Ripple CEO Predicts 90% Odds of CLARITY Act Approval by April

- Ripple CEO lifts CLARITY Act approval odds to 90% after White House roundtable talks

- Stablecoin yield dispute remains key hurdle as banks and crypto firms seek compromise

- Prediction markets swing sharply despite rising confidence from industry leaders

Momentum around U.S. crypto legislation intensified this week after the Ripple CEO placed a 90% probability on the CLARITY Act becoming law by April 2026. The projection followed a high-level White House roundtable that brought together digital asset executives, banking representatives, and federal officials seeking to resolve final disputes over market structure rules.

As a result, Brad Garlinghouse’s updated estimate marked a measurable shift from his prior 80% outlook, signaling what he described as tangible progress in negotiations. His remarks came as lawmakers face a White House-backed push to finalize compromise language before the end of February, a timeline that could determine whether Congress advances the bill this spring.

White House Talks Signal Measurable Progress

The Ripple CEO shared his updated forecast shortly after attending a market structure discussion in Washington. Leaders from Ripple, Coinbase, major U.S. banks, and legislative advisers participated in the meeting, which focused on resolving disputes that have stalled the CLARITY Act in recent weeks.

“I think it’s now 90% it will pass by the end of April,” Garlinghouse said, referencing bipartisan engagement. He added that earlier predictions had been viewed as overly optimistic. “I had said a couple of weeks ago, I thought end of April at the time, people thought that was a little optimistic.”

The 10-point increase from 80% to 90% reflects what he described as constructive dialogue between crypto firms and traditional financial institutions. The White House has reportedly encouraged both sides to reach common ground before the end-of-February deadline.

Stablecoin Yield Dispute Remains Central

At the center of the negotiations is a dispute over stablecoin yields. Banking groups, on one hand, have advocated for a broad prohibition on crypto firms distributing yield or interest on stablecoin holdings. They argue such products could undermine traditional deposit models.

Digital asset firms, on the other hand, counter that a blanket ban would suppress innovation and disadvantage blockchain-based financial services. Regardless, the Digital Chamber proposed exempting yield generated through activities such as liquidity provision and staking, rather than imposing a universal restriction.

Treasury Secretary Scott Bessent urged lawmakers last week to pass comprehensive crypto legislation this spring. Senator Bernie Moreno, a member of the Senate Banking Committee, echoed that timeline at the World Liberty Forum, stating the bill could clear Congress by April.

Prediction Markets Reflect Volatility

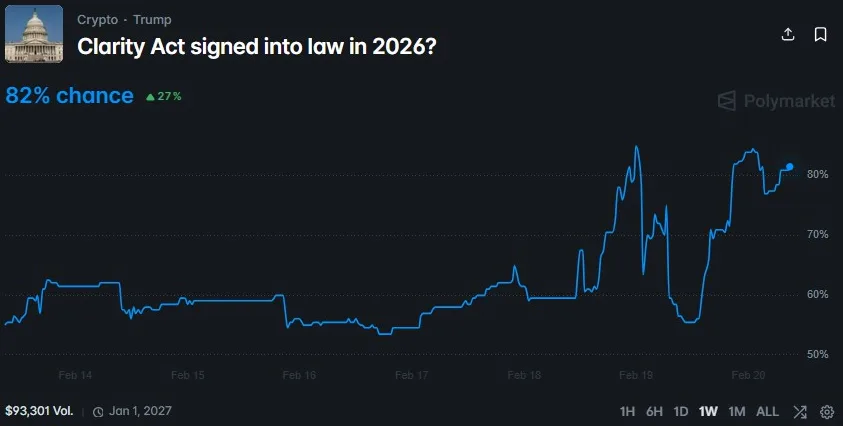

While executive confidence rose, prediction markets showed rapid swings. On Kalshi, contracts pricing the CLARITY Act becoming law before June surged to 85% Thursday morning from 39% the previous evening, following statements from industry leaders and lawmakers. However, those odds later retraced to 46%.

Moreover, contracts projecting passage before 2027 hovered near 71%, down from an overnight high of 87%. On Polymarket, odds of enactment in 2026 climbed to 86% at publication time. The volatility indicates that traders remain cautious despite public optimism.

Source: Polymarket

The divergence between executive commentary and market pricing underscores lingering uncertainty about whether lawmakers can reconcile final provisions within the compressed timeline.

Related: CLARITY Act Gains Momentum as Coinbase CEO Signals Win-Win-Win Outcome

Why the Bill Matters

If enacted, the CLARITY Act would represent one of the most consequential U.S. crypto frameworks in years. The legislation aims to clarify regulatory oversight between the Securities and Exchange Commission and the Commodity Futures Trading Commission, an issue that has generated prolonged legal disputes over token classification.

Supporters argue that clearer statutory definitions could encourage institutional participation and reduce enforcement-driven ambiguity. Meanwhile, critics maintain that restrictive language, particularly around stablecoin yields, could push innovation offshore.

For now, the 90% estimate offered by the Ripple CEO reflects growing confidence among industry leaders. Whether Congress converts that optimism into legislation by April will depend on how swiftly negotiators bridge the remaining divide.