Regulators vs Protocols: Who’s Sketching the Blueprint for Crypto’s Future?

The cryptocurrency industry is evolving as adoption, application, and regulation increase worldwide. Digital assets, as of November 2025, have reached a record high market capitalization of over $4.2 trillion.

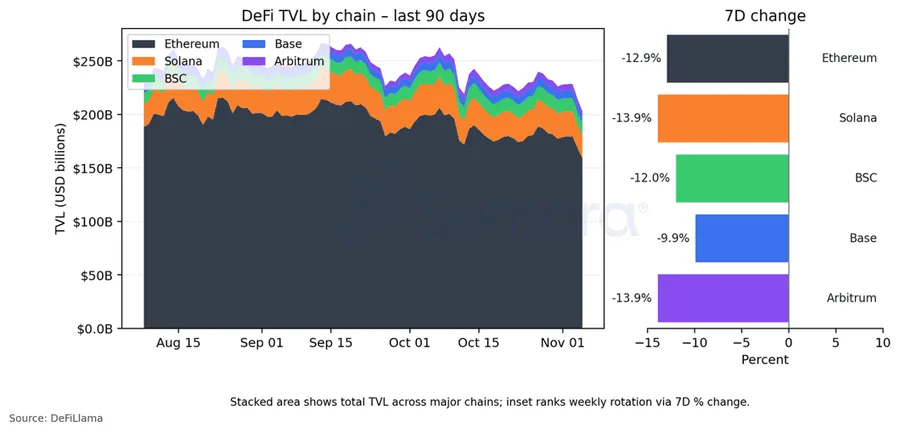

According to data from Defillama, total value locked (TVL) in decentralized finance stands near $134 billion, after recent market swings cut into earlier highs. Ethereum, the largest DeFi ecosystem, has seen its TVL drop by roughly 14% to approximately $75 billion.

Source: X

At the same time, the total crypto market cap as of early November 2025 has dropped to $3.5 trillion from a record high of over $4.2 trillion, while stablecoins represent over $312 billion.

Regulators and protocol developers are engaged more as crypto trading and tokenized finance grow.

- Developers aim to build the core infrastructure, which includes features like consensus, smart contracts, DeFi rails, and token standards to ensure networks remain scalable and secure.

- Supervisors respond by tightening rules on AML, sanctions, and consumer protection, using licensing, monitoring, and heavy fines to steer behaviour.

That push-and-pull now shapes how crypto trading, protocols, capital, and compliance fit together in the coming decade.

Understanding Crypto Protocols

Protocols are sets of rules that organise how data and value move across a network without a central authority. In blockchains, protocols encode consensus mechanisms, data storage, and execution logic. They underpin decentralised finance (DeFi) and tokenisation.

Key Protocol Functions Include:

- Consensus and security: Algorithms like Proof of Work or Proof of Stake help participants agree on the ledger’s state and prevent double-spending. Cryptography provides security for transactions, which makes them immutable and auditable. These features make blockchains resistant to tampering, which allows transparent record-keeping.

- Smart contracts and automation: Self‑executing contracts run when preset conditions are met. They power decentralised applications for lending, insurance, gaming, and more. Contracts automate payments, enforce agreements, and can embed KYC or AML rules.

- Token issuance and management: Standard templates allow developers to issue tokens to describe utility, governance rights, digital art or physical assets. These protocols, like Ethereum that support fungible (ERC-20) and non-fungible (ERC-721) tokens, as well as programmable governance tokens. Chain interoperability increases the application.

- Wallet security and interoperability: Users store tokens in wallets secured by private keys. Protocols integrate encryption and multi‑signature schemes to protect funds. Cross‑chain bridges and interoperability frameworks allow value to move across networks, while scalability solutions such as layer‑2 systems aim to increase throughput and lower fees.

These functions enable decentralisation, transparency, and open access.

