USDH Proposal V2 Brings $20M Incentives and PayPal Global Access

- Paxos unveiled USDH Proposal V2 with PayPal and Venmo access, and $20M in ecosystem growth.

- The proposal links revenue to TVL with fees paid in HYPE to align stablecoin adoption.

- Paxos holds licenses for all regions, placing USDH for compliant scaling under the MiCA.

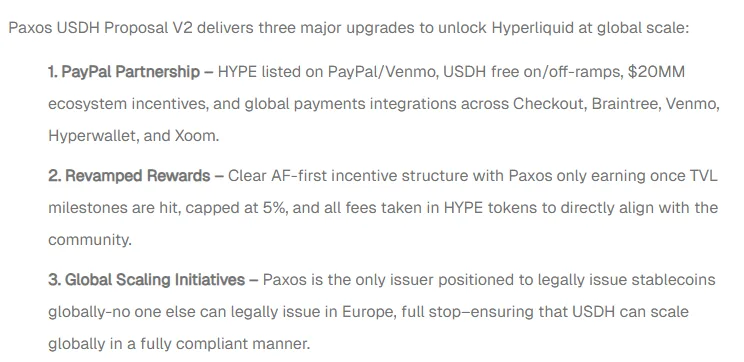

In an unprecedented move, Paxos unveiled USDH Proposal V2 on Wednesday, which is a major development in regulated stablecoins. The update introduces HYPE listings on PayPal and Venmo, fee-free USDH on- and off-ramps, and $20 million in ecosystem incentives. The proposal builds on Paxos’ record as a licensed stablecoin issuer since 2018, having issued more than $160 billion in tokenized assets under the New York Department of Financial Services (NYDFS) and Monetary Authority of Singapore (MAS) oversight.

The history of compliance and international licensing is the basis of USDH’s new expansion plan. Further, this would push it to align the incentives of issuers with the expansion of the ecosystem rather than immediate revenue.

PayPal Partnership and Global Payment Access

The integration allows USDH to access PayPal’s global payment rails, bringing potential mainstream adoption at scale. For PayPal and Venmo users, this partnership reduces barriers to entering the stablecoin market by removing transaction fees and offering simple integrations with existing payment tools. For Paxos, the collaboration builds on its prior role in powering PayPal USD but now extends incentives to align adoption with HYPE growth.

Source: Paxos

The rollout plan sets out Paxos’ intention to woo USDH into becoming a global payment vehicle across consumer and institutional channels. In correlating HYPE directly into PayPal’s platforms, Paxos ensures that both tokens advance together in a regulated environment, bypassing the limited appeal in crypto-native markets.

Revamped Rewards and Incentive Alignment

A primary innovation under Proposal V2 is its redesigned reward system. Paxos shall generate income only when the total value locked in USDH crosses $1 billion. Once the TVL crosses $5 billion, the revenue share will be capped at 5%, and Paxos shall be paid for any fees in HYPE tokens.

This structure gives a strong incentive for Paxos to see Hyperliquid’s community grow. The traditional paradigm of first taking value has been flipped. In other words, Paxos wins only when Hyperliquid sees sustained adoption. The company tagged it as “Clear AF,” referencing the super-clear model that implements a strong anti-conflict-of-interest location by aligning fully with network participants.

Earlier proposals revealed that roughly 95% of the USDH reserve yield would be channeled toward repurchasing HYPE. This approach is such that the reserve income is recirculated into the ecosystem to the benefit of validators, users, and partner protocols. The new structure takes the current structure a notch higher with transparent standards used to assure the community of the way value is repatriated.

The proposal reflects feedback received in the first 72 hours after USDH’s initial release, when Paxos engaged in continuous discussions with the Hyperliquid community. According to the company, every concern was addressed through direct responses, and Proposal V2 was crafted as the community’s answer.

Related: Circle Expands Hyperliquid with USDC and CCTP V2 Rollout

Global Scaling and Regulatory Position

Proposal V2 also outlines Paxos’ ambitions for global expansion. The company stressed that it is the only issuer capable of legally offering stablecoins in Europe under the Markets in Crypto-Assets (MiCA) framework. Paxos also operates under licenses in the United States, Singapore, Abu Dhabi, Latin America, and the Asia-Pacific region, ensuring a strong compliance base for international issuance.

This regulatory foundation distinguishes USDH from competitors, often criticized for opaque reserve practices or weaker oversight. USDH reserves consist of highly liquid assets, such as U.S. Treasury Bills, providing added assurance of stability.

The introduction of USDH under clear legal standards arrives as global regulators finalize their frameworks. With the GENIUS Act in the U.S. and MiCA in Europe, the environment now allows compliant issuers to expand responsibly.

The grander plan addresses the methodology of proving that incentive-driven ecosystems can indeed scale under stringent regulatory scrutiny, all while remaining transparent and resilient. Should USDH stand, it would become the gold standard of regulated adoption, marrying ecosystem rewards with full legal standing.