PI Price Prediction: 20% Rally Breaks Bearish Channel, Targets $0.40 Level

- PI surges 20%, snapping a months-long bearish trend and signaling bullish momentum.

- ISO 20022 listing boosts Pi’s global credibility and fuels institutional optimism.

- Momentum indicators show bullish strength with eyes on the $0.40 resistance target.

The broader crypto market slipped into mild losses on Tuesday, with Bitcoin falling to $112k. Yet Pi Network’s token moved against the tide, surging more than 20% in 24 hours and reclaiming levels last seen in late September.

CoinMarketCap data shows PI trading above $0.27, signaling renewed strength after weeks of consolidation. That rebound marks a steep recovery from the October 10 low near $0.15, when a broad market sell-off knocked prices across the board.

This rally coincides with fresh figures from PiScan showing over 2.6 million PI tokens leaving exchanges within 24 hours. Often, traders see that kind of withdrawal as a sign that holders are moving assets into private wallets, a step usually linked to long-term confidence rather than quick selling.

Even with the strong upswing, PI still sits roughly 91% below its late-February record high. Yet the token has broken out of a bearish channel that had capped its price for months. Chart watchers say that escape could mark the first hint of a larger shift in trend. Some analysts, however, remain divided on whether the momentum can last or if it’s merely a short-lived recovery.

Why the PI Token Is Gaining Ground Today

Part of the excitement stems from Pi Network’s entry into the ISO 20022 global payments framework on October 29, the same messaging standard used by Ripple and Stellar. That update places Pi in line with international banking protocols, giving it a potential foothold with institutions exploring blockchain-based payments.

By aligning with ISO 20022, Pi strengthens its credibility in cross-border transactions and regulatory compliance. This development positions the token as a potential bridge between digital assets and traditional finance, a narrative that may be fueling investor enthusiasm.

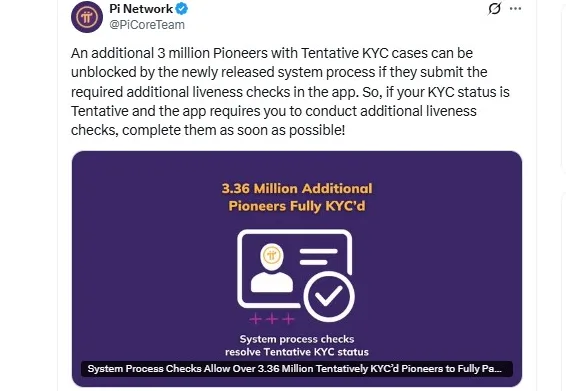

At the same time, Pi Network is rolling out an upgraded automated KYC process that builds on a previous phase, verifying about 3.36 million users. The new system aims to clear another three million accounts, tightening security and paving the way for a full Mainnet launch.

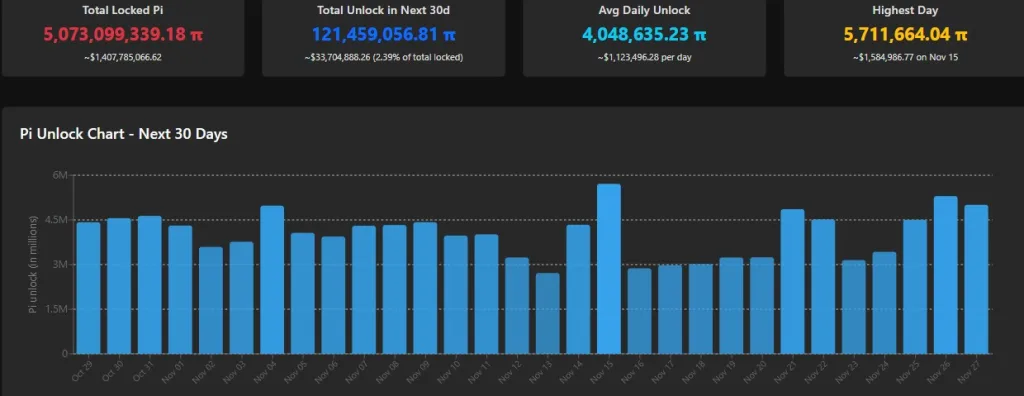

Pi’s supply schedule is also in focus. Approximately 121.5 million tokens, equivalent to roughly 2.4% of the locked supply, are scheduled for release soon. Data from PiScan reveals that about 5.07 billion tokens still remain locked, valued at $1.36 billion. Besides, the largest single unlock, expected on November 15, could free roughly 5.7 million PI worth more than $1.5 million.

Related: Bitwise Solana ETF Sees $57.9M First-Day Surge

Can the Breakout Last?

From a technical stance, momentum indicators lean bullish for now. On the daily charts, the MACD line, currently positioned near -0.0048, has crossed above the signal line at -0.0155, indicating that buyers are regaining control. The expanding green bars on the histogram reinforce this view.

If the trend holds, analysts expect the next hurdle to be near $0.29, a zone matching the 61.8% Fibonacci retracement. Clearing that barrier could open more room toward $0.32, and later toward the $0.35–$0.37 region seen in mid-September. Sustained buying could even lift the token to $0.40 in the weeks ahead.

Should momentum fade, however, PI could fall back toward $0.21–$0.19, an area that has previously acted as support. A deeper slide might revisit $0.15, its former bottom.

For now, Pi Network’s move out of its downward channel gives traders a reason to watch closely. Whether it becomes the start of a larger recovery or fades into another brief spike will depend on how the next round of trading unfolds.