$VIRTUAL Surges to Top of Crypto Gainers: Here’s What Sparked the Run

- VIRTUAL jumps 12% as trading volume rises 65%, securing the top spot among daily gainers.

- The marketplace launch on January 15 renews attention as interest in agent systems accelerates.

- Active traders climb to 4,000, matching the highest participation level recorded in December.

Virtuals Protocol (VIRTUAL) emerged as one of the top-performing crypto assets over the past day after posting a sharp rally that defied recent bearish expectations. The artificial intelligence–focused token climbed roughly 12% in 24 hours, reversing a prior decline and returning to levels that place it among the strongest gainers in the market.

The move was accompanied by a surge in activity across spot and derivatives markets, signaling broad participation rather than a thin, isolated price spike. Trading volume also jumped more than 65%, lifting VIRTUAL to the top of daily gainers’ lists and marking one of its most active sessions since mid-December.

A Launch Window That Pulled Traders Back

Much of the renewed attention centers on an approaching milestone: the protocol’s planned release of its decentralized agent marketplace on January 15. The idea behind the marketplace is straightforward: users will be able to trade and deploy autonomous digital agents that carry out tasks and potentially generate revenue.

That concept alone has drawn a wave of curiosity back to the project. The timing adds another layer, as interest in agent-driven systems has been rising across several sectors. An alliance announced in December with OpenMind AGI also re-entered the discussion.

The cooperation aims to bridge these agents with robotics infrastructure, a direction some analysts have described as the early stage of embodied systems that blend software with physical environments.

While that term still sits in the experimental category, the development has nudged VIRTUAL into a broader conversation occurring across enterprise infrastructure markets. This, combined with the upcoming release, created a setup that traders appear increasingly willing to engage with.

Usage Metrics and Revenue Add Weight to the Rally

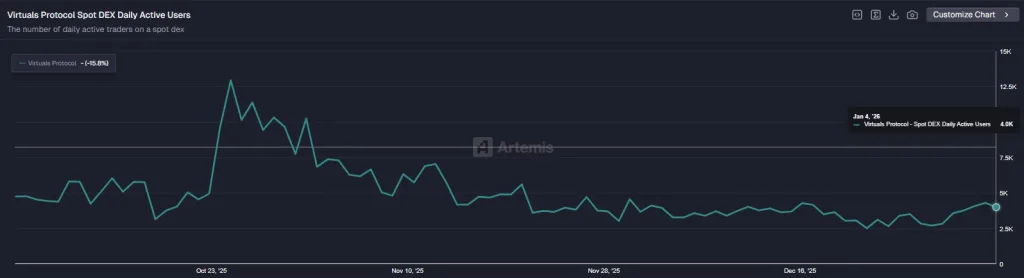

Beyond the hype cycle, activity within the protocol itself has been climbing. Data from Artemis showed a bump in user participation over the past day, with active traders on decentralized exchanges rising to about 4,000.

Source: Artemis

That number was last recorded on December 19 and suggests that the spike is not being driven by a narrow cluster of wallets. Besides, revenue has moved in the same direction. Figures tracked by the same analytical firm indicate that the protocol generated more than $32.9K over the last 24 hours, a period marked by widespread caution across digital-asset markets.

Source: Artemis

Taken together, the pickup in user activity, rising fees, and higher trade counts point to something sturdier than a one-off push. Each metric reinforces the other, offering a clearer context for why the price jumped when it did.

Derivatives Flow Tilts Toward Buyers

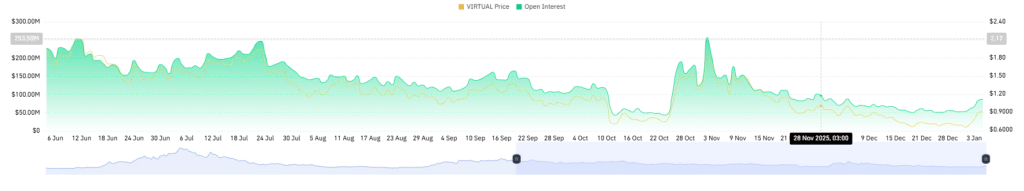

What played out in the derivatives market added another layer to the picture. Liquidity increased by 43% to $125.71 million over the past day, mostly from traders opening long positions.

Source: CoinGlass

The shift wasn’t subtle. Buy orders outweighed sell-side flows for most of the session, adding momentum behind the move seen on the token’s futures market.

Source: CoinGlass

Funding data reflected the same tilt. CoinGlass metrics showed a funding rate of roughly 0.0043%, a reading that tends to appear when long positions hold the upper hand.

Related: SHIB Bullish Structure Strengthens as Analyst Targets 246% Rally

Technical Structure Shows a Gradual Rebound Forming

On the weekly chart, VIRTUAL has spent much of the past year inside a falling wedge, broad at the top, narrowing as price carved out lower highs and lower lows. The latest bounce from the lower boundary has become a talking point as the asset trades near $1.21, up more than 69% on the week.

Several retracement zones now sit overhead. The 23.6% level appears around $1.43, while $2.13 and $2.70 mark deeper retracement points tied to earlier cycles. The previous major high sits near $5.12.

Source: TradingView

Meanwhile, momentum remains neutral. The weekly RSI sits around 49, leaving room for movement without signaling exhaustion. Price is also pressing against short-term moving averages, with the 20-week band acting as a nearby hurdle.

Whether the rally holds will depend on follow-through, but for now, traders have been given a fresh set of numbers to work with, and VIRTUAL has reclaimed a place near the top of the daily leaderboard.