Stablecoin Market Soars to $311B as USDT and USDC Lead

- Tether and USDC account for over 83 percent of the global stablecoin market share.

- New players, such as USDe and PYUSD, are expanding amid demand for the digital dollar.

- Regulatory frameworks are emerging as global oversight of stablecoins intensifies.

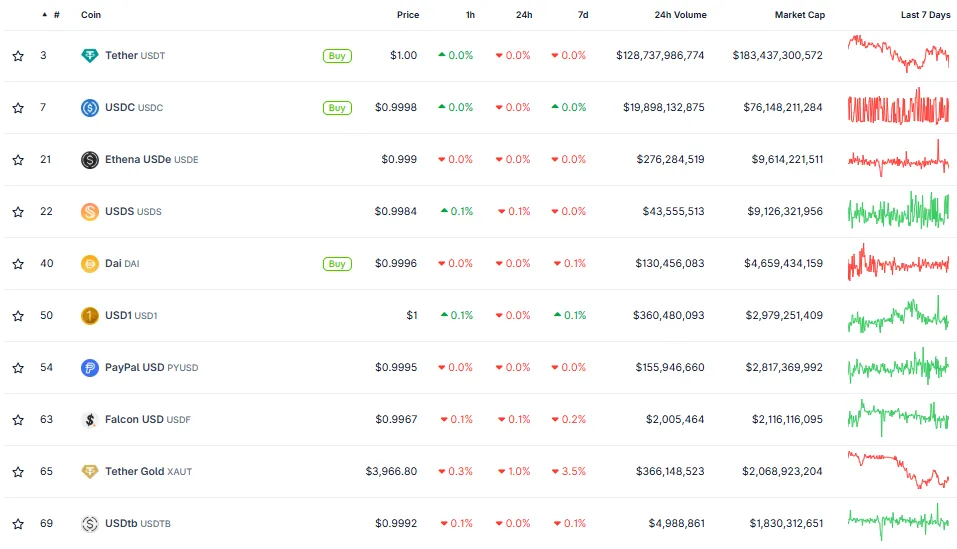

The global value of USD-backed stablecoins has risen to $311.56 billion, according to data from CoinGecko. The figure illustrates the increasing demand for digital dollars used in trading, lending, and cross-border transactions. Within just 24 hours, the total trading volume reached $148.6 billion, underscoring the continued centrality of stablecoins to cryptocurrency liquidity and payment activity. Tether (USDT) and USD Coin (USDC) collectively hold more than 83% of the market, confirming their position as the two most widely used digital currencies in circulation.

The Two Giants at the Core

Tether (USDT) remains firmly at the top, with a market capitalization of $183.44 billion and daily trading volume of $128.73 billion. The token maintains a steady $1.00 price, serving as the backbone for digital exchanges and institutional transfers worldwide.

Just behind, USD Coin (USDC) holds a $76.15 billion market cap with $19.89 billion in 24-hour trading volume. Trading near $0.9998, USDC has become the preferred choice for regulated financial products and corporate payment systems. Both tokens anchor nearly all stablecoin liquidity across the market, making them vital to DeFi operations and settlement flows between exchanges.

New Tokens Build Market Depth

A new generation of stablecoins is expanding the field of digital currencies. Ethena’s USDe has reached a $9.61 billion valuation and sees $276.28 million in daily trading volume. Priced at $0.999, the token continues to gain traction as investors look for diversified on-chain assets. USDS follows with a $9.12 billion capitalization and $43.55 million in trading, maintaining a price of $0.9984.

The decentralized token Dai (DAI) is currently trading at $0.9996 and has a market capitalization of $4.65 billion, with $130.45 million in transactions. DAI is known for its hybrid collateral model and continues to shadow DeFi lending markets. On the other hand, USD1 is equivalent to $1.00, with a market cap of $2.98 billion and $360.48 million in trades, while PayPal USD (PYUSD) is at $0.9995, with a market cap of $2.82 billion and $155.94 million in trading.

Further down, Falcon USD (USDF) boasts a $2.12 billion market capitalization and $2.01 million in daily trading volume, indicating steady institutional adoption and liquidity growth.

Related: Kyrgyzstan and Binance Unite to Launch National Stablecoin

Asset-Backed Growth and Regulation Ahead

Tether Gold (XAUT), a cryptocurrency linked to gold, is currently priced at $3,966.80, with a market capitalization of $2.06 billion and a 24-hour trading volume of $366.14 million. The coin has suffered a 3.5% price loss over the last week, but it remains a choice for investors seeking exposure to tangible assets. USDTb, which costs $0.9992, boasts a market capitalization of $1.83 billion and a daily trading volume of $4.98 million.

The stability of all the leading tokens signals the establishment of a reliable, mature financial layer operating on the blockchain. Nevertheless, the rising supply has caused regulators globally to take notice. US, EU, and Asian policymakers are pushing for new regulations to tighten oversight and transparency of reserves.

The Markets in Crypto-Assets (MiCA) framework in Europe is one of the first complete initiatives to regulate stablecoins on a large scale. As these frameworks take shape, the market faces an important question: Will liquidity remain concentrated in USDT and USDC, or will newer entrants, such as USDe and PYUSD, manage to share the stage? Stablecoins now sit at the heart of the global digital economy, linking traditional finance with blockchain networks through unmatched speed, liquidity, and utility.