UNI Soars Over 60% in a Week to $10—Can Bulls Keep the Rally Alive?

- UNI surges over 60% after breaking resistance as Uniswap unveils its UNIfication proposal.

- $39M in inflows show traders locking in profits amid cooling RSI and rising leverage.

- Governance overhaul ties UNI’s value to usage, fueling long-term optimism and debate.

Uniswap’s governance token, UNI, has staged an impressive comeback after spending nearly three months weighed down by sellers. The token, which had fallen sharply from its Q3 peak near $12, spent most of the quarter struggling beneath a heavy resistance line that capped every attempt to move higher.

That pattern finally cracked in early November. Buyers stepped in as UNI touched support between $4.7 and $5.0, a zone that had already shown resilience earlier in the year. From there, a reversal began to form, quiet at first, then gathering pace as confidence returned across the broader market.

By midweek, the move turned explosive. UNI broke cleanly above the ceiling that had confined it for months and sprinted toward the $10 mark, a rally of roughly 118% from its recent lows. However, following this peak, the token slightly retraced, now hovering above the $8.00 zone.

Source: TradingView

The area between $8.00 and $8.50 now acts as a short-term support band, sitting right along the 50% Fibonacci retracement level. Momentum, however, is beginning to cool. The Relative Strength Index has eased to 65 from its earlier overbought reading, showing that buying pressure is relaxing.

Trading volume tells a similar story: red bars are now growing during small dips, a sign of cautious selling. Analysts are watching the $8.00 mark closely. A fall beneath it could open the door to $7.60 or even $6.50, levels tied to the 38.2% and 23.6% Fibonacci zones.

On-Chain Clues Show Traders Locking In Gains

Data from the past 72 hours shows UNI experiencing a wave of exchange inflows worth about $39 million. Such movements usually suggest investors are already taking profits after a strong run.

Source: CoinGlass

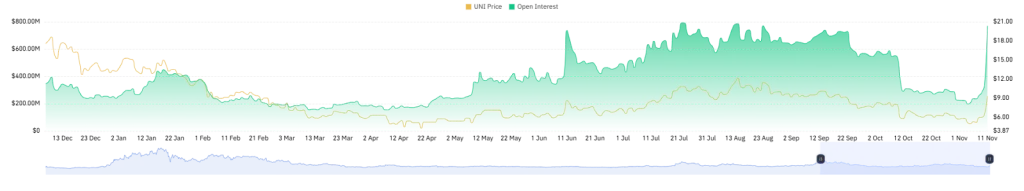

Meanwhile, activity in UNI’s futures market has exploded. Open interest surged 86% yesterday to roughly $770 million. Trading volumes have soared by more than 800%, touching $5.8 billion, levels not seen since August. That scale of leverage means the next move could be violent in either direction.

Source: CoinGlass

The pattern is familiar: traders are holding their positions rather than closing them. When leverage piles up like this, markets often react sharply, either through a breakout or a fast correction.

Governance Overhaul Lights the Spark

The surge in price came shortly after Uniswap Labs and the Uniswap Foundation revealed the UNIfication proposal, a sweeping plan that ties the UNI token more directly to network performance.

The proposal activates a mechanism that burns a portion of trading fees, gradually cutting supply. It also directs part of the liquidity provider fees to the protocol itself, while Unichain sequencer fees will flow into the same burn process.

In addition, a Uniswap Growth Budget will fund development and ecosystem initiatives under a single Service Provider Agreement. Most of the Foundation’s staff and projects are set to merge with Uniswap Labs, creating one consolidated structure aimed at improving efficiency and long-term governance.

A smaller administrative team will stay behind to manage the Foundation’s $100 million grants pool before winding down. The restructuring is meant to create tighter alignment between development and financing, a long-standing friction point within the ecosystem.

Related: Uniswap Foundation Unveils DUNI to Boost DAO Legal Position

Can UNI Keep Its Momentum Alive?

The UNification plan has reignited enthusiasm across the market, yet the question remains whether it can sustain interest once the excitement fades. The shift effectively connects token value with platform activity, giving investors a clearer link between usage and reward.

From a technical standpoint, UNI must defend the $8.00 level to keep the recovery intact. A solid base there could allow another retest of $10 and possibly $12 if sentiment holds. Falling below, though, could drag the price back toward earlier support zones and shake confidence among short-term holders.