U.S. Nasdaq Futures Break Records While Bitcoin Falls

- Nasdaq Futures climbs to a record 26,244.25 points as Wall Street rally gains momentum.

- Bitcoin plunges to $112K amid Fed policy uncertainty and signs of bearish market pressure.

- Nvidia, Microsoft, and Apple drive strong Wall Street gains as tech stocks lead the rally.

U.S. stock futures held steady on Tuesday night after Wall Street closed at record highs for the third session in a row. This market optimism comes as investors remain cautious, awaiting a possible rate cut from the Federal Reserve that could shape market direction for the rest of the quarter.

The Nasdaq 100 E-mini Futures, for instance, reached a record 26,244.25 points, rising 0.31%, even as Bitcoin tumbled to $112k. The opposing moves captured a shift in sentiment, optimism in equities contrasted with sharp volatility across digital assets.

Market analyst Ash Crypto called the move “manipulation at its finest,” pointing to the uncanny timing of the Nasdaq’s surge and Bitcoin’s drop, a pattern that stirred debate among traders watching global liquidity flows.

Stocks Hold Ground as Investors Await Fed Outcome

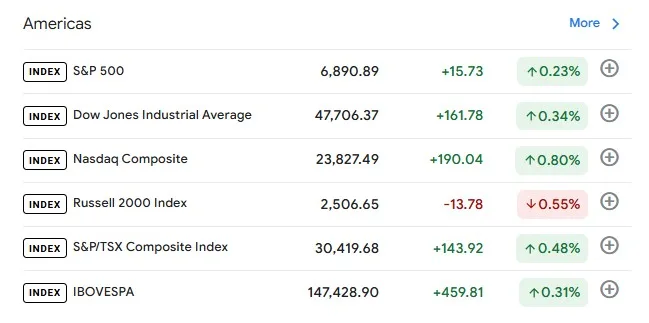

The broader tone across U.S. markets stayed upbeat. The S&P 500 Futures added 0.23% to 6,890.89, the Dow Jones Industrial Average Futures rose 0.34% to 47,706.37, and the NASDAQ Composite gained 0.8% to 23,827.49.

Meanwhile, the Russell 2000 Index slipped 0.55% to 2,506.65, showing that smaller companies lagged behind the rally. Optimism was underpinned by growing confidence that the Fed would trim rates by a quarter of a percentage point to support economic growth.

The two-day policy meeting was underway, and investors were awaiting guidance on whether further cuts could follow, given weaker inflation and the lingering effects of the recent government shutdown.

Global sentiment improved further after reports suggested that President Donald Trump and China’s Xi Jinping were preparing to meet later in the week. Negotiators were said to be finalizing a plan aimed at avoiding new tariffs and sanctions, a step that lifted confidence in global trade stability.

A dovish stance from the Fed, combined with progress in trade talks, could reinforce Wall Street’s recent climb, encouraging investors to extend positions in major equity benchmarks.

Tech Giants Push Markets Higher

Technology shares once again led the advance. Nvidia rose around 5%, setting a fresh record after announcing a $1 billion investment in Nokia, a move designed to strengthen the telecom company’s next-generation infrastructure.

The chipmaker’s announcement at its annual conference sparked renewed enthusiasm across semiconductor and AI-linked sectors. Microsoft gained nearly 2% ahead of its earnings report, while Apple also advanced, both briefly touching a $4 trillion valuation during the session.

In a related development, OpenAI confirmed the completion of its recapitalization, a move expected to benefit Microsoft, which holds a 27% stake in its for-profit entity. Several other heavyweight names, including Alphabet, Amazon, and Meta Platforms, are set to release their quarterly results later this week, setting the stage for another decisive moment in the tech-driven rally.

Related: SHIB Price Holds $0.000010 as Market Sentiment Turns Neutral

Bitcoin Holds Near Support as Sellers Dominate

In contrast, Bitcoin fell from above $116k to near $112.15k, forming an ascending wedge pattern, typically a bearish setup. The token briefly rebounded after touching the wedge’s support trendline, climbing back above $113k.

If the Fed rate cut signals a softer stance, Bitcoin may attempt a recovery toward $116k or higher. However, the coin faces key support at the 61.8% Fibonacci level ($112,567) and the 50% level ($111,405).

The MACD indicator suggests near-term weakness, with red histogram bars expanding below zero and the MACD line at 453.70, showing a growing bearish divergence. Momentum remains negative, indicating that sellers continue to dominate short-term sentiment.

The contrasting performance between traditional equities and cryptocurrencies highlights a broader market divide. While Wall Street continues to thrive on optimism surrounding rate cuts and strong tech earnings, Bitcoin’s pullback underscores the cautious tone still lingering in digital assets. As investors await the Fed’s next move, the coming days could determine whether Bitcoin follows equities higher on renewed liquidity or remains under pressure as traders rotate toward safer, yield-driven assets.