- Solana’s developer community exceeds 2500, showcasing robust growth and innovation in 2023.

- Market cap of Solana hits $43B, indicating strong investor confidence amidst recent market fluctuations.

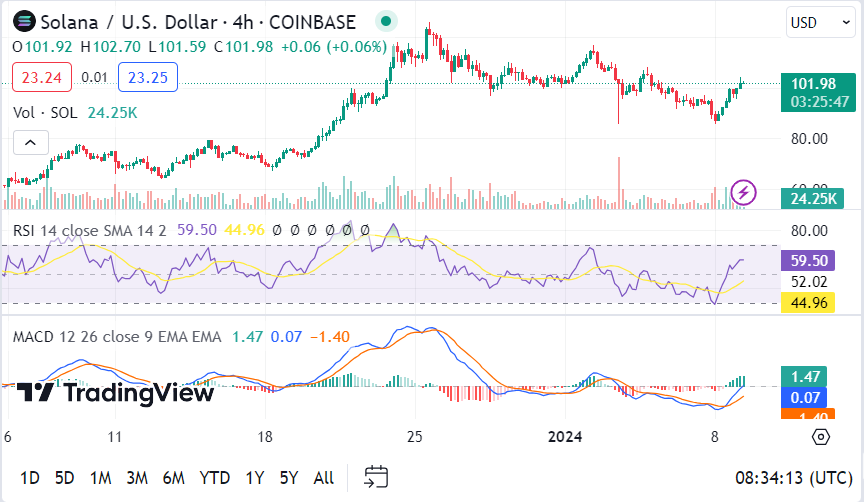

- Technical analysis indicates a potential bullish trend for Solana, but caution is advised due to mixed indicators.

The Solana ecosystem has shown remarkable growth and innovation throughout 2023. A notable surge in its developer community and technological advancements has made significant headlines in the blockchain industry.

As highlighted on X, formally Twitter today, Solana boasts over 2500 monthly active developers engaged in its open-source repositories. This impressive number reflects a robust developer retention rate of over 50%. These statistics underline the platform’s commitment to fostering a vibrant and sustainable developer environment.

In the financial domain, Solana’s market performance has been equally noteworthy. The cryptocurrency currently trades at $101.82, with a substantial 24-hour trading volume of $3 billion. This figure marks a 13.05% increase in price over the last 24 hours.

However, it is essential to note an 11.04% decline in the past week. With a circulating supply of 430 million SOL, the market cap is an impressive $43 billion. Such financial dynamics suggest a strong investor interest and market confidence in Solana.

Technical analysis of Solana’s price movement reveals more layers. According to Ali, a prominent blockchain figure, the hourly chart hints at the formation of a bull flag pattern. This pattern, if confirmed, could push Solana above the $110 resistance level. Consequently, such a move could set the stage for an ambitious climb towards a target of $163. Investors and traders are keenly observing these developments for potential opportunities.

Moreover, Solana’s 4-hour Relative Strength Index (RSI) sits at 59.50. This value indicates a balanced market sentiment, neither overbought nor oversold. Investors are advised to monitor the RSI closely, as an approach towards the overbought territory might signal a potential price reversal.

The 4-hour Moving Average Convergence Divergence (MACD) shows a positive value. This suggests a current upward trend and hints at a possible continuation of bullish momentum in the near term.

However, the 4-hour Know Sure Thing (KST) indicator shows a negative value. This suggests a short-term downward trend in Solana’s price, indicating a potential correction or consolidation phase. Investors should consider this in their strategic planning.

These developments in the developer ecosystem and financial markets highlight Solana’s growing impact and potential within the blockchain space. As the platform continues to evolve, it attracts developers and investors alike, underlining its significant role in shaping the future of blockchain technology.