Shiba Inu Traders Eye Autumn 2025 as Token Struggles Under Bearish Pressure

- Shiba Inu slips below $0.00001250, raising concerns while investor sentiment weakens.

- Marketing lead Lucie highlights Shibarium adoption and long-term growth beyond price swings.

- The support holds at $0.00001180, with resistance firmly placed around $0.00001320.

Shiba Inu has been under heavy selling pressure over the last few days, with its price falling below $0.00001250 and investor optimism fading. Despite this downturn, marketing lead Lucie assured community members that the upcoming autumn season could provide a much-needed boost. She stressed that the project’s focus extends beyond short-term price action and remains committed to ecosystem growth.

Lucie explained that the team is concentrating on building Shibarium adoption rather than reacting to daily price swings. According to her, the current low value of Shiba Inu tokens should not discourage long-term goals, as development work continues at a steady pace. Her comments were intended to provide reassurance to investors that the project is still advancing regardless of market volatility.

Shiba Inu Burn Rate Rises as Market Struggles Below Key Resistance

The supply has also been declining due to token burns. Shibburn data indicate that over 219,849 SHIB were burnt in 24 hours, representing a 211.77% increase in the rate at which SHIB were burned. Total supply has now been estimated at 589.24 trillion tokens.

As of press time, SHIB is down by 1.25% and the market capitalization has slipped to $7.23 billion, but trading volume has climbed 76.51% to reach $214 million. This rise in activity reflects increased participation despite weakening price levels.

Shiba Inu is trading at $0.00001229, staying under its key moving averages. The 50-day average stands at $0.00001320, the 100-day at $0.00001277, and the 200-day at $0.00001315. Each of these levels has acted as firm resistance, blocking recovery. Price action remains flat, with small-bodied candles and long wicks reflecting indecision and fading momentum.

The immediate support level is close to $0.00001180, and the resistance is near $0.00001320. The first sign of a possible rebound would be a breakout beyond the 200-day average, whereas a weakness below the support level would add selling pressure. Consolidation would probably proceed until that time. Momentum indicators also suggest weakness. The MACD line has a value of -0.000000020, which is below the signal line at -0.00000016, which indicates a bearish momentum.

Related: Shiba Inu Bears Press Hard: Can Buyers Defend Key Levels?

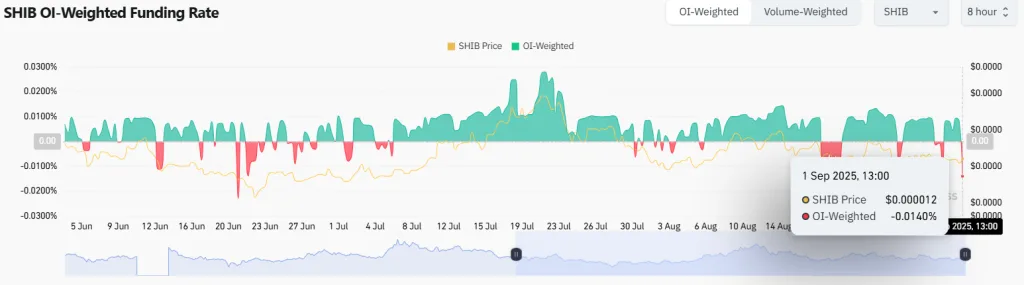

Bearish sentiment is increasing in the derivatives markets. The funding rate now stands at -0.0140%, and liquidations indicate that long positions worth more than $188,000 have been washed away, compared to a mere $24,700 of shorts. This asymmetry highlights the power of sellers and the challenges confronting bullish traders.

Shiba Inu has been placed in a precarious position over the period, with seasonal optimism impacting investor sentiment. Favorable developments in history in the autumn give investors optimistic withdrawals. Nonetheless, till the price brushes major technical levels, the token would most probably be undergoing a range-bound state and would require a clearer change driver.