Networks have Proof of Work (PoW) systems like Bitcoin or Proof of Stake systems like Ethereum, after it abandoned PoW in 2022. Proposers or miners invest resources to propose and verify blocks, which prevents fraud and double-spending attacks.

Global Regulatory Landscape

The regulators have stopped occasional enforcement and shifted focus to structured rulemaking. According to PwC’s 2025 report, the US has shifted its focus from “regulation by enforcement” to formulating laws that define the roles of the SEC and CFTC.

Lawmakers revisit bills to define digital assets and create safe‑harbour regimes. The SEC and CFTC issued joint statements pledging to harmonise definitions and provide safe‑harbour exceptions for DeFi protocols.

Further, the GENIUS Act sets reserve and disclosure standards for fiat‑backed stablecoins, and separate guidance confirms that fully collateralised stablecoins and certain staking arrangements are not securities.

Meanwhile, Europe’s Markets in Crypto‑assets Regulation (MiCA) entered a transitional period in 2024. It mandates authorisation and capital requirements for crypto‑asset service providers and will be fully implemented by mid‑2026.

Asian centres such as Hong Kong, Singapore, and Japan have adopted licensing regimes and stablecoin frameworks. Middle Eastern jurisdictions like the UAE and Bahrain have also developed comprehensive set of rules to encourage innovation while implementing anti-money laundering standards. These frameworks are meant to give assurance to businesses and investors.

Enforcement and Penalties

Regulators responded to this growth with tougher enforcement. A recent Fenergo report notes that North American regulators imposed more than $1.06 billion in penalties in the first half of 2025. That figure marks a 565% increase compared with the same period in 2024.

Penalties covered failures in AML programs, Know-Your-Customer (KYC) checks, sanctions screening, suspicious activity reporting, and transaction monitoring.

One of the largest actions came from the U.S. Department of Justice, which fined cryptocurrency exchange OKX more than $504 million for AML failures.

Another exchange, BitMEX, received penalties exceeding $100 million for similar issues. Enforcement agencies stressed that they expect crypto platforms to maintain robust compliance frameworks comparable to those in traditional finance.

Fenergo’s data also shows a steep climb in sanctions-related fines. In the first half of 2025, sanctions violations generated about $228.8 million in penalties, up from $3.7 million in sanctions-related penalties during the same period in the prior year.

Rory Doyle, head of financial crime policy at Fenergo, warned that regulators treat digital asset firms as high-risk if controls lag. Authorities now treat sanctions screening and AML controls as central obligations, not optional extras.

Regional differences still appear. Authorities in Europe, the Middle East, and Africa issued about $168.2 million in fines in the same period, a 147% increase year-on-year. Asia-Pacific regulators imposed roughly $3.4 million, down from $10.7 million in the first half of 2024. Analysts point out that some Asian jurisdictions still put more emphasis on licensing and guidance than on large headline fines.

Crypto Crime and DPRK Activity

The latest Chainalysis 2025 Crypto Crime mid-year update reveals over $2.17 billion in stolen cryptocurrency services so far this year. That number exceeds the total for 2024 and sits 17% above 2022, which previously ranked as the worst year on record. If current trends continue, the lost money to services alone will exceed $4 billion by the end of the year.

The largest single incident in 2025 was the hack of the Bybit exchange by North Korea’s “TraderTraitor” hackers. Attackers stole approximately $1.5 billion in the largest crypto heist in history.

Chainalysis links the operation to sophisticated social-engineering and IT worker infiltration tactics that mirror earlier DPRK campaigns. The attack accounts for about 69% of all funds stolen from services so far this year.

Chainalysis also points out the increasing impact on personal wallet compromises. In 2025, attacks on people account for more than 23% of the overall stolen value. Hackers focus more on high-value wallets, phishing, malware and “address poisoning”.

The report follows an increase in “wrench attacks”, in which criminals pursue physical coercion to gain access to private keys. These incidents correlate with bitcoin price surges, which are suggestive of opportunistic targeting.

