Trump’s Greenland Push Draws Early Bets in Crypto Markets

- Polymarket traders price Trump’s Greenland acquisition odds near 15% before any formal deal.

- U.S.–Denmark talks and Arctic security concerns drive early geopolitical positioning on-chain.

- Greenland resource narratives and macro risk factors influence crypto market sentiment.

President Donald Trump’s renewed interest in Greenland has moved from political debate into financial positioning. Crypto-based prediction markets are now assigning probabilities to the outcome. Traders are converting diplomatic signals into price movements. This activity is unfolding despite the absence of formal negotiations or policy decisions.

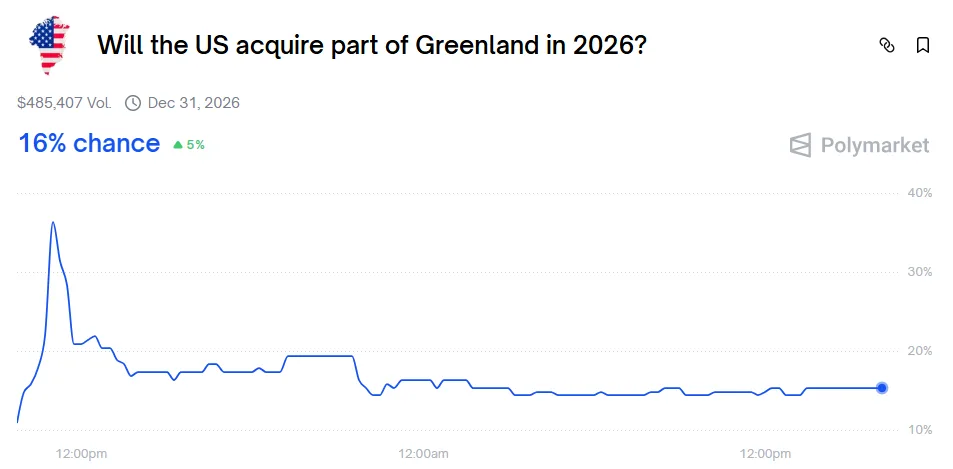

On Polymarket, a leading on-chain prediction platform, traders are betting on whether Trump will acquire Greenland before 2027. The market currently prices the probability at about 15%. Nearly $3 million has been committed to the outcome. The figure reflects skepticism, but the volume shows sustained engagement.

Source: Polymarket

Trump’s Greenland Push Returns to Diplomatic Talks

The market activity follows new diplomatic signals from Washington. On January 7, U.S. Secretary of State Marco Rubio confirmed he would meet Danish leaders to discuss Greenland. He stated that the United States has not abandoned Trump’s long-standing interest in the territory. Rubio cited national security concerns tied to increased Russian and Chinese activity in the Arctic.

Rubio emphasized that diplomacy remains the preferred path. He did not rule out stronger options if talks fail. His comments echoed earlier statements made by Trump during his previous term. The remarks revived attention from allies and market participants alike.

Greenland and Denmark have reiterated that the territory is not for sale. Greenland’s government has repeatedly rejected any proposal involving a transfer of sovereignty. European officials have warned that aggressive action could strain NATO relations.

While no military action appears imminent, the rhetoric alone has influenced capital flows. On-chain traders have begun allocating funds based on different escalation paths. The market response mirrors earlier activity tied to geopolitical events elsewhere.

