Pippin Price Stays Firm as Shorts Fade and Liquidity Resets

- Pippin’s price holds $0.445 near the 0.382 level while the rising channel stays intact.

- Negative funding below zero shows shorts stayed active even as the price moved higher.

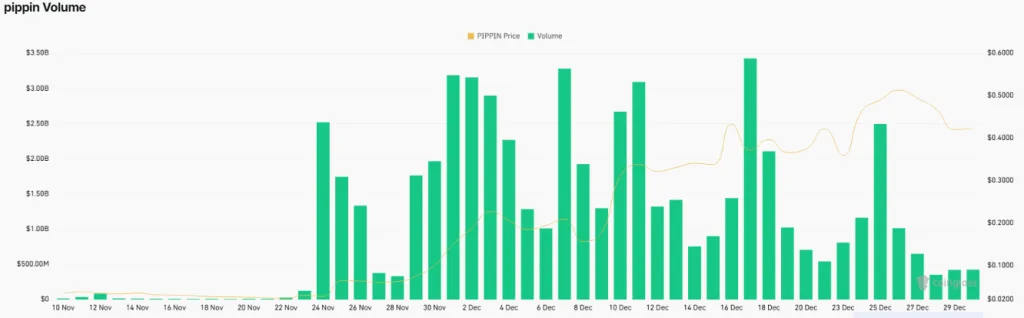

- The token’s volume peaked near $3.5B, then cooled as price held the $0.42 to $0.48 zone.

Pippin has been making profitable market moves, raising concerns among investors about whether it is fit for their attention. Speaking on the performance, Pippin/USDT closed at $0.445021 on Dec. 30, posting a +4.93% daily gain after trading between $0.412786 and $0.462273 on MEXC. The price remains inside a rising channel that began near $0.027678, the Fibonacci 1.0 base. From that base, price advanced over 1,500%, peaked near $0.718814, and then entered a corrective phase that preserved bullish structure.

With the price holding above $0.40, structure, derivative positioning, and participation metrics now converge into a single question: can spot demand sustain continuation without forced leverage flows?

Price Structure and Fibonacci Levels

The current price of the token is evaluating the 0.382 Fibonacci retracement at $0.454800, which is also the level of the last daily closure. The price is squeezing in within the channel, and this zone indicates the immediate direction. The lower boundary of the channel that has been in place since early December reinforces the mid-range support represented by the 0.5 retracement at $0.373246, which is below it.

Source: TradingView

Furthermore, deeper support sits at the 0.618 retracement at $0.291692, which also marks the last higher low that maintained trend integrity. If the token manages to hold its ground above $0.373, it will maintain the consolidation, while a move below $0.291 will break the channel and reset the structure.

Overhead resistance clusters at the 0.236 Fibonacci level at $0.555706, followed by the cycle high near $0.718814. Price previously accelerated above $0.40 with expanding volume, confirming participation rather than thin liquidity.

Momentum and Derivatives Positioning

Momentum remains constructive and is still cooking. The RSI(14) reads 60.23, down from a recent peak of 66.01, signaling cooling strength without bearish divergence. RSI holds above the 50 midline, a level historically aligned with continuation inside rising channels.

Coinglass OI-weighted funding from Nov. 26 to Dec. 29 shows price rising while funding stayed mostly negative. Rates printed repeatedly between -0.30% and -0.70% as the price advanced toward $0.50–$0.57, reflecting persistent short positioning.

Source: CoinGlass

Stress intensified between December 1 and December 6, when funding dropped near -1.50% while price held at $0.15–$0.18. On Dec. 8, funding briefly reset near 0% as the price moved toward $0.30, signaling short covering.

Related: PIPPIN Holds Bullish Structure Despite a 20% Drop From Its ATH

Volume and Participation Trends

CoinGlass volume data from Nov. 10 to Dec. 29 shows a shift from near-zero activity below $0.05 into sustained high participation. The first major surge was on Nov. 24, with a volume of approximately $2.5 billion as the price cleared $0.20 after more than 10 quiet days.

Source: CoinGlass

Between Nov. 30 and Dec. 3, daily volume exceeded $3.0B while price advanced toward $0.30, confirming trend initiation. A second expansion occurred on Dec. 7–10, when volume again crossed $3.0B as price reclaimed $0.35.The largest spike was printed on Dec. 17 near $3.5 billion, coinciding with a price above $0.45. After Dec. 20, volume declined to $400M–$700M while price held at $0.42–$0.48, indicating consolidation rather than exit.