- The Reverse Repo facility experiences a significant drop, with only $683 billion remaining.

- Financial analysts express worries over potential interest rate increases due to depleted Reverse Repo reserves.

- The financial community closely monitors the situation, anticipating broader implications for interest rates and market stability.

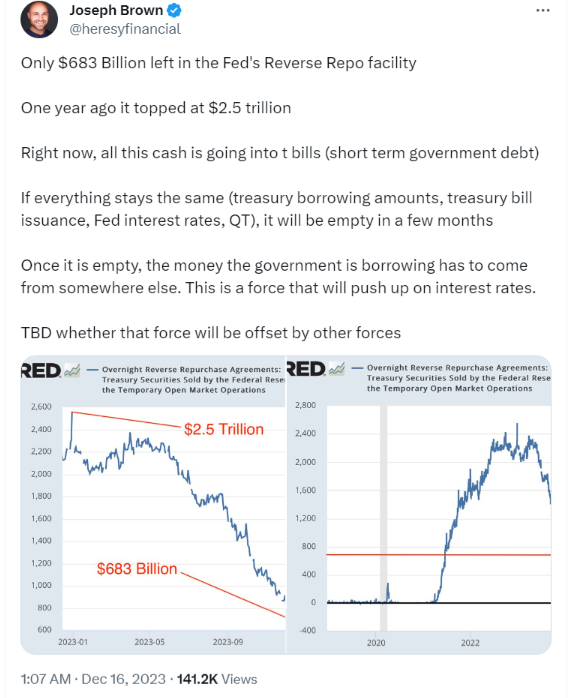

In a recent tweet, financial analyst Joseph Brown, operating under the handle heresyfinancial, highlighted a significant development in the Federal Reserve’s Reverse Repo facility. As of now, only $683 billion remains in the facility, a drastic reduction from the $2.5 trillion reported one year ago.

The Reverse Repo facility is currently witnessing a substantial outflow of funds, with the majority being directed towards short-term government debt, specifically Treasury bills. This shift in the allocation of cash has implications for the broader financial landscape, particularly in relation to interest rates.

Brown warned that should the existing conditions endure, taking into account elements like treasury borrowing amounts, treasury bill issuance, Federal Reserve interest rates, and Quantitative Tightening (QT), the Reverse Repo facility might run out in a few months. When depleted, the government will have to explore other avenues for borrowing funds, potentially leading to an increase in interest rates.

The financial community is now closely monitoring this situation, as the depletion of the Reverse Repo facility could act as a significant force influencing interest rate movements. The tweet emphasized that the impending depletion of the facility will necessitate the government to secure funds from alternative sources, potentially leading to a rise in interest rates.

The consequences of this development remain uncertain, as it depends on whether the upward pressure on interest rates resulting from the emptying Reverse Repo facility will be offset by other market forces. Brown’s tweet leaves the resolution of this question to be determined (TBD).

Subsequently, this revelation prompts a broader discussion about the delicate balance within the financial system. As the Reverse Repo facility nears depletion, it underscores the intricate interplay between various economic factors. The dynamics of treasury borrowing, bill issuance, central bank policies, and market reactions are integral components that collectively shape the financial landscape.

Market participants, policymakers, and analysts are currently closely monitoring the unfolding of this situation. The potential repercussions on interest rates may significantly affect different sectors of the economy, such as lending, investments, and overall market stability. As this facility approaches depletion, the subsequent influence on interest rates is a vital element to keep a close eye on. The broader financial community is eagerly anticipating further developments in the months ahead.