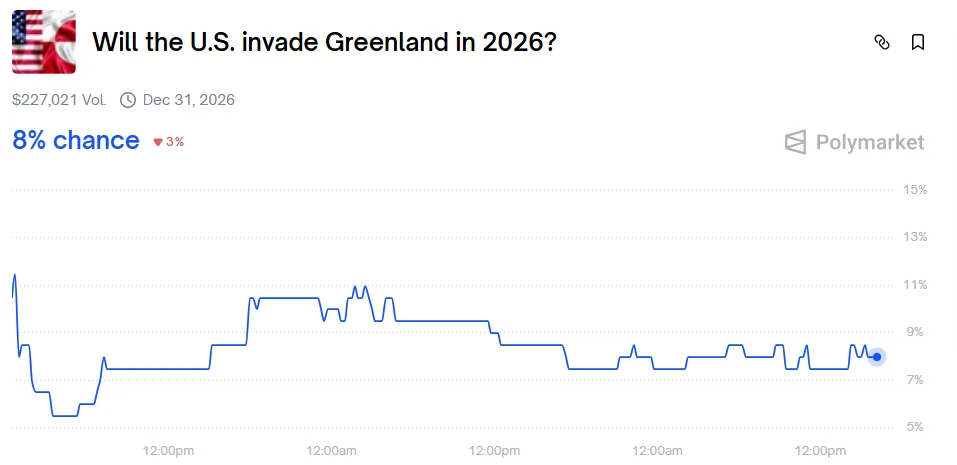

Polymarket data shows traders breaking the Greenland question into multiple scenarios. One contract asks whether the United States would acquire part of Greenland in 2026. That outcome is also priced near 15%. A separate contract focused on a U.S. military invasion trades at roughly 8%.

Source: Polymarket

The invasion scenario carries the lowest probability among related markets. It is also the most heavily discounted by traders. This pricing suggests limited belief in extreme escalation. Traders appear to favor restrained political developments.

Bets, Stakes, and Risk Pricing Shape Greenland Markets

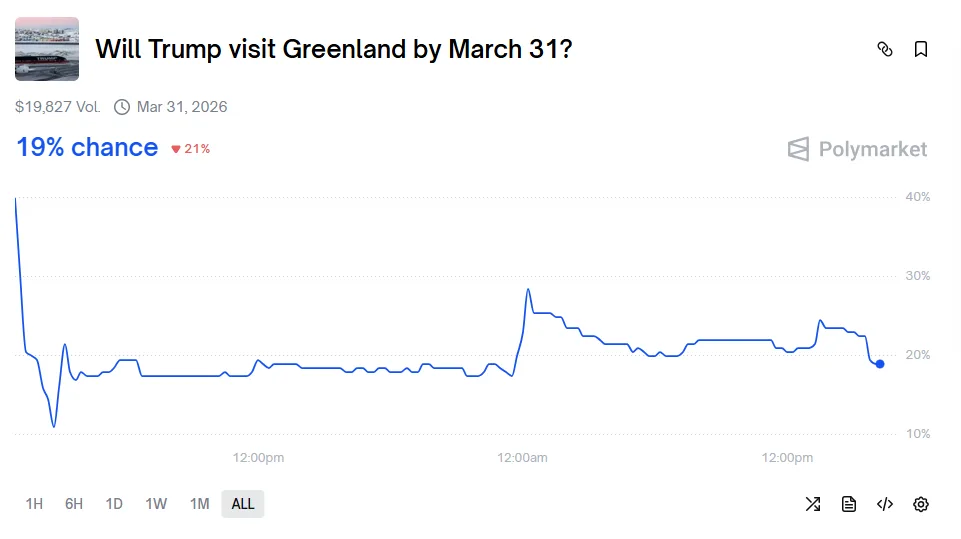

A symbolic event shows higher implied odds. A contract tied to Trump visiting Greenland before March 31 is priced near 19%. Liquidity in that market remains thin. The higher probability reflects expectations of signaling rather than policy shifts.

Source: Polymarket

A receding order book would also support a cautious stance. Above these acquisition-related markets, sellers rule. The top seems in the high teens. Only traders step in when the price is down – controlled risk. Buyers stop behind hardened highs.

Related: Trump Strategy Drops Crypto, Prioritizes AI and Quantum

Out of geopolitics, Greenland’s resources have also been catching the interest of crypto-linked industries. Its frigid weather and renewable energy potential have sparked conversation about bitcoin mining here. It has been revived as the United States works to decrease its dependence on foreign hash power.

The Financial Times has reported limits to this narrative. Greenland has extensive ice coverage and limited infrastructure. Mining operations would face logistical challenges. Complex ore structures also complicate extraction efforts.

Greenland’s rare earth mineral reserves remain strategically significant. These materials are critical for GPUs and advanced computing hardware. They also support artificial intelligence infrastructure. Any shift in access could affect crypto-adjacent sectors, including AI-linked tokens and real-world asset projects.

At a macro level, traders view the issue through a broader lens. Large territorial or resource ambitions often involve fiscal expansion and debt issuance. They also raise geopolitical tension. These conditions have historically influenced Bitcoin demand.

Polymarket does not predict outcomes. It reflects how capital responds to uncertainty. Unlike traditional markets, it converts headlines into probabilities in real time. Whether Trump’s Greenland interest advances or stalls, crypto markets have already priced the risk.