The cryptocurrency platform is witnessing a remarkable breakout with Stacks (STX), as highlighted by CryptoBusy, a well-known analytics platform. The buzz is all about STX’s multi-month breakout, indicating a strong upward trend with predictions of reaching the $2 mark in the near future.

This excitement is not without merit, considering the recent performance of STX. As anticipation of Bitcoin ETF on January 10, 2024, soars, It trades at an impressive $2, following an 11% surge in the last 24 hours.

The increase is even more noteworthy, given the 16% rise experienced over the past week. This trend suggests that Stacks is not merely experiencing a short-term spike but a sustained upward trajectory, reflecting a deeper and more enduring interest from the market.

The current trading volume for Stacks stands at a substantial $396 million. This high volume underscores its increasing popularity and strengthens its position in the cryptocurrency market.

With a circulating supply of 1.4 billion STX, the market capitalization of Stacks has reached an impressive $2.8 billion. This financial growth positions Stacks as a formidable player in the cryptocurrency realm, attracting both seasoned and new investors.

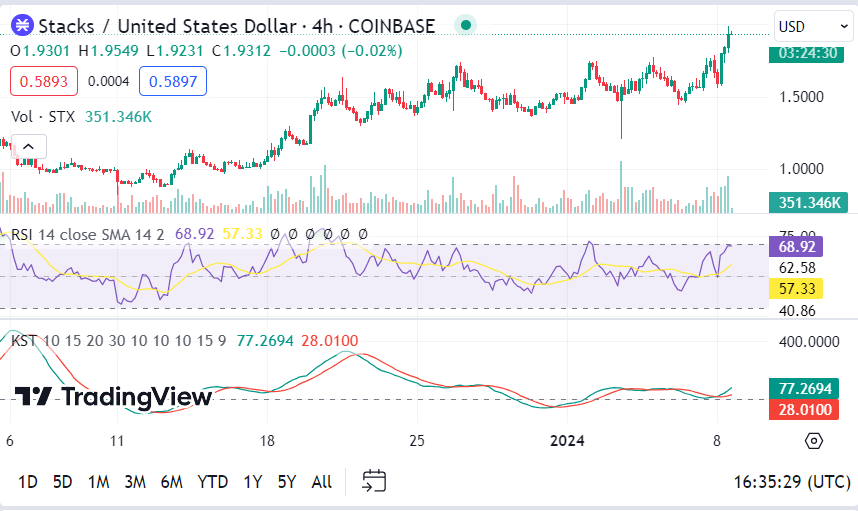

Further analysis of STX’s technical indicators sheds light on its market dynamics. The 4-hour Relative Strength Index (RSI) is at 68.92, indicating a strong relative market strength compared to its counterparts. This high RSI level suggests a robust market presence for Stacks.

Additionally, the positive trend in the 4-hour Moving Average Convergence Divergence (MACD) reinforces this perspective, signaling an upward momentum in STX’s price. This could potentially point to a bullish trend in the near term.

However, caution is seen in the 4-hour Know Sure Thing (KST) indicator, indicating that the stock’s price has experienced a significant increase over the past 4 hours.

The current market performance of Stacks, as brought into focus by CryptoBusy’s tweet, goes beyond a mere temporary upswing. It represents a solid foundation of market confidence and a strong fundamental position. The blend of high trading volume, a robust RSI, and a positive MACD reading paint a bullish picture for Stacks.

However, the slight caution indicated by the KST warrants vigilance among investors. As Stacks continues its ascent, it stands out as a cryptocurrency to watch, potentially reaching the anticipated $2 mark soon. This scenario underscores the dynamic and multifaceted nature of the cryptocurrency markets.