A separate Multilateral Sanctions and Measures Team (MSMT) report covering January 2024 to September 2025 estimates that DPRK has stolen about $2.8 billion in cryptocurrency during that period. Investigators describe how North Korean networks move funds across multiple blockchains, use cross-chain bridges and mixers, and rely on over-the-counter brokers in several jurisdictions. They also point to links with Russian and Cambodian laundering networks.

The U.S. Treasury’s Office of Foreign Assets Control (OFAC) has reacted with new sanctions. OFAC designated several North Korean individuals and entities, including Korea Mangyongdae Computer Technology Corporation, and tied them to IT worker programs and cybercrime operations. Authorities also flagged 54 digital currency addresses associated with Cheil Credit Bank, previously sanctioned in 2017, and targeted payment platforms such as Huione Pay, which has now drawn attention from FinCEN.

DeFi Protocol Risk

Security incidents in DeFi protocols continue to influence both regulators and market participants. On 3 November 2025, Balancer V2 suffered a major exploit that drained about $128 million from composable stable pools. Analysts traced the root cause to a flawed access-control check, which allowed an attacker to trick the internal accounting system and withdraw funds.

The attack extended beyond Balancer itself. Around 27 forked protocols that reused parts of Balancer’s V2 code also faced risk, across networks such as Ethereum, Berachain, Arbitrum, Base, and Sonic. Some chains responded with aggressive emergency actions.

Berachain validators coordinated a network halt and transaction rollback, recovering more than $12 million but triggering debate over decentralization. Sonic froze the attacker’s account while keeping the chain online.

These events accelerated capital flight. Balancer’s TVL dropped from around $776 million to about $345 million, a fall of more than half, according to DeFi data. Several derivative protocols saw TVL declines of 50% or more as users withdrew funds. The broader DeFi market also reacted. Aggregate TVL across major networks fell from nearly $150 billion to around $130 billion, reflecting reduced risk appetite.

For regulators, such incidents highlight systemic risk in composable code. One vulnerability can spread through many dependent applications. For protocol teams, they underline the limits of traditional audits and the need for simpler, more robust designs and continuous monitoring.

Related: Tether and Tron Crime Unit Freezes $300M in Crypto Funds

Policy Responses

Lawmakers now treat stablecoins and tokenization as core financial infrastructure. In the United States, the GENIUS Act sets federal rules for fiat-backed stablecoins, covering reserves, redemptions, disclosures, and supervision.

In Europe, MiCA now applies to all crypto-asset service providers and stablecoin issuers, with licensing, capital, and strict reserve rules. Compliance budgets have jumped, especially for smaller firms that now spend heavily on legal work, cybersecurity, and reporting.

At the same time, tokenized real-world assets have passed roughly $35.8 billion, led by U.S. Treasuries and private credit, while several forecasts point to multi-trillion-dollar potential. Central banks test their own rails through CBDCs, including China’s e-CNY at national scale and the digital euro, DREX, and e-rupee in pilot or build phases.

Protocols Adapt

Developers now ship more “compliance-aware” code. Some DeFi protocols gate certain functions behind zero-knowledge KYC checks or jurisdiction filters, even while the core contracts stay permissionless. Others use permissioned variants of public chains so approved validators and regulators can review all activity.

At the same time, wallet security sits higher on the agenda. Providers promote hardware devices, multisig setups, and safer recovery, while analytics firms and regtech vendors track stolen funds, sanctions risks, and AML red flags in real time.

Shared Blueprint: Perimeter vs Runtime

Regulators set the perimeter by defining who may issue stablecoins, run exchanges, or distribute tokenized assets. Protocols still shape the runtime by controlling consensus rules, smart-contract behavior, and DeFi market logic.

The emerging blueprint for crypto’s future comes from this interaction: law and supervision steer access and trust, while code and cryptography decide how value actually moves on-chain.