Solana ETFs Rise as Price Faces Key $190 Reclaim Challenge

- Solana remains weak near $154, while recovery depends on reclaiming the $190-$215 range.

- Bitwise’s Solana ETF launch gathers inflows and reshapes the U.S. crypto ETF landscape.

- Institutional confidence in SOL ETFs continues despite market uncertainty and volatility.

Solana (SOL) faces renewed bearish momentum as its price slips below a critical resistance zone between $190 and $215, according to market analyst DonAlt. The weekly TradingView chart reveals a clear structural breakdown, with Solana trading around $154.97, reflecting a 5.83% weekly decline.

Source: X

The analyst emphasizes that a recovery beyond the area marked in red could indicate a structural reversal; however, the trend remains bearish until such confirmation. Under the resistance, a significant support area is located at $144, which is also the point of historical accumulation from late 2023.

According to the analyst, this area is now Solana’s bottom range, and a short-term bounce could occur if it is tested. If this support is not maintained, it could result in further drops to previous consolidation regions; thus, the negative scenario still prevails unless the upper range is regained.

Solana ETFs Maintain Strong Institutional Momentum

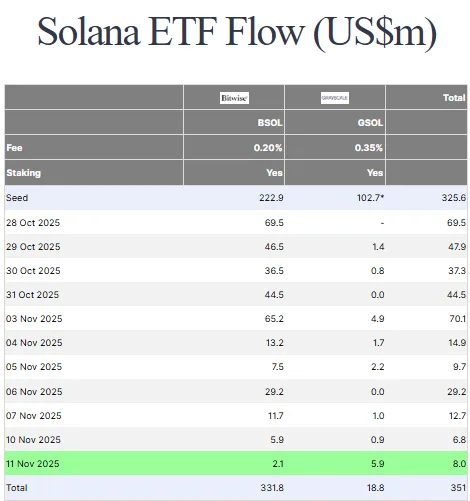

Solana’s spot exchange-traded funds (ETFs) have been remarkably persistent in attracting inflows even though the prices are on the weaker side. Data collected by Farside Investors reveals that on November 10, 2025, the Solana ETF was $6.8 million, indicating the continued trust that institutions have in the market despite it being in a volatile state.

Source: Farside

The two main Solana ETFs—BSOL and QSOL—are responsible for managing these flows. In addition to the 0.35% carrying fee, the staking fee of QSOL is 0.20%. BSOL remains the main fund, which has received a total of $331.8 million in inflows since its inception, while QSOL attracted $18.8 million; thus, the total amount of inflows is $351 million.

The initial seed funding was worth $325.6 million, with BSOL’s share being $222.9 million and QSOL’s share $102.7 million. The inflows observed at the beginning of November remained strong, with $8 million posted on November 11, indicating sustained momentum since the end of October. According to analysts, these numbers serve as proof of the long-term commitment of institutional investors to Solana’s staking-enabled ETF structure; hence, investor confidence is deemed to be strong, despite potential price difficulties in the near term.

Related: Solana Price Rebounds as SOL ETF Sees $9M Inflow, Key Levels to Watch

Bitwise Leads Regulatory Shift With First Solana ETF

According to Reuters, Bitwise Asset Management disrupted the regulatory landscape by launching the first U.S. spot Solana ETF during the recent government shutdown. The product, Bitwise Solana Staking ETF (BSOL.P) tracks Solana’s spot price using an alternative approval process that bypasses formal SEC sign-off, giving Bitwise a first-mover advantage in a market many expect to grow rapidly.

The product attracted $420 million in its first week, according to LSEG data, with analysts at JPMorgan projecting that “altcoin” ETFs could draw $14 billion in their first six months, including $6 billion into Solana-related funds. Bitwise Chief Investment Officer Matt Hougan stated, “We do like firsts at Bitwise. We are following the rules.”

The development has pushed competitors such as Grayscale, VanEck, Fidelity, and Invesco to revise their filing strategies, with many adopting Bitwise’s approach. Grayscale converted its private Solana fund into an ETF, while other firms are exploring similar launches, including products linked to Ripple’s XRP.