In a recent turn of events, Polkadot’s NFT (Non-Fungible Token) activity has experienced a notable decline over the past week, raising concerns among investors. Polkadot has unveiled a strategic maneuver aimed at rejuvenating its NFT realm.

Polkadot’s official X account (formerly known as Twitter) announced their plans to introduce NFTs from the Sub0 Biodiversity Collection. This collection results from a collaborative effort between Polkadot and the Sovereign Nature Initiative. This development is particularly noteworthy because it stands as the inaugural collection to undergo minting on the Polkadot Asset Hub. This milestone presents an enticing prospect for reigniting the interest of prospective buyers in the Polkadot NFT space.

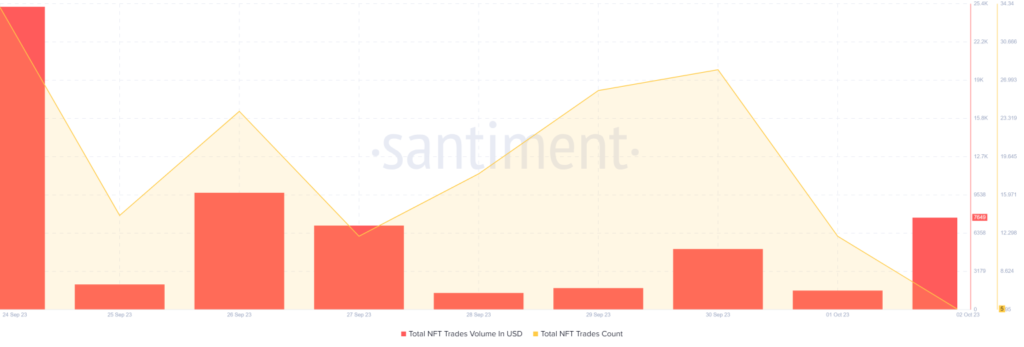

An insightful analysis of Santiment’s chart data reveals that Polkadot’s NFT ecosystem recorded a significant dip in key metrics over the previous seven days. During this period, DOT’s total NFT Trade Counts experienced a sharp and somewhat unexpected plunge. Furthermore, the NFT Trade Volume, measured in USD, also declined, intensifying worries within the community.

As of writing, DOT is trading at $4.27, boasting a market capitalization exceeding $5.2 billion. This upward momentum in price also correlates with a surge in 1-week price volatility, indicating a renewed vigor in the market. DOT experienced an impressive surge of over 1.83% in the past 24 hours alone.

A closer examination of DOT’s daily chart provides valuable insights into its future trajectory. Most market indicators present a bullish outlook for Polkadot, signaling the potential for further price appreciation. For instance, the Chaikin Money Flow (CMF) displayed a significant uptick, underscoring renewed confidence in the asset. Moreover, the Relative Strength Index (RSI) comfortably exceeded the neutral mark of 50, affirming the current bullish sentiment surrounding DOT.

Interestingly, trading volume mirrored the positive trajectory of its price, acting as a solid foundation for the upward surge. Nevertheless, a few metrics painted a more cautious outlook. Despite the price increase, DOT’s Social Volume experienced a slight decline. Additionally, the Binance Funding Rate for DOT turned red alongside the price rise, suggesting a degree of investor reluctance towards acquiring DOT at an elevated price point.