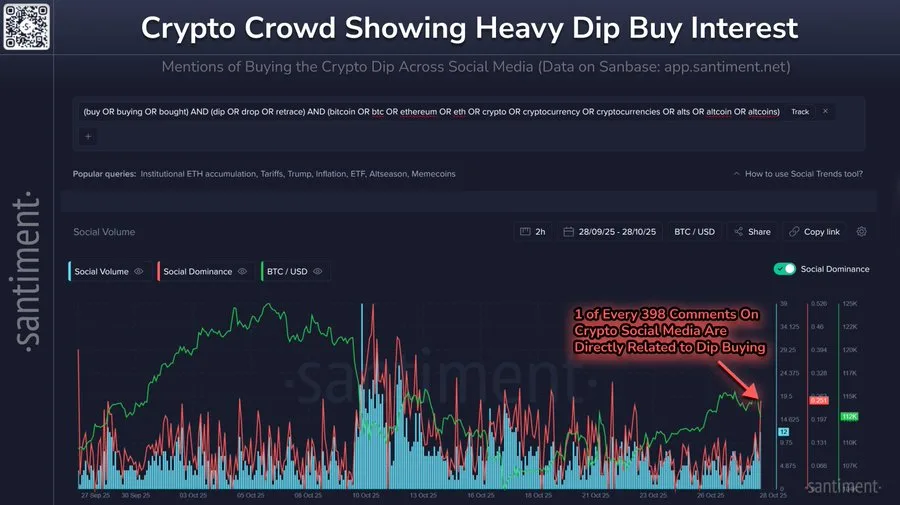

Retail Dip Buying Could Trigger Market Pullback: Santiment

- Bitcoin holds steady as traders wait for the Federal Reserve’s policy announcement.

- Retail dip buying rises, but analysts warn optimism may signal more short-term losses.

- Institutional inflows and positive funding rates point to strengthening market support.

Bitcoin traded around $113,000 as investors awaited the Federal Reserve’s policy update. The market remained stable ahead of the announcement, showing limited movement amid broader economic uncertainty. Traders continued to watch macroeconomic indicators and institutional market trends closely.

Analytical platform Santiment noted that the rally led to a surge of retail chatter regarding buying the dip following a slight retrace in the market on Tuesday. The company cautioned that skyrocketing retail optimism often comes before more downside. As history has shown, the actual buying opportunities come when traders least expect a rebound and are most skeptical of a recovery.

Historically, Bitcoin’s strongest recoveries have emerged when optimism gives way to fear. Retail traders often assume the decline has ended too soon, while excessive enthusiasm tends to signal short-term weakness despite brief rallies that follow.

Fed Rate Cut Decision Sparks Market Anticipation

The Federal Reserve’s Open Market Committee is likely to deliver a 25 bps cut, reducing the federal funds rate range to 3.75%- 4.00%. The move is targeted at struggling economic growth and growing labor concerns.

