.

Rising from a weekly low of $0.00934, PENGU rallied more than 30% from its early-week bottom, supported by renewed sector-wide interest in digital collectibles and improving macro sentiment across the broader crypto market.

Why is PENGU’s Price Up Today?

A renewed wave of liquidity entered the NFT segment, which outperformed the broader market with an 11.87% gain. PENGU led the advance, climbing more than 26% within a day and triggering a sharp rise in speculative inflows.

The collection of 8,888 Ethereum-based NFTs now carries a market cap of roughly $645 million, accompanied by a 24-hour trading volume of $123 million, marking a 180% surge within the same period. The spike reflects heightened activity around Pudgy Penguins’ expanding brand footprint, including retail products, toys, and recent licensing initiatives such as the Kung Fu Panda alliance.

The surge also aligns with Bitcoin’s 8% rebound to $93k, which lifted altcoin sentiment while pushing the Fear & Greed Index from 16 (Extreme Fear) to 22 (Fear). PENGU’s strong reaction, however, stood out: while Bitcoin gained 8%, PENGU advanced more than 26%, indicating additional token-specific drivers.

PENGU Price Action: Short Squeeze, Technical Breakout, and Fresh Support Zones

PENGU’s momentum accelerated after the token dipped to the $0.0093 support band earlier this week. The rebound quickly gathered pace, sending the token’s price more than 36% higher toward the $0.0128 level. However, this zone capped PENGU’s bullish price action, resulting in a slight retracement, where it found support around the 78.60% Fib level at $0.0120.

Following the rally, the derivatives liquidation data confirmed the presence of a short squeeze. In just 24 hours, more than $1 million in short positions were wiped out compared to $605k in long positions. The imbalance shows that sellers bore most of the impact as the market pushed higher.

Forced exits from short positions added fuel to the rally, helping PENGU clear the first major resistance zone with unusual speed. Price structure has also improved. The token now trades above both the 20-period and 50-period moving averages, signaling a break from its recent downward drift.

The 78.6% Fibonacci level at $0.0120 has become the nearest support, with the 50% Fib at $0.0110 and the 38.2% Fib near $0.0106 forming secondary layers of protection. These levels align closely with the moving-average ribbon, creating a well-defined set of zones for traders to watch.

Momentum readings further reflect the strength of the rebound. The RSI sits at 66, showing that buyers remain in control but are approaching overbought 70 territory, where rallies often slow. There is still room for additional upside, though the margin has narrowed after several strong sessions.

Such sentiments leave the market at a pivotal point: can bullish pressure carry PENGU higher, or is the chart setting up for a breather before the next move?

Related: AVAX Showdown Builds as Bulls and Bears Battle for the Next Break

Analysts Weigh In: Is a Bigger Move Developing?

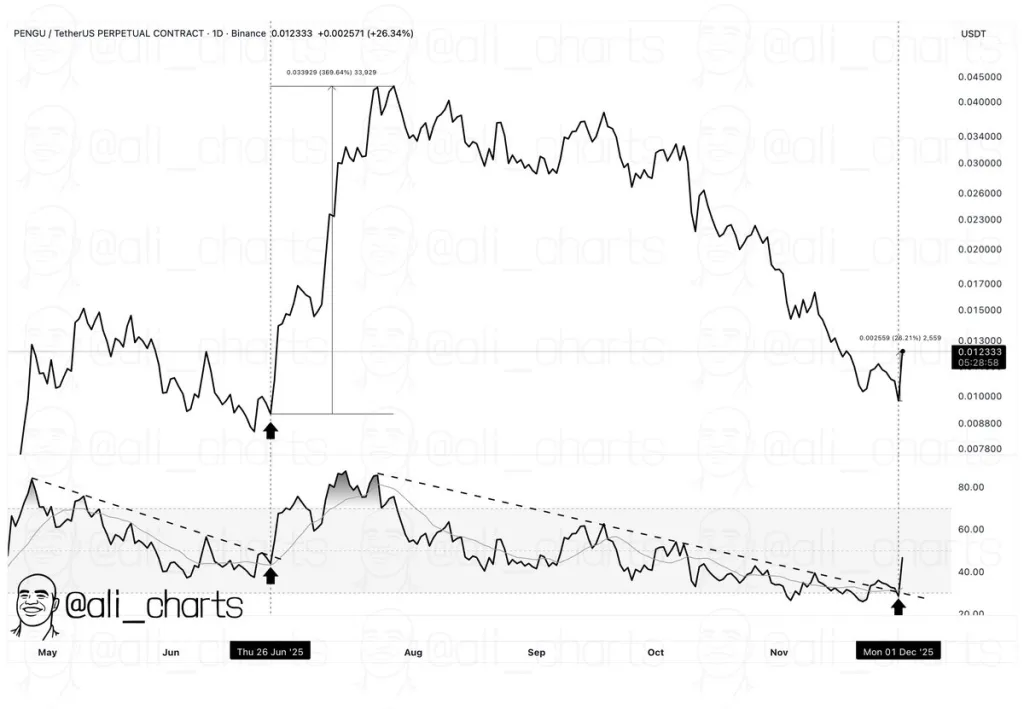

Analyst Ali first flagged this setup on November 25, noting that PENGU’s daily RSI was testing a long-standing resistance trendline. He highlighted that the last time this structure broke, in late June, the token rallied 369% from approximately $0.008 to above $0.046. The latest chart confirms that the same pattern has repeated.

The RSI has again breached its resistance line, and the price reacted instantly at the breakout point. Ali believes the alignment of conditions, trendline break, RSI surge, and immediate price strength sets the stage for another major momentum cycle.

Overall, PENGU now sits at a decisive point after revisiting key resistance on strong volume, rising momentum, and a confirmed short squeeze. Support levels are firm, yet overbought signals introduce caution. The coming sessions will determine whether buyers extend the breakout or pause before the next major move.