SHIB Bullish Structure Strengthens as Analyst Targets 246% Rally

- SHIB’s wedge breakout signals early strength and hints at a broader trend reversal.

- Analyst targets $0.000032 as SHIB builds momentum toward a possible 246% rally.

- Improving sentiment and meme-coin gains help drive renewed interest in Shiba Inu.

Shiba Inu’s price action has taken a sharp turn upward at the start of the new year, and the shift is catching attention across the market. The token clawed its way off a familiar support pocket, the $0.00000712 to $0.00000681 band, where selling pressure finally thinned after months of slow erosion.

From there, momentum slowly gathered and then snapped forward. By press time, SHIB trades at $0.000008732, a level that only days ago seemed distant. The move comes as the meme-coin segment posts an outsized jump compared with the broader market.

Sector gains reached 5.7% in the past 24 hours, driven by PEPE’s 11% lift and BONK’s 10% surge. SHIB followed with a 6% rise, enough to outperform the wider crypto market’s mild 0.56% advance.

Besides, SHIB’s 17% weekly climb fits that script, aligning with past cycles where speculative flows return through the most volatile corners first before spreading outward.

Wedge Breakout

The technical conversation surrounding SHIB has also shifted. For months, the chart showed a descending wedge that compressed price action deeper and deeper, each lower low accompanied by a quiet counter-signal from momentum indicators.

These divergences rarely tell when a turn will begin. Analyst Javon Marks highlighted the move in a chart shared on X, noting how the breakout lines up with a final divergence near the recent lows.

Source: X

His takeaway: the pattern doesn’t point to just a reflexive bounce. It suggests a more significant unwinding of accumulated seller fatigue. Marks went further, outlining a potential advance toward $0.000032, roughly 246% up from current prices, a level that has acted as a reaction zone in earlier cycles.

What to Look Out For: Volume and Technical Strength

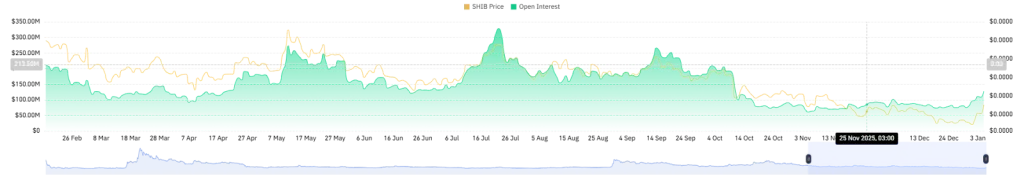

Whether SHIB can keep pushing higher will depend in part on how trading activity holds up. According to CoinMarketCap’s data, volume jumped sharply, climbing 137% to roughly $327 million over 24 hours.

That figure needs to stay above the $300 million mark to avoid the usual post-breakout fizzle. So far, turnover looks healthy, though the market has been known to cool suddenly. Technically, the token is in a better position than it was a few weeks ago.

Source: TradingView

It pushed back above the 23.6% Fibonacci level at $0.00000871 and continues to hover above both the 50-day SMA at $0.00000803 and the 20-day MA at $0.00000749. Still, SHIB stalled beneath the 100-day MA at $0.00000925, which now forms a short-term ceiling.

Meanwhile, the RSI sits around 62, placing it in a neutral-to-bullish zone. This level suggests bullish momentum remains intact, with room for continuation before reaching overbought conditions.

A close above the January 5 high near $0.00000940 would open room toward the 38.20% Fibonacci marker at $0.00000988. Beyond that, the 200-day SMA at $0.0000110 stands out, a slower, heavier barrier that often redirects momentum.

Related: Bitcoin’s $89K Reclaim Structural Shift Despite Bearish Flows

Market Tailwinds Stir Fresh Momentum for SHIB

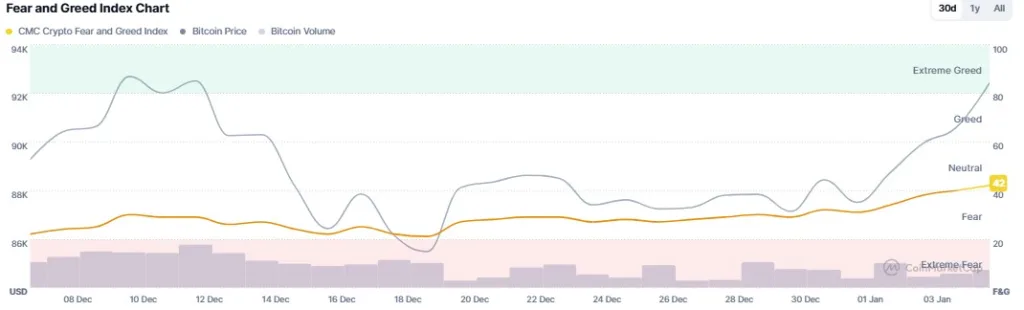

Not to leave out, market-wide sentiment has quietly improved. The Fear & Greed Index, which sat at 25 a month ago, has drifted up to 42. Bitcoin’s steadier footing has also helped; the asset is up 1.4%, reclaiming the $92.4K as ETF products logged roughly $456 million in weekly inflows.

Source: CoinMarketCap

These shifts often free up liquidity for altcoins when traders feel confident enough to extend risk outward. Derivatives data adds its signal. CoinGlass data shows open interest in SHIB increased by about 16%, contributing to a broader $126 million total.

Source: CoinGlass

The reading suggests traders are adding exposure rather than closing it out, a stance that usually amplifies volatility. In summary, SHIB’s breakout, stronger liquidity, and improved sentiment point to a clearer path for upside, though significant resistance levels remain ahead.

Market conditions appear more supportive than in recent months, and if momentum continues to hold, Shiba Inu may stay among the market’s more reactive and closely tracked assets.