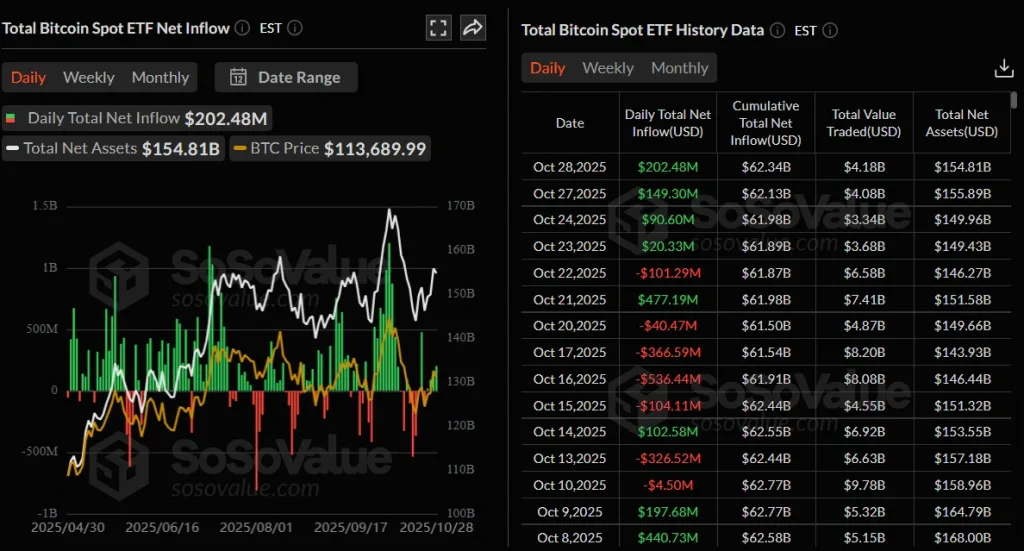

Amid this environment, some institutional buyers are back. SoSoValue data indicated that the US-listed Spot Bitcoin ETFs took in $202.48 million on Tuesday. It was the fourth consecutive day of inflows, indicating renewed interest from big investors. If sustained, inflows could offer structural support for Bitcoin’s current price

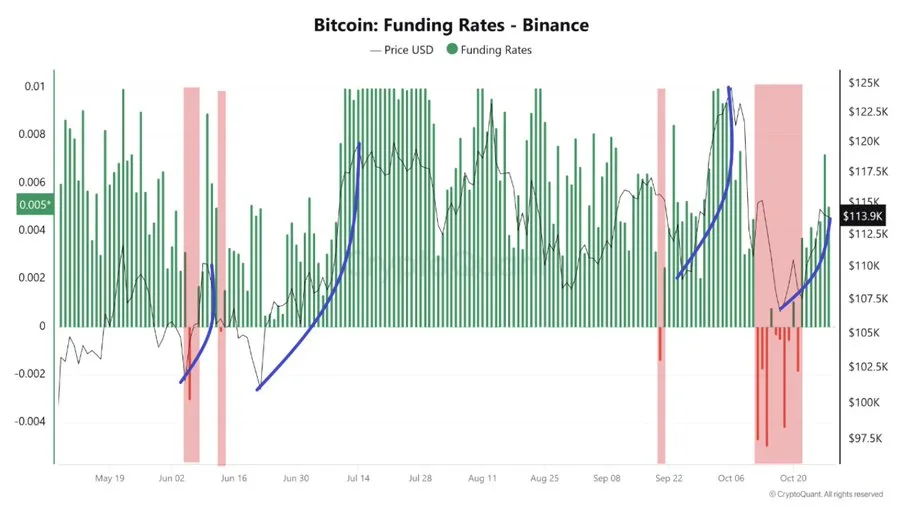

Funding trends signal growing momentum for Bitcoin recovery

CryptoQuant reported that Binance Bitcoin funding rates have remained positive since October 22, 2025. Over the past six months, negative funding rates have aligned with local bottoms, while positive rates have marked short-term uptrends. The current readings suggest early momentum for a potential upward phase.

Analyst Michael van de Poppe noted that Bitcoin has already retested lower levels and found buying pressure. He expects volatility to rise sharply as the FOMC announcement approaches. He advised traders against using high leverage unless they have strong experience in volatile conditions.

Related: Metaplanet Secures $500 Million Bitcoin Credit Facility

He also pointed out that gold’s current sideways action is a stark contrast to the potential upside in the price of Bitcoin. According to him, the cryptocurrency is still undervalued compared to traditional assets. If that combination of factors could remain, the price level around $112,000 may offer a good medium-term opportunity.

The short-term trajectory of BTC now hinges on the tone set by the Fed and the post-decision market reaction. A dovish tone could underpin risk investors, and a hawkish message might sell the market off once again. But robust ETF demand and supportive funding data suggest resilience endures.

Bitcoin price remained little changed as traders waited for the Federal Reserve’s latest take on interest rates. Traders are waiting for more clarity from policymakers even as institutions continue to quietly shop. Market sentiment continues to remain precarious but has continued to be less volatile and appears to have stabilized in both spot and derivatives markets.